A Beginner’s Guide to Using Xero for Streamlined Bookkeeping and Invoicing

Since its 2006 founding in New Zealand, Xero has grown to become one of the top platforms for cloud-based accounting software. Its primary objective? to make accounting more accessible, intelligent, and simple for startups and small enterprises.

Table of Contents

- 1 Who Uses Xero?

- 2 Why Choose Xero for Bookkeeping?

- 3 Getting Started with Xero

- 4 Understanding the Xero Dashboard

- 5 Connecting Your Bank Account

- 6 Chart of Accounts in Xero

- 7 Managing Contacts and Clients

- 8 Creating and Sending Invoices

- 9 Automating Invoicing and Reminders

- 10 Handling Bills and Expenses

- 11 Reconciling Transactions

- 12 Generating Financial Reports

- 13 Integrations and Add-Ons

- 14 Tips for Staying Organized in Xero

- 15 Final Thoughts on Xero for Beginners

- 16 Frequently Asked Questions

Who Uses Xero?

From solo freelancers and consultants to growing startups and even mid-sized companies, Xero caters to anyone looking to simplify their financial management without hiring a full-time accountant.

Why Choose Xero for Bookkeeping?

Cloud-Based Advantages

Since everything is done online, you may handle your money from any location. Only a login and an internet connection are required; there are no installations or hardware restrictions. Additionally, your data is automatically backed up.

User-Friendly Interface

Xero’s interface is intuitive and clean. Even if you don’t come from a finance background, navigating it feels natural. It’s designed for non-accountants.

Getting Started with Xero

Creating Your Xero Account

Sign up with your email, create a password, and you’re good to go. They also offer a free trial, so you can explore without commitment.

Setting Up Your Organization Profile

Add your business name, address, tax ID, and select your financial year. This sets the foundation for accurate financial reporting.

Understanding the Xero Dashboard

Overview of Navigation Menu

The main dashboard shows your cash flow, invoices, bills to pay, bank balances, and more. The left-hand menu gives access to all the essential areas—business, accounting, contacts, reports, and settings.

Customizing the Dashboard

You can move widgets around to focus on what matters to you most—whether that’s outstanding invoices or recent expenses.

Connecting Your Bank Account

Real-Time Bank Feeds

Linking your bank account allows Xero to import your transactions automatically. This keeps your books up to date without manual data entry.

Security Features

Xero uses industry-standard encryption and multi-factor authentication, keeping your financial data secure and protected.

Chart of Accounts in Xero

What is a Chart of Accounts?

It’s a list of all the accounts your business uses to classify income, expenses, assets, and liabilities. Think of it as your business’s financial filing system.

How to Customize Accounts

You can edit existing accounts or create new ones to match your business’s unique needs. For example, if you run a digital agency, you might add accounts for software subscriptions and ad spending.

Managing Contacts and Clients

Adding Customers and Suppliers

You can manually add or import contacts from a spreadsheet. Each contact card can store key info, including tax settings and default payment terms.

Contact Groups and Smart Lists

Group contacts by category (like “Top Clients” or “Late Payers”) to make email campaigns or bulk actions more efficient.

Creating and Sending Invoices

Customizing Invoice Templates

Add your logo, brand colors, payment terms, and messaging. Xero lets you create multiple templates for different purposes.

Setting Payment Terms

You can set defaults (like Net 30) or tailor terms for each client. Xero will auto-calculate due dates for you.

Automating Invoicing and Reminders

Recurring Invoices

For clients you bill regularly, automate it! Set up a recurring invoice once and let Xero do the rest.

Automatic Payment Reminders

No one likes chasing payments. Xero can send polite, automatic nudges before and after the due date.

Handling Bills and Expenses

Uploading and Recording Bills

Snap a pic of a bill or upload a PDF, and Xero extracts the data automatically. You can then categorize and schedule it.

Scheduling Payments

See all your upcoming bills, prioritize them, and plan your cash flow. You can even batch-pay from within Xero (if your bank allows it).

How MEL Science is Making Learning Chemistry Fun and Interactive.

PADI Diving Courses: Unlocking the Door to the Underwater World.

Top 10 Features That Make RocketReach LLC a Must-Have Tool.

The Complete Review of iMobie: Enhance Your Mobile Experience Today.

The Future of Education: How edX is Transforming Online Learning.

Reconciling Transactions

How Reconciliation Works in Xero

Xero matches your bank transactions with what’s recorded in your books. With a few clicks, you can confirm and reconcile them.

Matching Transactions with Invoices

If an invoice has been paid, Xero detects the payment and lets you match it instantly—saving you loads of time.

Generating Financial Reports

Common Reports for Beginners

Profit & Loss, Balance Sheet, and Cash Flow are key. These give you a bird’s-eye view of your business health.

Customizing and Sharing Reports

Add filters, date ranges, or even share reports with your accountant with just a click. Reports update in real-time.

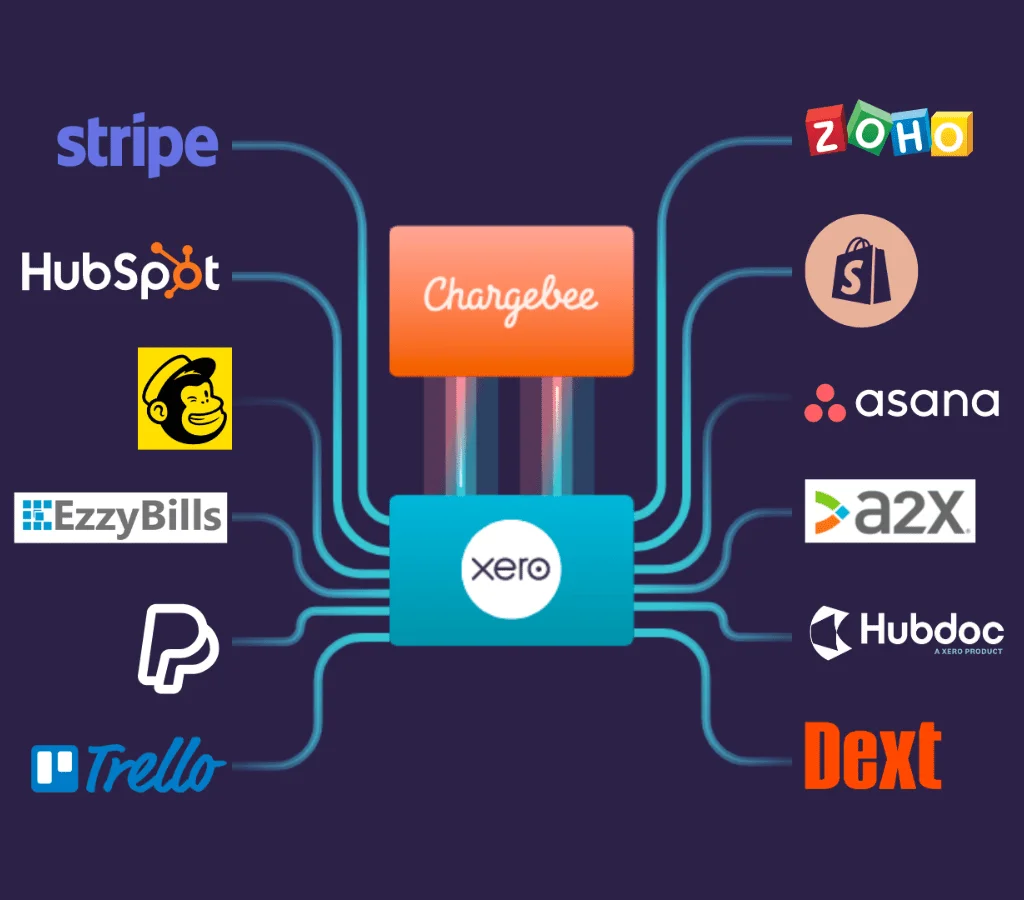

Integrations and Add-Ons

Best Apps to Connect with Xero

Connect tools like Stripe, PayPal, Shopify, HubSpot, and hundreds more. The Xero App Store has solutions for payroll, inventory, CRM, and even project management.

Syncing with Payroll and Inventory

Xero Payroll (available in select countries) integrates seamlessly. Inventory tracking helps product-based businesses monitor stock.

Tips for Staying Organized in Xero

Weekly and Monthly Checklist

- Weekly: Reconcile transactions, check overdue invoices, upload receipts

- Monthly: Review reports, update contacts, review bills

Avoiding Common Mistakes

Don’t forget to categorize transactions correctly and avoid duplicating contacts or invoices. Xero’s AI helps detect errors, but it’s good to review.

Final Thoughts on Xero for Beginners

Xero is a game-changer for small businesses wanting to take control of their finances. With its intuitive design, automation features, and powerful reporting tools, it takes the fear out of bookkeeping. Whether you’re flying solo or growing a team, Xero scales with you—and makes you feel like a financial pro without the suit and tie.

Frequently Asked Questions

A. Xero is more intuitive and often preferred by non-accountants, while QuickBooks offers more features for U.S.-based users. It depends on your business needs and location.

A. Yes! Xero has mobile apps for iOS and Android that let you invoice, reconcile, and check reports on the go.

A. Xero uses bank-level encryption, regular audits, and multi-factor authentication to protect your data.

A. Yes, but only in the Premium plans. It automatically updates exchange rates and converts transactions.

A. Minimal. Most users find they can navigate and use core features in a few hours, especially with Xero’s built-in tutorials and help center.

Recent Post

Barceló Hotels & Resorts ES AFF Digital Marketing Strategy

Amstar DMC (US & Canada) Marketing Strategies in the Travel Industry

How WEMAG DE Uses Online Marketing to Build Trust

Klarmobil Marketing Strategy: How Telecom Brands Grow Online

Study group Darmstadt DE: Digital Outreach Strategies That Work

How Ebuyer Uses Smart Marketing to Dominate E-Commerce

Hostnet NL: A Comprehensive Review of Their Web Hosting Services

Ayoa Review: Why It’s the Best Tool for Collaborative Work

Why Coverwise.co.uk is a Game-Changer for Insurance Solutions