Stax Payments Review

Stax Payments provides comprehensive payment processing solutions tailored for businesses of various sizes, offering features like automated billing, surcharging, and transparent pricing.

They focus on delivering a user-friendly platform with seamless integration capabilities and excellent uptime, ensuring reliable performance even as businesses scale.

Stax also offers specialized products, such as Stax Pay and Stax Connect, designed to streamline payment operations and enhance the overall payment experience.

4.8

Pricing Plan

Growth

Pro

Ultimate

Pricing per transaction

0% + 10¢ (in-person)

0% + 10¢ (online)

0% + 10¢ (in-person)

0% + 10¢ (online)

0% + 10¢ (in-person)

0% + 10¢ (online)

Monthly subscription

₹8218

₹13199

₹16519

Ranked 4 from 29 Credit Card Processing

Performance: |4.9|

Stax Payments is known for its robust performance in the payments industry, offering reliable and efficient payment processing solutions. They focus on delivering fast transaction processing, seamless integrations, and excellent uptime, ensuring that businesses can operate smoothly without interruptions. Additionally, their platform is designed to scale with business growth, maintaining consistent performance even as transaction volumes increase.

Uptime: |4.9|

Stax Payments is known for its strong uptime performance, ensuring that businesses experience minimal disruptions in payment processing. Their platform is designed to maintain high availability, which is crucial for businesses that rely on continuous payment operations. This reliability is a key aspect of their service, helping businesses operate smoothly and efficiently.

Customer Service: |4.8|

Stax Payments is recognized for its responsive and reliable customer service, offering support through various channels to assist businesses with their payment processing needs. Their team is known for being knowledgeable and helpful, addressing issues quickly to minimize disruptions. Stax emphasizes a customer-first approach, ensuring that users have the resources and guidance they need to effectively manage their payment systems.

Pricing: |4.7|

Stax Payments offers transparent pricing designed to be straightforward, with no hidden fees. They provide different pricing models to suit various business needs, including flat-rate pricing and membership-based pricing options. Their approach is intended to help businesses better manage costs associated with payment processing. Stax emphasizes clarity in their pricing structure to avoid unexpected charges, allowing businesses to predict their expenses more accurately.

Overview

| POS equipment | 8 terminals available, including SwipeSimple, Dejavoo, Pax, 4 Clover devices, and 1 mobile reader for purchase. |

| Payments methods accepted | Credit and debit cards, select digital wallets, ACH, and bank transfers. |

| Payout times | Standard payout within 72 hours, with an optional same-day payout upgrade available. |

| Contract Terms | Monthly agreement with no cancellation fees. |

| Customer support | Available through live chat, email, ticket system, fax, and phone. |

| Security | Level 1 PCI-compliant, featuring tokenization, end-to-end encryption, multi-factor authentication, advanced fraud detection, and payer verification. |

An Excellent All-in-One Payment Processor for US Businesses

Stax is a payment processor exclusively available to US merchants, designed to streamline your credit card processing costs with a flat monthly fee and a zero-markup interchange rate model. If your business processes over $8,000 in credit card transactions each month, you could potentially save up to 40% with Stax.

Catering to small businesses, large enterprises, and SaaS companies, Stax offers a variety of plans suited for both physical and online stores.

In addition to standard card readers and mobile POS software, Stax provides several valuable features. It seamlessly integrates with popular e-commerce platforms, is easy to implement on your website, and even allows you to send invoices via text or email.

Additionally, Stax integrates with QuickBooks and Xero for automated accounting, connects with Slack or MSTeams to keep your team informed, and links with Mailchimp to automatically add new subscribers to targeted email campaigns. With so many exceptional features, it’s no wonder that Stax is highly regarded by its customers.

After thoroughly reviewing hundreds of customer testimonials, reaching out to customer support, and conducting an in-depth analysis of this service, I’m here to help you determine if Stax is the right fit for you and your business.

FEATURES |5.0|

Stax Payments offers a variety of features designed to streamline payment processing and integrate seamlessly with business operations. Here’s a detailed breakdown of the key features provided by Stax:

1. Payment Processing Solutions:

Point of Sale (POS) Systems: Stax offers hardware and software for in-person transactions. Their POS systems are designed to be user-friendly and integrate with various business operations.

Online Payment Gateway: Businesses can accept payments through their websites using Stax’s customizable payment gateway. This supports various payment methods, including credit and debit cards.

Mobile Payments: Stax provides mobile payment solutions, allowing businesses to accept payments via smartphones or tablets, ideal for businesses that operate on-the-go or in field settings.

2. Integration Capabilities:

CRM and ERP Integration: Stax integrates with various Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems, facilitating streamlined operations and data management.

Customizable API: For businesses with specific needs, Stax offers APIs that allow for custom integrations with existing systems and software.

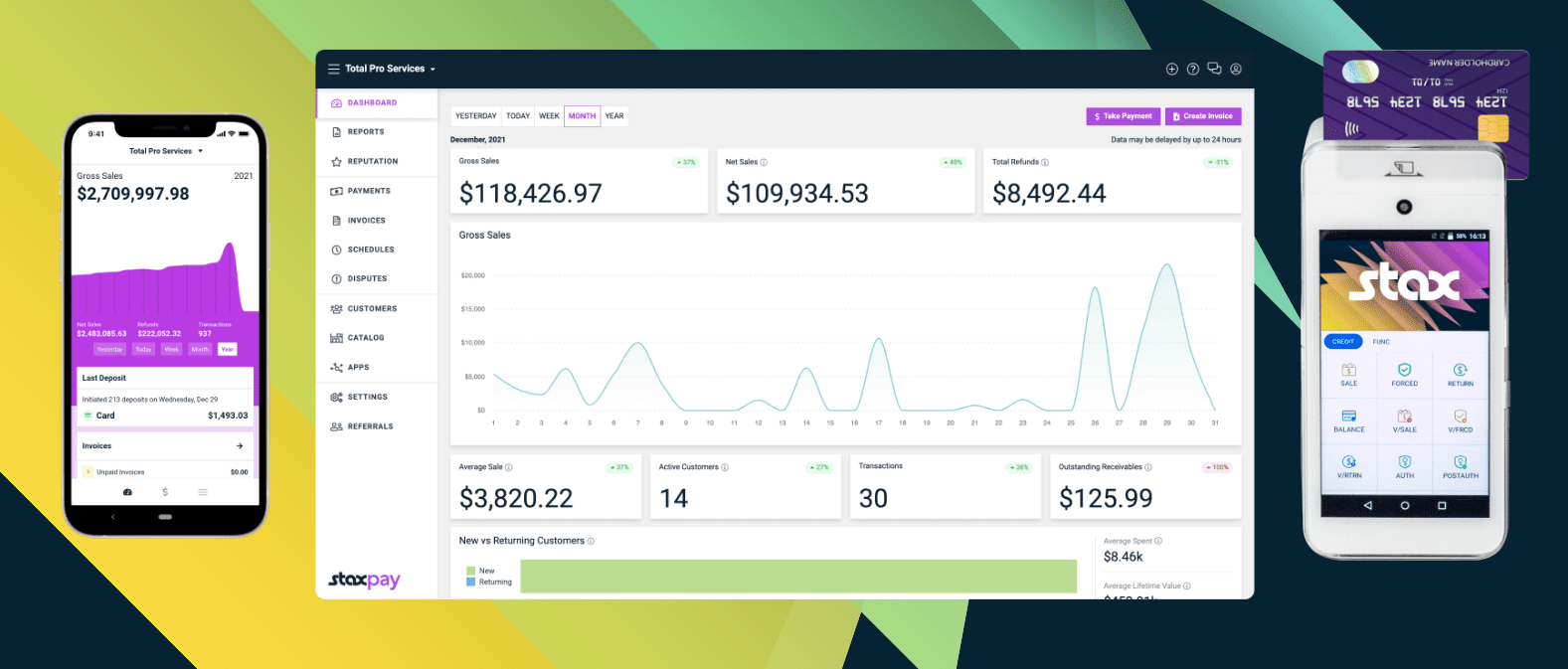

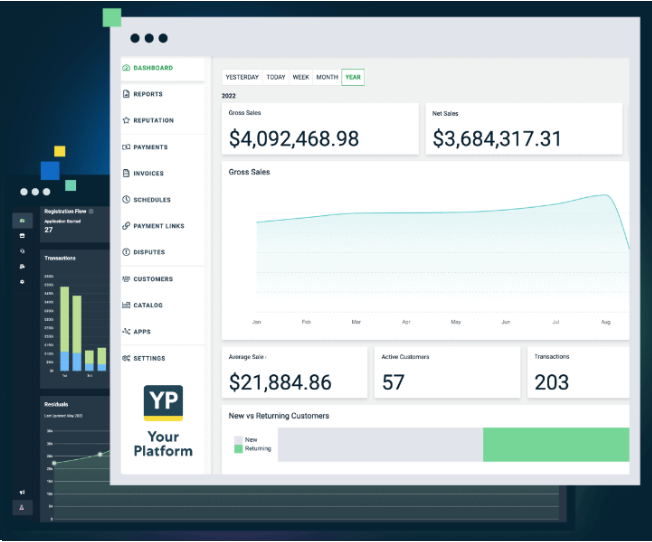

3. User-Friendly Dashboard:

Reporting and Analytics: The dashboard provides detailed insights into transactions, sales, and customer data. This includes real-time reporting and historical data to help businesses make informed decisions.

Account Management: Businesses can manage their accounts, view transaction history, and access various administrative tools through an intuitive interface.

4. Security Features:

PCI Compliance: Stax ensures that its payment solutions meet Payment Card Industry (PCI) compliance standards to protect customer data and prevent fraud.

Fraud Prevention Tools: The platform includes various tools to detect and prevent fraudulent transactions, helping to safeguard both businesses and their customers.

5. Customer Support:

24/7 Support: Stax provides around-the-clock customer support, ensuring that businesses can get help whenever needed.

Dedicated Account Managers: Businesses often have access to dedicated account managers for personalized support and advice.

6. Business Insights and Tools:

Customer Insights: The platform offers tools to analyse customer behaviour and purchasing patterns, which can help businesses tailor their marketing strategies and improve customer retention.

Inventory Management: Some POS solutions include inventory management features, allowing businesses to track stock levels and manage products more effectively.

Stax Offers an Impressive Range of Features

Stax provides every feature you’d expect from a payment processor—and more.

Many businesses could rely solely on Stax without needing additional integrations. It includes built-in invoicing and a powerful developer kit for creating custom shopping carts on your website.

However, Stax also supports integrations with popular e-commerce platforms like Bigcommerce and Magento, making it easy to optimize payments on your existing online store.

It’s important to note that not all of Stax’s features come standard. For instance, pre-built e-commerce shopping carts and the ability to pass credit card processing fees to customers require an additional monthly fee.

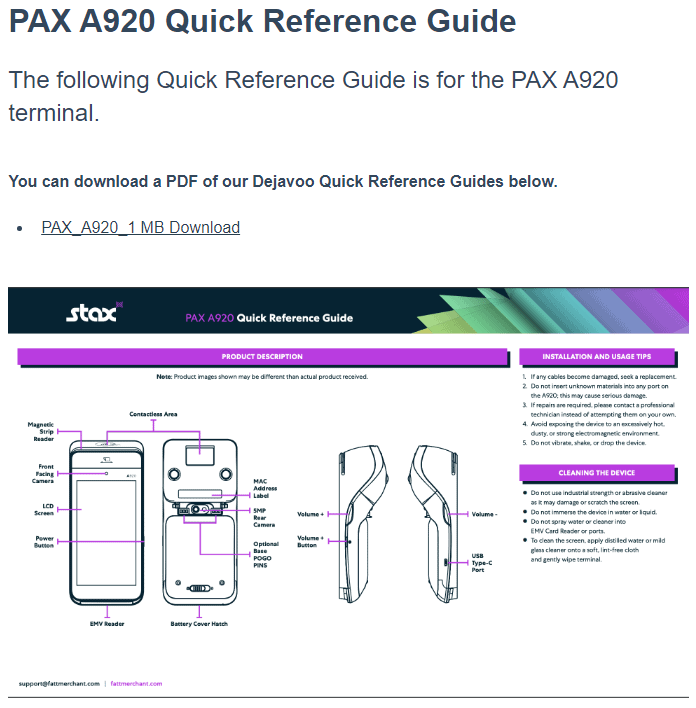

Wide Variety of POS Devices for Purchase

As a Stax customer, you can choose from several POS devices, including Swipe Simple, Dejavoo, or PAX terminals, to handle in-person transactions, whether they’re keyed in, swiped, or contactless. The terminal you select should be based on your business needs, preferred payment methods, and whether you require a mobile terminal.

Comprehensive E-Commerce Support with Developer Tools

Stax provides various options for managing your e-commerce store. You can integrate Stax with platforms like WooCommerce, Shopify, or Magento, or use Stax to manage your e-commerce backend and implement a pre-built shopping cart on your website. There’s no need to migrate your entire store to start using Stax.

Stax’s developer tools for creating a shopping cart on your site are user-friendly, even if you’re not familiar with coding. You can quickly set up a Stax shopping cart using one of its no-code, pre-built templates, allowing you to start selling almost immediately.

Additionally, you can offer digital gift cards and customize your e-commerce payments with your branding. While these are optional add-ons, they can enhance your brand’s image, especially if your e-commerce store generates a significant portion of your business.

Accepted Payment Methods

Stax supports a standard range of payment methods, including debit and credit cards, ACH transfers, Google Pay, and Apple Pay. However, it does not support PayPal or cryptocurrency, and currently, Stax only processes payments in USD.

Where Stax stands out is in its payout speed. Unlike most card processors, Stax offers same-day deposits to your merchant account, though this feature comes at an extra cost. Otherwise, Stax typically takes 24-72 hours to process credit card payments and 4-5 business days for ACH transfers. If you frequently handle these types of transactions, the same-day payout option may be worth considering.

Business Software Integrations

Stax integrates with other software via Zapier, offering you access to thousands of potential integrations. While you can create custom integrations using Zapier, Stax also provides several pre-built integrations with popular project management, marketing, and accounting software.

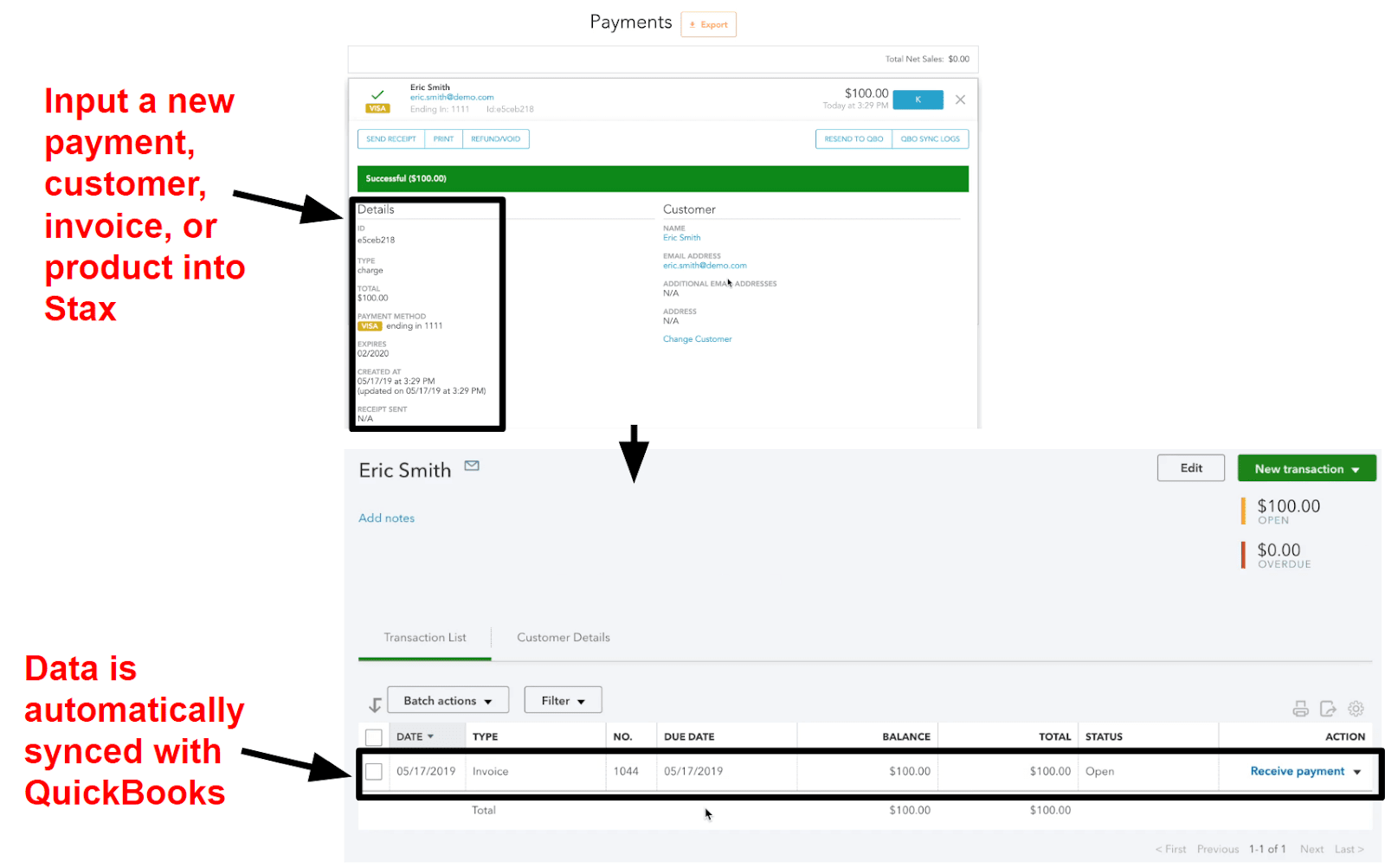

The standout integration Stax offers is undoubtedly the optional add-on that connects Stax to QuickBooks. Although there is an additional fee for this service (and the exact cost isn’t disclosed until you apply for a Stax merchant account), this built-in integration can save you significant time on accounting tasks.

What sets the QuickBooks integration apart from others is its two-way functionality, eliminating the need for manual payment reconciliation. With real-time data synchronization, your payments, customer information, invoices, and product or service details are automatically shared between Stax and QuickBooks, simplifying your accounting process.

Popular Credit Card Processing

PROS AND CONS OF STAX PAYMENTS

Pros of Stax Payments

Transparent Pricing: Stax Payments uses a subscription-based pricing model with predictable monthly fees and low per-transaction costs, avoiding the hidden fees often associated with traditional payment processors.

Comprehensive Solutions: The platform offers a range of payment processing options, including POS systems, online gateways, and mobile payments, making it a versatile choice for various business needs.

User-Friendly Interface: Stax provides an intuitive dashboard with real-time reporting and analytics, allowing businesses to easily track transactions and make informed decisions.

Robust Security: With features like PCI compliance and advanced fraud prevention tools, Stax ensures that sensitive customer data is protected against fraud and breaches.

Responsive Customer Support: Stax is known for its effective customer support, offering 24/7 assistance and dedicated account managers to help resolve issues and provide personalized support.

Cons of Stax Payments

Limited International Reach: Stax Payments primarily serves the U.S. market, which may be a drawback for businesses with international operations or customers outside the U.S.

Fee Structure for High Volumes: While the flat-rate pricing can be beneficial for many, businesses with very high transaction volumes might find other pricing structures more cost-effective.

Potential Integration Limitations: Some businesses may find that Stax doesn’t offer all the integrations or features they need, depending on their specific requirements.

Complexity for Very Large Enterprises: Larger businesses with more complex needs might find Stax’s offerings less tailored compared to other processors that provide bespoke solutions for high-volume or specialized operations.

Products

Stax Pay: A comprehensive payment processing solution that offers businesses the ability to accept payments through various channels, including in-person, online, and mobile.

Stax Connect: A platform designed for software companies and SaaS providers, enabling them to integrate payment processing capabilities directly into their own software applications.

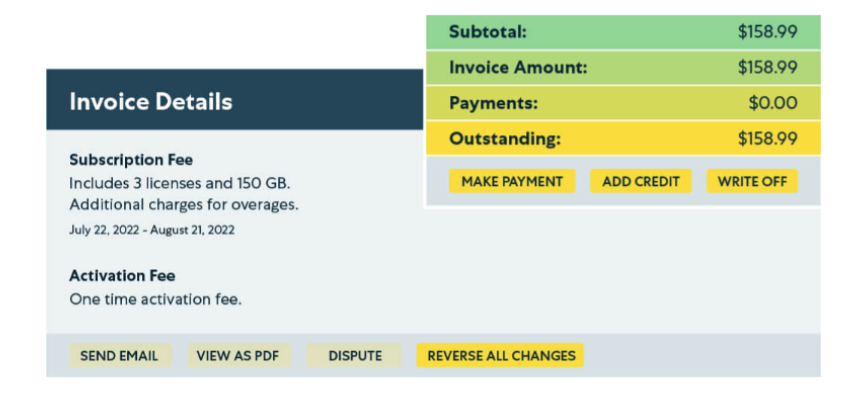

Stax Bill: An automated billing and invoicing solution that helps businesses manage recurring payments, subscriptions, and invoicing with ease.

Stax Processing: The core payment processing service offered by Stax, providing businesses with a secure and efficient way to handle credit card transactions.

CardX by Stax: A product that allows businesses to pass credit card processing fees directly to the customer, helping to reduce the business’s costs associated with accepting credit card payments.

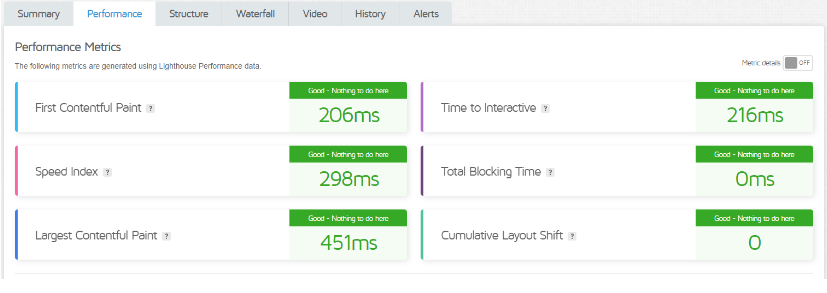

GTMetrix

The First Contentful Paint (FCP) occurs in just 206 milliseconds, ensuring that users see content almost immediately after accessing the site. The Speed Index of 298 milliseconds further emphasizes the site’s efficiency in displaying content quickly. The Largest Contentful Paint (LCP) at 451 milliseconds suggests that the largest visible element on the page loads rapidly, contributing to a positive user experience.

Additionally, the Time to Interactive is only 216 milliseconds, meaning that users can start interacting with the site almost instantly. Importantly, the Total Blocking Time is 0 milliseconds, indicating no delays that would prevent user interaction, and the Cumulative Layout Shift (CLS) is 0, ensuring a stable and predictable layout without any unexpected shifts. Overall, the website demonstrates exceptional speed and responsiveness, providing a seamless and user-friendly experience.

EASY OF USE |5.0|

Clean Layout: The website features a clean and organized layout, making it easy to navigate and find information quickly.

Intuitive Navigation: The main menu is straightforward, with clearly labeled sections like Products, Pricing, and Support, allowing users to easily access the information they need.

Responsive Design: The website is mobile-friendly, ensuring that it functions well on various devices, including smartphones and tablets.

Informative Content: Each page is rich with information, including detailed descriptions, FAQs, and clear calls to action, helping users understand the services offered.

Live Chat Support: A live chat option is available for real-time assistance, enhancing user experience by providing immediate support when needed.

Quick Load Times: The site loads quickly, reducing wait times and improving overall user experience.

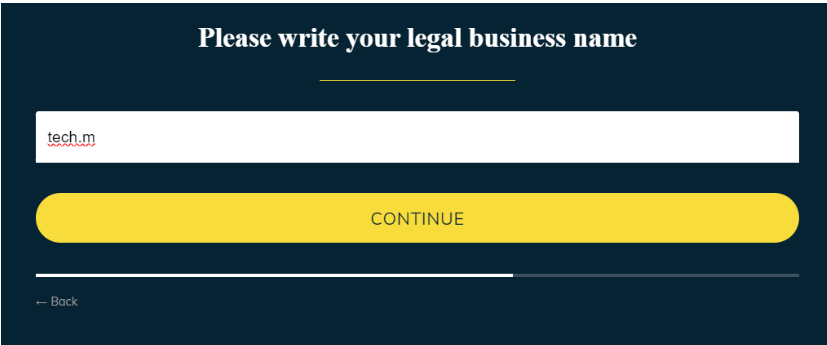

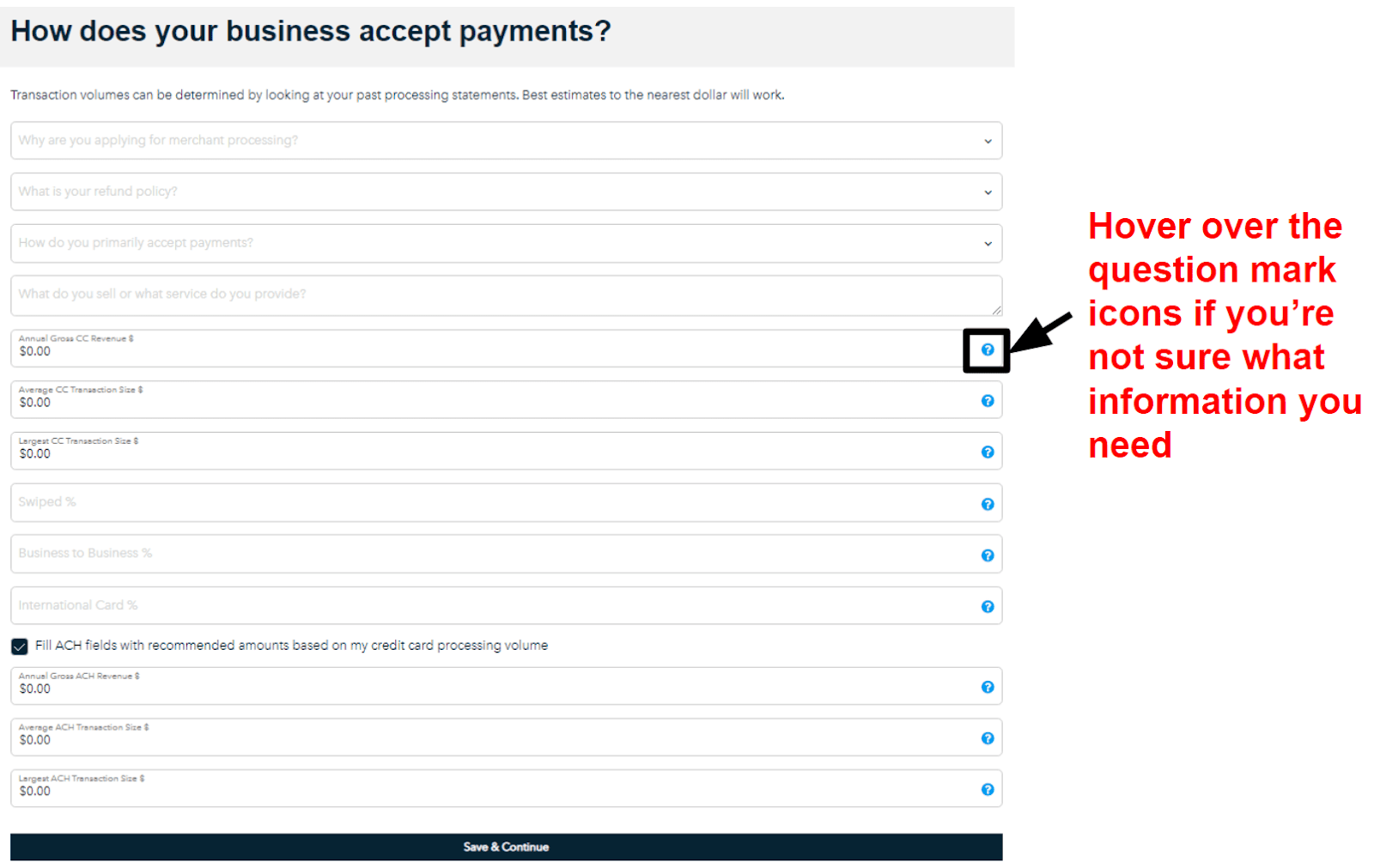

Let’s create your account

To create an account with Stax Payments, follow these general steps:

Visit the Stax Payments Website: Go to the Stax Payments official website.

Sign Up or Get Started: Look for a “Sign Up,” “Get Started,” or “Request a Demo” button. This is typically found on the homepage or in the upper right corner of the site.

Fill Out the Form: You will be asked to provide information about your business and yourself. This might include your business name, contact details, and some basic information about your payment processing needs.

Submit Your Application: After filling out the form, submit it for review.

Verify Your Information: You may need to verify your email address or phone number, and provide additional documentation about your business for verification purposes.

Account Approval: Once your application is reviewed and approved, you will receive instructions on how to log in and set up your account.

Set Up Your Account: Follow the instructions provided to complete your account setup, including configuring payment options, linking your bank account, and integrating with your existing systems if necessary.

Stax Offers an Exceptional User Experience

Setting up a merchant account with Stax is straightforward. According to Stax, account approval typically takes 24 to 48 hours, provided you submit the correct documentation. Stax clearly outlines the required documents and the accepted file formats for scanned versions, making the process smooth.

You can either apply on your own or reach out to the Stax sales team for assistance in customizing your application to fit your business needs.

Getting Started with Stax

To apply for a Stax merchant account, you’ll need at least three months of payment processing history.

Just click “Sign Up” or “Get Started” to provide some basic details about your company and yourself. After that, you’ll be directed to Stax’s application form, where you’ll provide detailed business information and upload the necessary documents to support your application.

Make sure you have uploaded the required documentation and that all of your details are correct in the Review area. After arranging everything properly, select “Save & Sign.

The underwriting staff at Stax will then examine your application. You can speak with the applications team directly by contacting Stax’s customer care if you don’t hear back from them in a few days or if you need more help.

Stax Pay Simplifies Sales Management

Stax’s all-in-one payment platform is designed for ease of use. Whether you’re new to payment processors or not, you’ll find it simple to navigate your sales data, create and schedule payments, view customer information, and more.

If you need assistance with Stax Pay, the extensive knowledge base offers dozens of articles for both desktop and mobile applications. You’ll find guides on everything from creating invoices to understanding different decline codes, ensuring you’re never left without support.

Wide Compatibility with Third-Party POS Devices

Stax integrates with over 90% of third-party POS devices, so you won’t need to replace your current equipment when switching to Stax.

This extensive range of integrations is particularly beneficial for larger or more established businesses, especially since Stax only provides terminal devices. You’ll need to source registers, cash drawers, and inventory management tools separately. Keep in mind that your POS manufacturer may charge additional fees for conversion or integration.

PRICING |4.9|

Stax Payments offers a pricing model that is generally centered around a subscription-based approach rather than traditional per-transaction fees. Here’s a basic overview:

Subscription Fee: Stax charges a monthly fee that covers all transactions, which can simplify budgeting and planning. The exact amount can vary depending on the plan and services you choose.

Transaction Fees: Unlike many traditional processors that charge per-transaction fees, Stax includes these fees in the subscription, so you don’t see additional charges per transaction.

Additional Services: There may be additional costs for advanced features or services, such as fraud protection or advanced reporting.

The exact pricing can vary based on factors like business size, transaction volume, and specific needs. For the most accurate information, it’s best to contact Stax directly or visit their website.

Subscription costs do not include cents per transaction; instead, they are based on processing volume. Handling up to $150,000 annually: $150,000–$250,000 in processing fees annually, or $99 per month: $139/month, processing fees of above $250,000 annually: $199+/month.

Great Value Monthly Pricing for High-Volume Businesses

Stax offers a straightforward subscription model designed to save you up to 40% on payment processing costs. You pay a flat monthly fee plus a small per-transaction fee, with no markup on interchange fees or assessments.

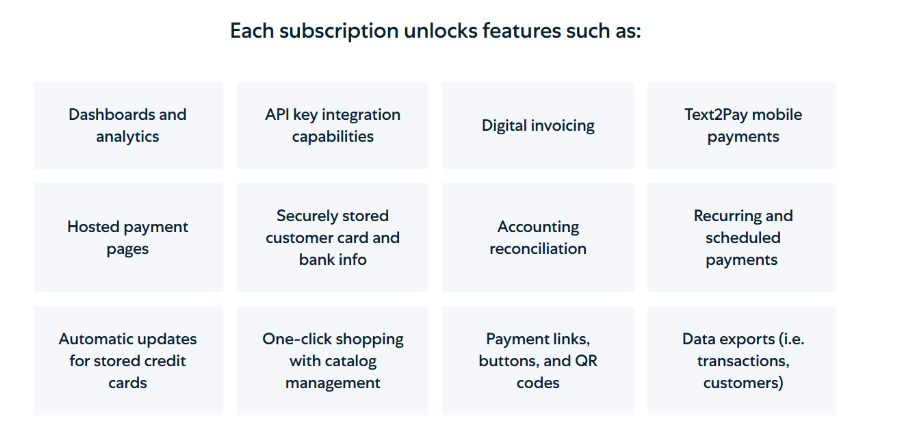

Stax provides three pricing tiers: Growth ($99/month), Pro ($159/month), and Ultimate ($199/month). Regardless of the plan, you will incur a flat fee of 0% + 10¢ per transaction, whether in-person or online, with no markup on interchange rates. Each plan supports up to $500,000 in annual processing volume. For businesses with higher volumes, a custom quote from Stax is necessary.

Each plan includes access to Stax’s dashboard, analytics software, and ACH processing. To use digital invoicing or integrate with QuickBooks, you’ll need the Pro plan. The Ultimate plan offers advanced features such as data exporting, recurring invoices, payment scheduling, and more.

Stax’s pricing model is particularly beneficial for businesses with high transaction volumes. According to Stax’s customer service, businesses processing over $8,000 per month can expect to save money, as Stax does not apply a markup to market interchange rates unlike many other processors.

Furthermore, Stax allows you to pass the per-transaction fee to customers through its surcharging feature, potentially increasing your savings.

However, the pricing structure may not be as transparent as it appears. Potential hidden fees for data processing, PCI compliance, and chargeback protection might not be included in the basic pricing. It’s recommended to consult with a sales representative to understand the full fee structure.

Stax offers the flexibility to cancel your account at any time without cancellation fees or contract obligations. However, you must provide written notice of cancellation at least 30 days in advance. If your billing date falls within this 30-day notice period, you will still be billed for that time.

Growth

0% + 10¢ (in-person) 0% + 10¢ (online)

/Transaction /Transaction

Pro

0% + 10¢ (in-person) 0% + 10¢ (online)

/Transaction /Transaction

Ultimate

0% + 10¢ (in-person) 0% + 10¢ (online)

/Transaction /Transaction

COMPLIANCE & SECURITY |5.0|

Stax Payments places a strong emphasis on compliance and security to protect both businesses and their customers. These are some salient features of their methodology:

PCI Compliance: Stax is PCI DSS (Payment Card Industry Data Security Standard) compliant, ensuring that they meet industry standards for handling credit card information securely.

Data Encryption: They use advanced encryption technologies to protect data during transactions and storage, reducing the risk of data breaches.

Fraud Prevention: Stax offers tools and features to help detect and prevent fraudulent transactions, enhancing security for both merchants and customers.

Tokenization: To further protect sensitive payment data, Stax uses tokenization, which replaces sensitive data with secure tokens that are meaningless if intercepted.

Regular Audit: Stax undergoes regular security audits and assessments to ensure they maintain high standards of data protection and compliance.

These measures are designed to ensure that transactions are secure and that customer information is protected throughout the payment process.

PCI Compliance & More

Stax is a Level 1 PCI Service Provider, the highest standard of PCI compliance. It is also HIPAA compliant and provides EMV-compliant terminals to ensure secure transactions.

Stax requires all merchants to achieve full PCI compliance within 60 days of opening an account, or they will incur a non-compliance fee. Fortunately, Stax offers a detailed guide and an easy-to-use dashboard to assist you in meeting PCI compliance requirements.

Additional Security Features

As part of its PCI compliance, Stax employs tokenization to protect credit card numbers used and stored by your business. This means you can securely set up subscriptions and retain card information without exposing your customers’ financial data.

Additionally, Stax enhances fraud protection by placing temporary risk holds on customer accounts that need further verification. For more information on this fraud prevention measure and advice on avoiding fraud, chargebacks, and other security risks, you can refer to Stax’s knowledge base and blog.

CUSTOMER SUPPORT |4.4|

To get in touch with Stax Payments’ customer support, you can use the following resources:

Customer Support Page: Visit the Stax Payments support page. Here, you can find FAQs, contact forms, and other resources to help with your queries.

Contact Form: You can fill out the contact form available on their support page for specific inquiries or issues.

Phone Support: Stax Payments may offer phone support. Look for a phone number on their website or support page.

Email Support: They might also provide an email address for support inquiries. This should be listed on their support or contact page.

Live Chat: Check if there is a live chat feature on their website for real-time assistance.

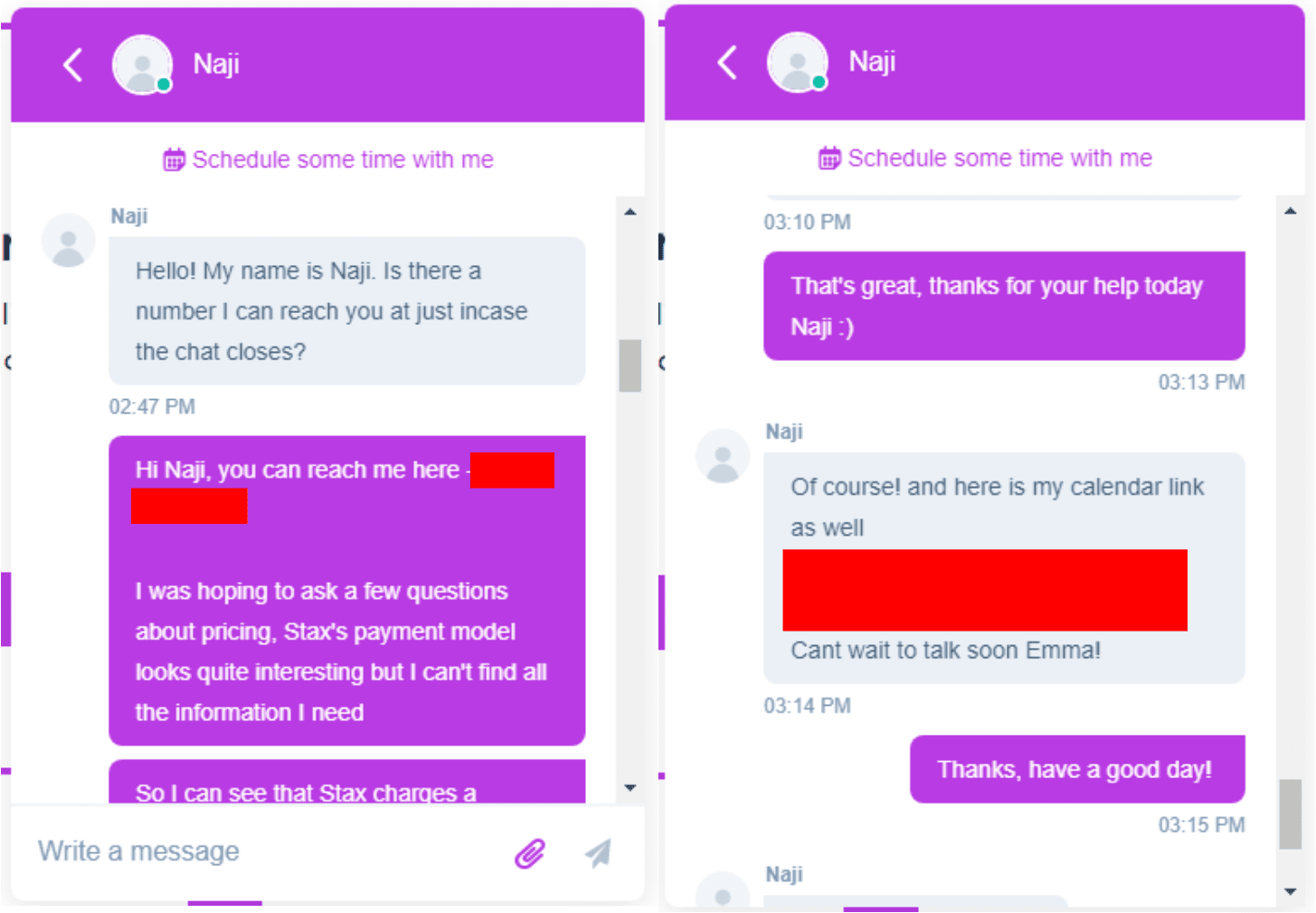

Friendly and Knowledgeable, but Sales-Focused

Stax provides multiple customer support channels, including live chat, email, web forms/tickets, phone, and fax. They also have a detailed knowledge base with well-written articles that cover nearly every aspect of their payment processing services.

While Stax does not specify their customer support hours, I found that live chat responses were available outside of typical office hours, which is a positive aspect. However, this also underscores a major issue: Stax’s website lacks clarity in several areas.

I initially tried to get more information using the website’s “Get In Touch” form, but unfortunately, I never received a response.

On the other hand, the live chat experience was much better. When using live chat, you need to answer a few basic questions about your business before entering the support queue. Despite reaching out during regular business hours, I was quickly connected to a support agent.

Stax’s customer support team is notably sales-oriented. Before addressing my questions, the agent required my email address, phone number, and scheduled a call with a payment consultant. After about 15 minutes of navigating the sales process, I finally received clear answers to my queries.

I then used a different email account to test the email support channel. I received an informative response the next business day, as expected.

Who can partner with Stax?

Software companies

Unlock enormous potential for revenue development with vertically customized embedded payment and recurring billing systems.

B2B service providers

In order to give business owners access to a greater range of tools that they require to maintain the smooth operation of their businesses, Stax is open to B2B referral relationships.

Alternative LMS

Frequently Asked Question.

Stax Payments is a subscription-based payment processing platform that offers businesses a flat-rate pricing model, enabling them to accept payments through various channels such as in-person, online, and mobile.

Stax operates on a subscription-based pricing model, where businesses pay a monthly fee instead of traditional per-transaction fees. This helps simplify billing and can lead to significant savings for businesses with high transaction volumes.

Stax supports a wide range of payment methods, including credit and debit cards, ACH payments, eChecks, and contactless payments like Apple Pay and Google Pay.

Yes, Stax is PCI DSS compliant, meaning it adheres to the highest industry standards for securely handling payment card information.

Yes, Stax offers integration options through its API and with various third-party platforms. Stax Connect, in particular, is designed for software companies looking to embed payment processing directly into their applications.

Stax Bill is an automated billing and invoicing solution provided by Stax, which helps businesses manage recurring payments, subscriptions, and invoicing efficiently.

To get started, you can visit the Stax Payments website, sign up for a plan, and provide your business details. Once your account is set up, you can begin processing payments.

Stax offers multiple customer support options, including live chat, email support, and phone support. You can also access a comprehensive knowledge base on their website.

Stax serves a wide range of industries, including retail, healthcare, professional services, e-commerce, and more, providing tailored payment solutions to meet the specific needs of each sector.

CardX by Stax is a product that allows businesses to pass credit card processing fees directly to customers, helping to reduce the costs associated with accepting card payments.