Square Payments Review

Square is a major player in payment processing, known for its easy sign-up process that allows merchants to start accepting payments quickly.

Square is a major player in payment processing, known for its easy sign-up process that allows merchants to start accepting payments quickly. Its straightforward flat-fee pricing is attractive to many businesses, and new users often benefit from discounts on its premium hardware.

4.8

Pricing Plan

Square Plus for Retail

Square Plus for Restaurants

Square Free

Pricing per transaction

2.5% + 10¢

2.6% + 10¢

2.6% + 10¢

Monthly subscription

₹7388

₹5728

₹0

Ranked 3 from 29 Credit Card Processing

Performance: |4.9|

Square Payments delivers excellent performance with its user-friendly platform, transparent flat-fee pricing, and reliable hardware like the Square Reader. It offers fast payment transfers, real-time analytics, and robust fraud prevention. While Instant Transfers and business account features have some limitations, Square remains a top choice for small to medium-sized businesses seeking a comprehensive payment processing solution.

Uptime: |4.9|

Square Payments maintains a strong uptime, ensuring reliable access to its payment processing services. The platform is designed for high availability, with robust infrastructure supporting consistent performance. While exact uptime statistics aren’t always publicly disclosed, Square’s reputation and performance suggest reliable service, minimizing downtime and disruptions for businesses relying on its payment solutions.

Customer Service: |4.8|

Square Payments offers reliable customer service with support available through various channels, including phone, email, and live chat. The Premium plan includes access to premium support for quicker resolutions. While most users find the support team responsive and helpful, some have reported delays during peak times. Overall, Square’s customer service is considered effective and supportive for resolving issues.

Pricing: |4.7|

Square Payments features a pay-per-transaction pricing model with no monthly fees. The standard rate is 2.60% + 10¢ for swiped transactions and 2.90% + 30¢ for online payments. Optional Instant Transfers incur an additional 1% fee. Hardware prices start at $10, with complete kits ranging from $599 to $1,959. Custom pricing is available for specific business needs.

Overview

| POS equipment | Free mobile reader, 4 devices available to purchase |

| Payments methods accepted | Credit and debit cards, digital wallets |

| Payout times | 48 hours as standard. Optional same-day payout |

| Contract length | Monthly (no cancellation fees) |

| Customer support | Phone and email support available Monday – Friday (24/7 on some plans) |

| Security | PCI-compliant, end-to-end encryption, tokenization, two-factor authentication, handles PCI compliance for you |

About Square Payments Review

Square Payments is a cloud-based payment processing solution tailored for businesses in retail, food and beverage, and health and fitness industries. It offers key features such as fraud prevention, dispute resolution, contactless transactions, automated invoicing, and cash flow management.

With built-in analytics powered by machine learning, Square Payments monitors transactions in real-time to detect and track fraudulent activities, sending automatic alerts for any suspicious behavior. The system also streamlines checkout by generating automatic receipts, ensuring a digital record of every purchase. Additionally, the activity dashboard centralizes customer data and provides up-to-date insights on sales and inventory.

Square Isn’t Perfect, but It Excels in Many Areas

Square is versatile enough to support a wide range of businesses, from small retail stores to large e-commerce operations. Setting up a new merchant account is quick and free, taking about 3 minutes with no contracts or monthly fees.

Square’s transaction fees start at 2.5% + 10¢, varying depending on payment types and processing methods. This pricing structure is particularly advantageous for businesses with a smaller to medium volume of sales.

Square also provides a variety of hardware and software solutions, including card readers, registers, reporting tools, and integrated management features.

However, customer reviews often highlight issues with Square’s customer support. Are the low fees worth the potential support challenges? Keep reading to determine if Square is the right choice for your business.

What Is Square Credit Card Processing?

Founded in 2009, Square transformed the mobile payment landscape with the introduction of the Square card reader. Before its debut, accepting payments on the go was challenging for many merchants.

Today, with four million sellers using Square daily and more than four billion transactions processed, the platform has grown into a comprehensive suite of payment tools for businesses of all sizes. In addition to payment processing, Square provides various merchant tools to help businesses sell online, manage inventory, schedule appointments, and more.

The Square mobile reader remains central to Square’s offerings, allowing small businesses to accept chip and PIN, mobile, and contactless payments from virtually any location.

FEATURES |5.0|

Square’s Impressive Set of Features

Square Payments focuses on making payment processing as seamless and efficient as possible. Even with its free plan, Square offers valuable features like next-day transfers and business checking accounts, which other processors might charge extra for.

Whether you’re in retail or selling online, Square’s extensive range of tools is designed to support your success.

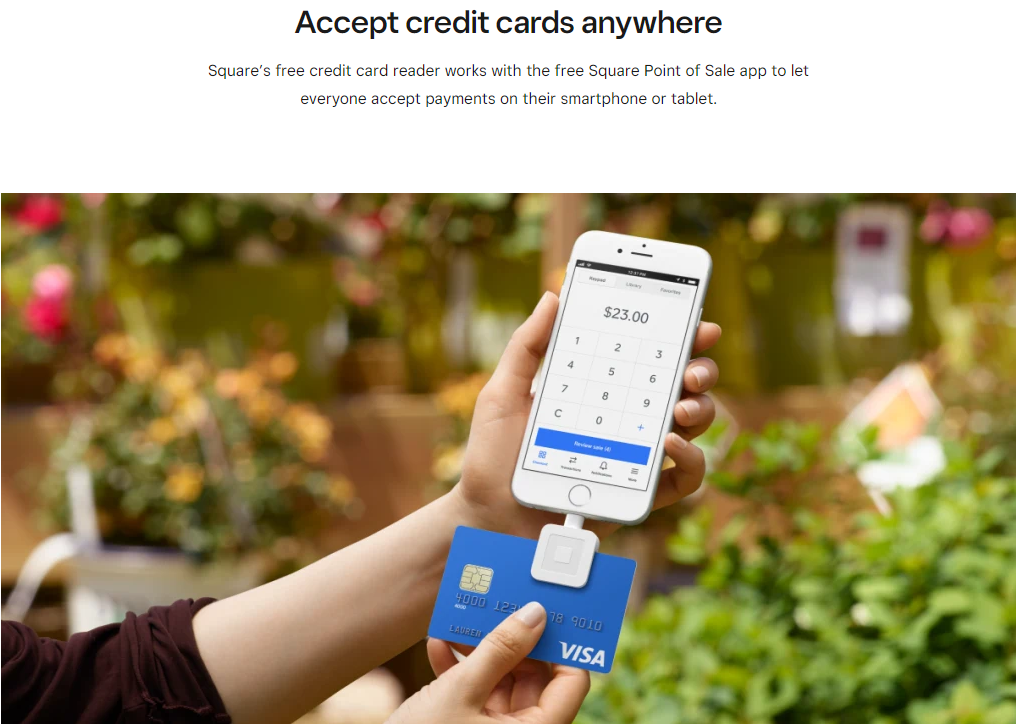

Free Mobile Reader for Your Business

When you sign up with Square, you receive a free mobile credit card reader. This compact device connects to your device’s headphone jack (for Android) or Lightning port (for Apple) and lets you accept credit card payments from almost anywhere, provided you’ve installed the free Square Point of Sale app.

The Square Reader is pocket-sized, battery-free, and capable of processing swipe payments even without a WiFi connection. Additional card readers are available for just $10 each, which is a great value.

Square also offers a variety of other hardware options, including a compact contactless and chip reader, a fully-featured card terminal, and a dual-screen POS register with integrated software. The new Square Stand 2nd generation quickly transforms a compatible iPad into a complete POS system with easy setup, integrated payment options, and dependable offline functionality.

For a limited time, you can get 20% off your first Square device purchase. If you decide you no longer need the equipment, you can return it within 30 days of shipment for a refund.

E-Commerce Tools for Any Business

Square’s e-commerce tools are truly impressive. If you’re looking to start selling online, Square simplifies the process in several ways:

Create a Free Online Store: With Square Online, you can launch a free online store using a range of professionally designed templates suited to various business types, such as retail, restaurants, services, and non-profits.

Integrate Payments on Your Existing Site: Easily add payment functionality to your current website by connecting to Square’s secure platform. You can accept payments online and via apps, and if you need assistance with API setup, Square can connect you with a certified software agency.

Sell Without a Website: Square allows you to create links, buy buttons, or QR codes that you can share via social media or email. This feature is perfect for donations, online services, memberships, and subscriptions.

All these services come with no extra costs, though online transactions incur a slightly higher fee of 2.6% + 10¢.

Various Payment Methods and Instant Payouts

Square accepts most magstripe and chip cards from Visa, MasterCard, American Express, Discover, JCB, and UnionPay, as well as online payments through PayPal, Apple Pay, Google Pay, Afterpay, and Cash App Pay.

Typically, your daily earnings are deposited into your external bank account within 1-2 business days. For quicker access, Square offers same-day payouts for a 1.5% fee per transfer, sending funds to your connected bank account within 15 minutes of your day’s close.

For even faster access, you can initiate instant transfers at the same rate (1.5%) for amounts up to $10,000 per transfer. Daily or weekly payouts do not have transfer limits.

Small Business Checking Account

Square provides instant access to your sales proceeds with its FDIC-insured business checking account. Setting up the account is quick and easy, requiring no extensive paperwork or credit checks.

This account eliminates typical banking fees, such as monthly maintenance and overdraft charges, and seamlessly integrates with your Square account, offering immediate access to your funds.

Popular Credit Card Processing

PROS AND CONS OF SQUARE PAYMENTS

Pros of Square Payments

Simple Sign-Up and Setup: Quick and easy to start using.

Flat-Fee Pricing: Transparent and straightforward pricing structure.

Compact Hardware: The Square Reader is small but powerful, perfect for mobile and in-store transactions.

Fast Transfers: Payments are deposited quickly, with an option for Instant Transfers.

Comprehensive Analytics: Real-time tracking and fraud prevention.

Cons of Square Payments

Instant Transfers Limitation: Not immediately available to all merchants; requires an established sales history.

Limited Business Account Features in the UK: Unlike in the US and Australia, Square UK does not currently offer a complimentary business account and debit card, which competitors like SumUp provide.

EASY OF USE |5.0|

Quick and Easy Onboarding for All Types of Businesses

Square is well-regarded for its straightforward onboarding process. You can sign up for a free Square account and start accepting payments the same day—no approval required.

Getting Started with Square

To begin, simply create an account and provide some basic business information. Once you receive your free reader, you can start accepting payments immediately. The process is even faster for businesses selling products and services online.

However, the ease of opening an account can be a double-edged sword. Some reviews highlight issues with unexpected account terminations. While Square makes it simple to join, it can also freeze “suspicious” payments and hold funds. To minimize issues, ensure you complete your profile thoroughly before starting to accept payments.

Integrations and APIs

Connecting Square with major website builders and e-commerce platforms is straightforward. It works seamlessly with WordPress, Wix, WooCommerce, Ecwid, and Shopify. Square also integrates with accounting tools like Zoho Books and QuickBooks, and email marketing platforms such as Mailchimp and ActiveCampaign.

For those who prefer a more customized setup, Square offers a range of payment APIs. These APIs allow you to integrate Square with your existing website or have a software agency handle the integration for you. Square’s API also facilitates the management of customer refunds, disputes, and credit card information. Detailed step-by-step setup guides are available to help you understand and implement the APIs effectively.

Advanced Business Software

Square provides a range of free tools and services designed to support and grow your business:

Dashboard and Reporting: Offers a comprehensive view of your total sales, real-time data, and valuable customer insights.

Team Management: Includes free scheduling and time-tracking software, enabling you to create and manage employee shifts through email or the mobile app.

App Marketplace: Provides free plans and trials for various apps and integrations, such as ShipStation, Setmore, Mailchimp, and Wix.

In addition to these free tools, Square offers paid software solutions, including payroll apps for employees and contractors, gift cards, a loyalty program, and an affordable email marketing platform starting at $15 per month.

PRICING |4.3|

Open Pricing Is Important, But Transaction Fees Can Add Up

Square is upfront about its fees. Merchants only pay a small percentage plus a few cents for each transaction processed through Square. There are no mandatory subscriptions, monthly fees, or hidden PCI fees, and the rates are consistent, so you always know your costs.

Here’s a breakdown of Square’s processing fees:

In-person and Mobile Card Payments: 2.5% + 10¢ per transaction

Invoiced and Online Payments: 2.6% + 10¢ per transaction

Recurring Billing and Card-on-File Transactions: 3.5% + 15¢ per transaction

Keyed-in Payments and Card-Not-Present: 3.5% + 15¢ per transaction

Virtual Terminal Transactions: 3.5% + 15¢ per transaction

ACH Bank Transfers: 1% ($1 minimum transaction)

Retail businesses can access better rates with Square’s Plus plan, which charges 2.5% + 10¢ per transaction and has a $60 monthly fee per location. This plan includes advanced inventory management tools for retail and enhanced team management and reporting tools for restaurants. Note that the Plus plan for restaurants has a slightly higher transaction fee of 2.6% + 10¢.

Square also offers three paid plans for online merchants, featuring benefits like a custom domain, customer review integration, abandoned cart recovery, and a real-time shipping calculator.

For businesses processing over $250,000 in credit card sales, custom pricing packages with advanced software solutions are available.

While Square’s pricing model may not be the lowest, it is transparent and straightforward, making it a good option for those who want to avoid the high monthly fees often associated with other credit card processors.

Square Plus for Retail

2.5% + 10¢

/Transaction

Square Plus for Restaurants

2.6% + 10¢

/Transaction

COMPLIANCE & SECURITY |5.0|

Square Is PCI-Compliant and Provides Robust Security Features

Square adheres to the Payment Card Industry Data Security Standard (PCI DSS), ensuring that customer credit card information is processed, accepted, and stored securely. As a PCI-compliant service, Square ensures your sensitive data remains protected.

PCI Compliance & Beyond

When using Square for processing and storing customer card data, you don’t need to manage PCI compliance yourself—Square handles it for you. As the merchant of record for every transaction, Square manages all compliance, regulation, and processing tasks with the banks on your behalf. Additionally, Square meets all PCI requirements without charging extra fees.

Square also complies with the California Consumer Privacy Act (CCPA) and has been adhering to the European General Data Protection Regulation (GDPR) since its introduction in 2018.

Additional Security Features

Square’s software is PCI-compliant, and its devices come with built-in end-to-end encryption, requiring no additional configuration. The integrated payment system ensures end-to-end encryption for all transactions processed at the POS terminal.

Square uses tokenization to store customer information securely, replacing sensitive data with tokens through a mathematically irreversible encryption method.

To safeguard merchant accounts from fraud and unauthorized access, Square employs 2-step verification and allows for advanced employee permissions to control account access.

CUSTOMER SUPPORT |4.3|

Impossible to Reach as a Non-Customer, Hard to Reach as a Customer

Square offers support via phone and email, but reaching their phone support team can be challenging. You must first obtain a customer code and enter it when calling. If your account has been unexpectedly terminated, accessing support becomes nearly impossible.

As a potential customer, I reached out to Square through an online form but did not receive a response. It seemed that Square’s sales team did not prioritize small businesses. However, signing up for a merchant account is free, which is a small advantage.

Unfortunately, things don’t get much better once you become a member of the Square Payments family of merchants. Many unsatisfied reviews come from merchants who signed up with Square but soon found that their accounts had been terminated and funds frozen for no apparent reason. Once that happens, communicating with Square becomes a Herculean task.

It’s worth noting that customer support is only available from 6:00 a.m. to 6:00 p.m., Monday to Friday. That’s unless you’re on the Plus or Premium restaurant plan, in which case you’ll get access to 24/7 customer support.

The Square support center has a public forum where you can ask questions and is most likely the only way to get certain information if you haven’t yet signed up. Fortunately, Square’s knowledge base features hundreds of articles, FAQs, and video guides on its hardware and software solutions, privacy policy, transfer options, fees, and pricing.

Alternative LMS

Frequently Asked Question.

Square Payments is a payment processing service that allows businesses to accept various forms of payments, including credit and debit cards, mobile payments, and online transactions. It offers both hardware (such as card readers) and software tools for managing sales and transactions.

- In-person and Mobile Card Payments: 2.5% + 10¢ per transaction

- Invoiced and Online Payments: 2.6% + 10¢ per transaction

- Recurring Billing and Card-on-File Transactions: 3.5% + 15¢ per transaction

- Keyed-in Payments and Card-Not-Present: 3.5% + 15¢ per transaction

- Virtual Terminal Transactions: 3.5% + 15¢ per transaction

- ACH Bank Transfers: 1% ($1 minimum transaction)

No, Square does not charge monthly fees. It operates on a pay-per-transaction pricing model, meaning you only pay fees for each transaction processed.

Square provides a variety of hardware options, including a free mobile card reader, compact contactless and chip readers, full-featured card terminals, and a dual-screen POS register. The Square Stand 2nd generation can turn a compatible iPad into a comprehensive POS system.

Yes, Square is PCI-compliant, ensuring that customer credit card information is processed and stored securely. Square handles PCI compliance for merchants, eliminating the need for individual validation.

Square integrates with major website builders and e-commerce platforms like WordPress, Wix, WooCommerce, Ecwid, and Shopify. You can also use Square’s payment APIs for custom integrations or connect with certified software agencies for setup.

Square offers customer support via phone and email. Phone support can be difficult to access, requiring a customer code for each call. Support is available from 6:00 a.m. to 6:00 p.m., Monday to Friday, with 24/7 support available for Plus or Premium restaurant plan users. There is also a public forum and a comprehensive knowledge base for additional help.

Funds are typically deposited into your bank account within 1-2 business days. For faster access, Square offers same-day payouts for a 1.5% fee per transfer, and instant transfers up to $10,000 per transfer are also available for the same rate.

Yes, Square provides an FDIC-insured business checking account with no monthly or overdraft fees. It integrates seamlessly with your Square account for instant access to your sales proceeds.

Square offers three paid plans:

- Square Plus: Includes additional features like PayPal integration, subscription setup, and advanced site customization for a $60 monthly fee per location.

- Square Premium: Provides lower processing fees, real-time shipping rates, and premium support for a higher monthly cost.

- Custom Pricing Packages: Available for businesses processing over $250,000 in credit card sales, offering tailored software solutions.