Sekure Payment Experts Review

Sekure Payment Experts is a company that provides merchant services, specializing in payment processing solutions for businesses of all sizes.

They offer a variety of services including credit card processing, point-of-sale (POS) systems, and merchant cash advances. The company aims to help businesses save money on payment processing fees by negotiating better rates and offering tailored solutions.

Sekure Payment Experts is known for its customer service and personalized approach, working closely with merchants to understand their needs and optimize their payment processing. They also provide support for various industries, including retail, hospitality, and e-commerce.

4.7

Pricing Plan

Interchange Plus

Simplified Flat Rate Pricing

The Edge Program

Pricing per transaction

2.99% + 19¢ (in-person & online)

3.5% + 19¢ (in-person & online)

0% (4% passed to customer)

Monthly subscription

₹0

₹0

₹3316

Ranked 7 from 29 Credit Card Processing

Performance: |4.9|

Sekure Payment Experts has a mixed performance reputation in the payment processing industry. On the positive side, they are recognized for helping businesses save on processing fees and offering a broad range of services, including credit card processing and POS systems, with personalized customer support. However, there are concerns regarding their aggressive sales tactics, long-term contract commitments with hefty early termination fees, and issues with pricing transparency. While some customers report positive experiences, others have expressed dissatisfaction, particularly in resolving disputes and handling payment processing issues. Overall, Sekure can be beneficial for businesses looking to lower costs, but careful consideration of contract terms and transparency is advised.

Uptime: |4.9|

Sekure Payment Experts generally maintains a reliable uptime for its payment processing services, ensuring that businesses can consistently process transactions without significant interruptions. While specific uptime statistics are not publicly disclosed, the company aims to provide stable and continuous service as part of its commitment to customer satisfaction. However, as with any payment processor, occasional technical issues or outages may occur, and experiences can vary depending on the specific setup or integration used by the business. Overall, Sekure strives to offer dependable uptime to support uninterrupted business operations.

Customer Service: |4.8|

Sekure Payment Experts is recognized for offering personalized and attentive customer service. They focus on understanding each business’s specific needs and providing tailored solutions, which many clients find beneficial. Their support includes hands-on assistance during setup and troubleshooting, aiming to ensure a smooth payment processing experience. This level of service is generally appreciated by businesses seeking a customized approach.

Pricing: |4.7|

Sekure Payment Experts’ pricing is designed to offer competitive rates and cost-saving opportunities for businesses. Here are key aspects of their pricing structure:

Customized Pricing: Sekure often negotiates rates based on the specific needs of each business, aiming to provide tailored pricing solutions that can help reduce overall payment processing costs.

Varied Fees: Pricing can include various fees such as transaction fees, monthly service fees, and potentially equipment costs. The exact fees depend on the services and solutions selected.

Contract Terms: Contracts may include early termination fees, so businesses should carefully review these terms to avoid unexpected costs if they decide to switch providers.

Potential Hidden Costs: Some businesses have reported concerns about pricing transparency, with occasional hidden fees or unexpected costs arising after the initial setup.

Rate Savings: Sekure’s primary selling point is their ability to negotiate better rates than some competitors, which can be beneficial for businesses looking to lower their processing expenses.

Overview

| POS equipment | Choose from a variety of free equipment, including terminals, tablet POS systems, mobile POS devices, and other options from various brands available for purchase |

| Payments methods accepted | ACH, bank transfers, digital wallets, and credit and debit cards |

| Payout times | Free same-day or next-day funding |

| Contract length | Monthly (no cancellation fees) or 3-year contracts (early cancellation fees apply) |

| Customer support | 24/7 support via phone, email, and live chat |

| Security | Level 1 PCI compliance with advanced fraud detection |

About

Sekure Payment Experts is a company specializing in payment processing solutions for businesses. They offer a range of services including credit card processing, point-of-sale (POS) systems, and merchant cash advances. The company aims to help businesses reduce their payment processing fees through tailored solutions and rate negotiations. Here’s an overview of Sekure Payment Experts in table form:

Services Offered: Credit card processing, POS systems, e-commerce solutions, merchant cash advances.

Pricing: Customized pricing, potential fees for transactions, monthly service, and equipment costs.

Cost-Saving Features: Negotiated rates to potentially lower processing costs.

Customer Service: Personalized and attentive support; mixed reviews with some issues in response times and dispute resolution.

Contract Terms: May include long-term contracts and early termination fees

Transparency: Some concerns about pricing transparency and hidden costs

Performance: Generally positive in terms of cost savings and service, but experiences vary

Affordable Processing with Free Perks, But Aggressive Marketing Might Be a Drawback

Sekure Payment Experts stands out from typical payment processors by employing ETA-certified payment experts across the US and Canada to find the best credit card processing and POS equipment for your business.

Although Sekure doesn’t offer gift cards like some competitors, it does provide the Rate Sekurity Guarantee™. If they can’t match your current rates, Sekure might cover your existing processor’s cancellation fees if you sign a 3-year contract. Their interchange-plus rates and straightforward flat-rate pricing are available on month-to-month agreements, allowing customization to fit your business needs.

Sekure’s flat-rate pricing is particularly advantageous for new, low-volume businesses or high-risk merchants. With its Edge zero-cost processing program, you can potentially save up to 100% on processing costs.

Given its cost-effective pricing models, Sekure is especially suitable for small businesses, though it also accommodates larger enterprises. If you’re new to payment processing or looking to reduce costs, Sekure offers free equipment without monthly, annual, or PCI compliance fees. Additionally, free same-day or next-day funding is available, and setup can be completed in as little as 48 hours.

For businesses branching into online sales, Sekure provides an e-commerce toolkit designed for small brick-and-mortar stores. This includes essentials like a simple checkout process with a “buy now” button, customizable hosted payment pages, and the option to send branded digital invoices via email. A free virtual terminal and a discounted payment gateway are also available.

After weeks of research, it’s clear that Sekure is a dependable processor—just be sure to thoroughly review your contract terms. Continue reading to see if it’s the right choice for your business.

FEATURES |4.8|

Here are the key features of Sekure Payment Experts:

Customizable Solutions: Tailored payment processing solutions to fit the specific needs of businesses.

Credit Card Processing: Accepts various credit card payments, including major brands.

Point-of-Sale (POS) Systems: Provides POS systems for retail and hospitality businesses.

E-Commerce Solutions: Offers online payment processing options for e-commerce businesses.

Merchant Cash Advances: Provides financing options through merchant cash advances.

Cost-Saving Negotiations: Aims to negotiate better processing rates and reduce overall costs.

Personalized Customer Support: Focuses on hands-on, personalized customer service and support.

Flexible Equipment Options: Offers various equipment options for payment processing, including POS terminals and mobile readers.

Contractual Agreements: Includes contracts with potential early termination fees and specific terms.

Reporting and Analytics: Provides tools for transaction reporting and business analytics to monitor performance and optimize processing.

Services Offered:

Sekure Payment Experts offers the following services:

Credit Card Processing: Solutions for accepting major credit cards, including Visa, Mastercard, American Express, and Discover.

Point-of-Sale (POS) Systems: Comprehensive POS systems for retail and hospitality businesses, including hardware and software solutions.

E-Commerce Payment Solutions: Online payment processing for businesses operating in the digital space, including secure checkout options.

Mobile Payment Solutions: Mobile payment processing options for businesses that need to accept payments on-the-go, such as mobile card readers.

Merchant Cash Advances: Financing options for businesses based on their future credit card sales, providing quick access to capital.

Gift and Loyalty Programs: Tools to implement gift card and loyalty programs to enhance customer engagement and retention.

Fraud Prevention Tools: Security measures to protect against fraudulent transactions and ensure safe payment processing.

Reporting and Analytics: Tools and reports to help businesses track transactions, manage sales data, and gain insights into payment processing performance.

Resources and tools

Sekure Payment Experts offers a variety of resources and tools to help businesses effectively manage their payment processing. These include ongoing customer support through dedicated account managers and a range of educational materials to guide businesses in optimizing their payment systems. They provide expert consultations and training sessions to ensure that businesses and their staff can fully utilize the payment solutions offered. Key tools include integrated POS systems, mobile payment solutions, and secure e-commerce payment gateways, all designed to facilitate smooth transactions across various platforms.

Additionally, Sekure offers fraud prevention tools to protect against fraudulent activities and provides robust reporting and analytics tools for tracking sales and optimizing performance. They also support the implementation of gift and loyalty programs, virtual terminals for manual payment processing, and integration assistance for seamless operation with existing business systems. These resources and tools are aimed at helping businesses streamline their payment processes and enhance overall efficiency.

Why Sekure Payment Experts?

Choosing Sekure Payment Experts can be advantageous for businesses seeking tailored and cost-effective payment processing solutions. They are known for their ability to negotiate lower processing rates, which can lead to significant cost savings. Sekure offers a wide range of services, including credit card processing, POS systems, mobile payment solutions, and e-commerce gateways, making them a versatile option for various business types.

In summary, Sekure Payment Experts stands out for its cost-saving potential, comprehensive service offerings, and commitment to customer support, making them a strong contender for businesses looking to optimize their payment processing.

Essential, Cost-Saving Features for Small Businesses

Sekure stands out for offering several cost-saving benefits, including free POS equipment, which helps lower initial setup costs, allowing you to allocate funds to other areas of your business. Additionally, free same-day or next-day funding ensures quick access to your earnings, aiding in effective cash flow management. With its extensive partner network, Sekure can provide solutions specifically tailored to your industry.

Free Equipment for Quick and Easy Processing

Sekure offers free equipment without monthly or annual fees, even if you choose not to sign a long-term contract. The sales agent assured me that every merchant, regardless of contract terms, receives free equipment. Larger businesses can even receive multiple devices at no cost. This is one of the most generous offers I’ve encountered in the industry.

However, you will eventually need to return the equipment to avoid extra fees. Sekure covers the shipping costs and will replace the equipment as long as you continue using its payment processing services. While Sekure partners with various brands, it primarily offers free Payanywhere hardware, including credit card readers, tap-and-pay terminals, and contactless POS systems. You also have the option to purchase additional devices to further optimize your business operations.

Discounts on Authorize.net Payment Gateway and Other E-Commerce Solutions

Unlike processors such as Stax or Square, Sekure doesn’t offer proprietary e-commerce solutions. However, this allows Sekure to partner with a wide range of industry-leading e-commerce providers. These partnerships include online selling platforms like Magento and BigCommerce, as well as shopping carts like OpenCart and ZenCart.

Sekure offers the Authorize.net payment gateway at significantly reduced rates and may even waive the gateway fees in some cases.

For small online stores, Sekure makes it easy to sell products using one-click “Buy Now” buttons that can be placed anywhere, from social media to your website, encouraging quicker purchases. You can also customize hosted payment pages with your branding without having to manage the technical and security details.

Sekure provides a free virtual terminal, which is particularly useful for businesses that accept payments over the phone, via email, or through text messages. This feature streamlines online payments for businesses that don’t have a website or shopping cart.

Variety of Payment Methods and Quick Payouts

In addition to credit and debit cards, Sekure Payment Experts enables you to accept a wide range of payment methods, including digital wallets like PayPal, Apple Pay, Google Pay, and Samsung Pay.

Sekure Payment Experts offers faster payouts than many competitors, with free, rapid disbursements typically occurring on the same day or the next. This quick access to funds helps maintain a healthy cash flow, allowing for prompt reinvestment in your business, which supports growth and stability in a competitive market.

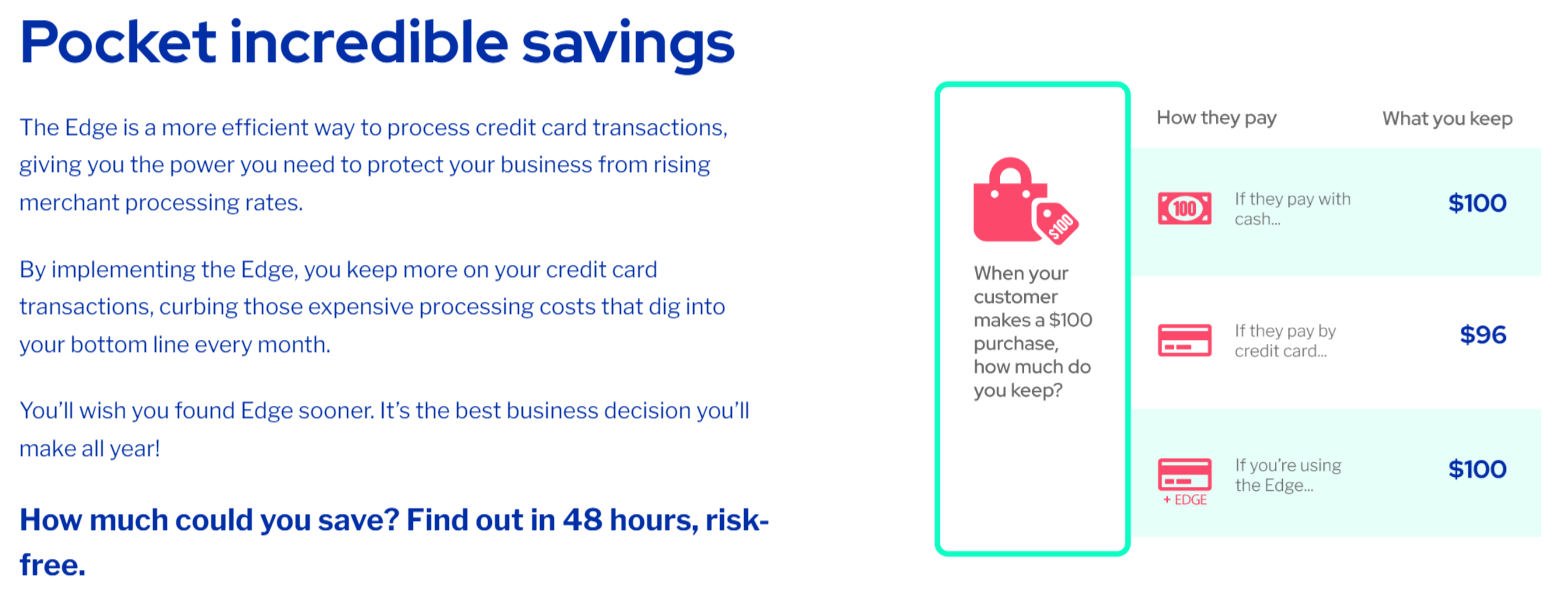

Save Up to 100% on Processing Fees

Sekure’s Edge program is a zero-cost processing solution that transfers your processing fees to your card-paying customers. Unlike traditional cash discounts that offer lower fees to cash-paying customers, Edge allows you to add a price increase per item to cover processing costs.

You’ll receive clear signage to display the two pricing options, informing customers that paying with cash will save them money. Sekure Payment Experts also provides PCI-compliant technology and hardware that automatically adjusts prices based on the payment method.

While many processors offer zero-cost processing programs, Sekure stands out as one of the most cost-effective options for budget-conscious businesses by also including free equipment without monthly or annual fees.

Flexible Automated Payments

Sekure simplifies the checkout process for repeat customers by automating online payments. Customers can securely save their payment information for future purchases, eliminating the need to re-enter details each time.

Like other payment providers, Sekure supports subscriptions and recurring billing, automating these processes to help maintain consistent cash flow. With customizable branded invoices, you can add a personal touch to each transaction, fostering brand loyalty and customer engagement.

Popular Credit Card Processing

PROS AND CONS OF SEKURE PAYMENT EXPERTS

Pros of Sekure Payment Experts

Customized payment solutions tailored to business needs

Potential cost savings through negotiated rates

Comprehensive range of services, including POS and e-commerce solutions

Personalized customer support and hands-on assistance

Offers tools for fraud prevention and business analytics

Cons of Sekure Payment Experts

Aggressive sales tactics reported by some customers

Long-term contracts with early termination fees

Concerns about pricing transparency and hidden fees

Inconsistent customer service experiences

Possible delays in issue resolution and support

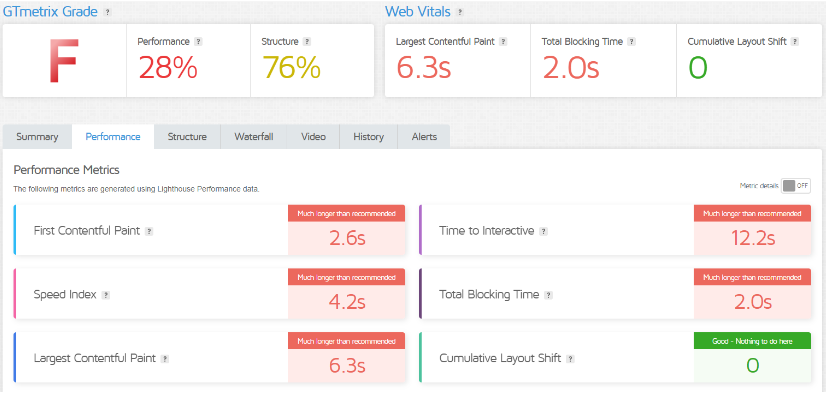

GTMetrix

EASY OF USE |4.9|

Sekure Payment Experts is generally regarded as user-friendly, with a focus on making their payment processing solutions accessible and easy to implement for businesses of all sizes. Here are some key aspects of their ease of use:

Intuitive POS Systems: Sekure offers POS systems that are designed to be easy to set up and use, with straightforward interfaces that require minimal training.

Simple Mobile Payment Solutions: Their mobile payment options are designed for on-the-go transactions, with user-friendly apps and mobile card readers that are easy to operate.

Guided Setup: Sekure provides hands-on support during the setup process, helping businesses get up and running quickly without technical difficulties.

Clear Reporting Tools: The reporting and analytics tools provided by Sekure are designed to be accessible, offering clear insights into sales and transaction data without requiring extensive technical knowledge.

Customer Support: With personalized customer service, Sekure helps businesses resolve any issues or questions quickly, contributing to an overall user-friendly experience.

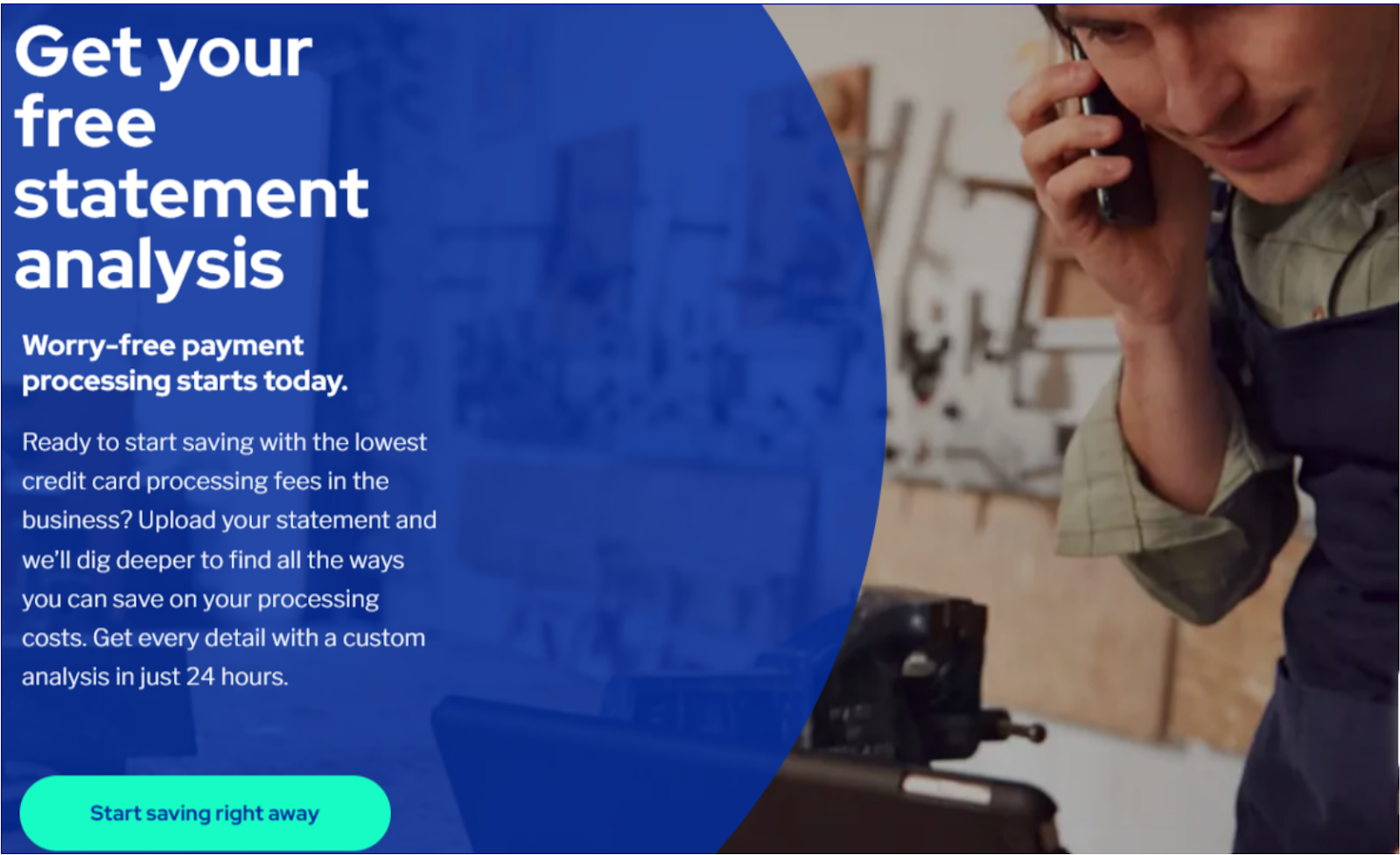

Simple Sign-Up, Onboarding, and Payment Processing

Signing up for credit card processing with Sekure is quick and straightforward. The process is highly beginner-friendly, allowing you to easily integrate it into your business without dealing with technical challenges.

Getting Started With Sekure Payment Experts

ou can either call or submit your business details to request a callback. If you’re currently using another processor, it’s a good idea to request a personalized savings analysis. For this, you’ll need to provide a recent monthly payment processing statement.

Sekure will then evaluate your fees and search for a better deal through its partner network. Keep in mind that, as a primary reseller of North American Bancard, Sekure may prioritize this processor, but you can request other options.

Once approved, Sekure’s onboarding process is simple and informative, guided by your personal payment expert. You’ll gain access to your account and receive a thorough walkthrough of the platform’s features and tools.

Access to Customized, Industry-Specific Software

Although Sekure doesn’t offer proprietary software, it partners with reputable equipment and software vendors to ensure you receive a payment management system tailored to your business needs.

For instance, if you run a retail business, Sekure Payment Experts might recommend RetailCloud, a specialized retail POS solution that includes features like customer relationship management (CRM), employee time and attendance scheduling, loyalty marketing, and other retail-specific tools. For hospitality businesses, Sekure might suggest HotSauce, a comprehensive software solution designed for restaurants, bars, and nightclubs.

ETA-Certified Personal Payment Experts

Sekure distinguishes itself by offering ETA-certified personal payment experts who provide specialized, industry-specific knowledge in payment processing. Their expertise simplifies the complexities of payment processing, allowing you to focus more on business growth and customer engagement.

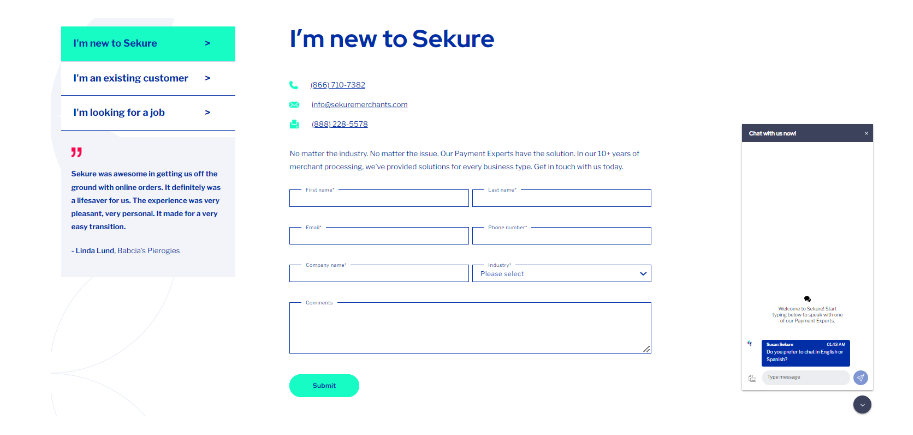

Create A Account

1. Visit the Website: Go to the Sekure Payment Experts website.

2. Fill Out the Contact Form: Provide your business information and contact details in the inquiry form.

3. Consultation Call: A representative will contact you to discuss your business needs and offer a tailored solution.

4. Sign Agreement: Review and sign the agreement provided, then proceed with the setup process guided by Sekure’s team.

PRICING |4.9|

Flexible Pricing Models and Competitive Rates, But Watch for Hidden Fees

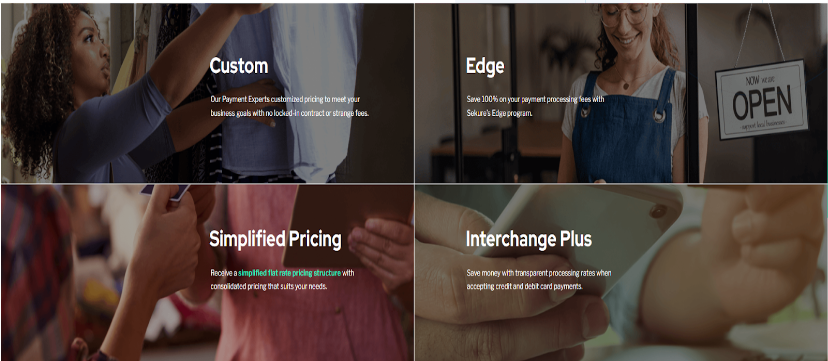

Sekure offers four pricing models: custom pricing, interchange-plus pricing, Simplified Pricing, and The Edge Program.

The custom pricing option is ideal for businesses with specific needs where traditional interchange-plus models may not be effective. Sekure’s payment experts will review your monthly processing statements and business requirements to develop a custom pricing model, ensuring you only pay for the features that benefit your business.

In the interchange-plus plan, there’s no monthly fee, and you’ll pay the interchange fee set by the credit card networks plus a fixed markup from the payment processor. While Sekure determines these rates on a case-by-case basis, the standard per-transaction fee is typically 2.99% + 19¢ (for both in-person and online transactions), which aligns with industry norms. Although transparent, this model may lead to fluctuating processing costs every six months.

If you prefer more predictable expenses, the Simplified Pricing model could be a better fit. This plan doesn’t require a merchant account qualification, making it suitable for new and high-risk businesses. You’ll pay a flat fee of around 3.5% + 19¢ per transaction (in-person and online), which is ideal for businesses with a low volume of high-value transactions.

Sekure’s Edge program, a zero-cost processing solution, allows you to save up to 100% on processing fees by adding a 4% surcharge to customers paying with cards. The program costs ₹3316 per month, and when paired with free equipment, it can significantly reduce expenses for budget-conscious businesses.

While this model can save money and offer customers a discount for paying with cash, it might not be suitable for all businesses or customer bases. For example, nonprofits and sellers of unique products or services might pass on processing fees without issue, but clothing or convenience stores might risk deterring customers.

Interchange Plus

2.99% + 19¢ (in-person & online)

/Transaction

Simplified Flat Rate Pricing

3.5% + 19¢ (in-person & online)

/Transaction

The Edge Program

0% (4% passed to customer)

/Transaction

Sekure offers complimentary equipment with no monthly or annual fees and no PCI compliance fees. You can save even more with a free virtual terminal and discounted rates for the trusted Authorize.net payment gateway. However, if you require additional features like e-commerce software, expect higher costs. There is also a $25 fee for successful chargebacks, which is standard among processors.

Sekure’s free equipment, discounted payment gateway, and competitive fees make it a good choice for budget-conscious small businesses. However, if you’re seeking even lower negotiable rates, Leaders Merchant Services might be a better option.

COMPLIANCE & SECURITY |5.0|

Sekure Payment Experts prioritizes compliance and security to ensure safe and reliable payment processing for businesses. They adhere to industry standards, including PCI DSS (Payment Card Industry Data Security Standard) compliance, which helps protect sensitive cardholder information during transactions. Sekure implements advanced security measures such as encryption and tokenization to safeguard data against breaches and fraud.

Additionally, they offer tools for fraud detection and prevention, helping businesses minimize risks associated with payment processing. Their focus on maintaining high security standards ensures that businesses can trust Sekure with the protection of their customers’ payment information.

No PCI Compliance Fees and Advanced Fraud Protection

Sekure prides itself on maintaining a strong track record of protecting customer information and accounts. With its free Payanywhere equipment, your business automatically meets PCI compliance standards, making it a dependable choice for merchants looking for straightforward payment processing solutions.

PCI Compliance & More

Sekure’s PCI Plus program provides free PCI compliance for qualified merchants. This program simplifies compliance by eliminating the need for self-assessment questionnaires (SAQs), scans, and PCI compliance or non-compliance fees often required by other processors.

In addition to managing PCI compliance, Sekure also ensures EMV compliance, protecting you and your customers from fraud when processing payments with Europay, Mastercard, and Visa.

Additional Security Features

Sekure provides HIPAA-compliant POS systems specifically designed for healthcare businesses. These systems incorporate encryption protocols and access controls to protect patient privacy. For additional compliance support, you can request assistance from an ETA-certified healthcare expert to help navigate the complexities of managing patient information.

Under its PCI Plus program, Sekure offers breach forgiveness of up to $100,000 for businesses classified as PCI Level-3 or PCI Level-4. In the event of a data breach, you won’t be responsible for any expenses unless they exceed $100,000.

Sekure also offers advanced fraud prevention features. Its POS systems and e-commerce technology can instantly verify customer information and reject suspicious transactions, safeguarding your business from cyberattacks. You can set up roles such as managers, administrators, and cashiers with specific permissions, such as issuing refunds and voiding transactions directly from your POS system.

Unlike some processors that automate chargeback management to cut costs, which can lead to false positives, Sekure employs a dedicated team to assist merchants in disputing chargebacks. This ensures that only legitimate disputes are processed and prevents exploitation of the system.

CUSTOMER SUPPORT |4.0|

Sekure Payment Experts is known for offering personalized and attentive customer support, aiming to provide businesses with the assistance they need throughout their payment processing journey. Their support includes hands-on help during the setup process, ensuring that businesses can smoothly integrate and start using their payment solutions. Sekure assigns dedicated account managers to clients, offering a single point of contact for any issues or questions that arise.

While many customers appreciate the personalized attention and responsiveness, experiences with their customer support can vary. Some clients report positive interactions and effective problem resolution, while others have experienced delays or challenges in getting issues addressed promptly. Overall, Sekure’s customer support is a key aspect of their service, but businesses should ensure they understand the level of support available and manage their expectations accordingly.

Responsive and Informative but Sales-Focused

Sekure provides support through phone, email, and live chat. However, the live chatbot requires you to leave your phone number, which can lead to persistent sales calls, making it harder to avoid them. While some support channels are available 24/7 for paying customers, sales support appears to be limited to standard business hours.

Email support responded within an hour with detailed answers to my questions, suggesting a call for a more in-depth discussion. When I called, I connected with a representative in less than a minute. He was knowledgeable and provided the information I needed, but he was also quite pushy, encouraging me to set up an account or leave information to “lock in rates.”

Sekure offers a Support Hub with articles on various topics like equipment management, online payments, and maintenance. Although it lacks extensive content such as video tutorials or images, likely due to the absence of proprietary solutions, it provides useful information. The Sekure blog covers industry-specific trends and practices, with articles filtered by industry and topics like payment processing and merchant services.

One notable feature is the savings calculator on Sekure’s website. While it may not be completely accurate, it provides a rough estimate of potential savings and helps set expectations. For a more tailored analysis, you can request a detailed savings assessment from one of Sekure’s payment experts.

Alternative Sekure

Frequently Asked Question.

Sekure Payment Experts is a provider of payment processing solutions that helps businesses accept payments through various methods including credit cards, debit cards, and online transactions.

Sekure Payment Experts integrates with your business to facilitate secure and efficient payment processing. It provides hardware and software solutions to handle transactions both online and in-person.

Sekure Payment Experts can process a wide range of payment types, including credit and debit cards, ACH transfers, and digital wallets.

Yes, Sekure Payment Experts uses advanced encryption and security protocols to ensure that all payment transactions are secure and comply with industry standards.

Sekure Payment Experts offers various integration options, including API, plugins, and custom solutions to fit different types of websites and e-commerce platforms.

Fees vary depending on the type of transaction, volume of transactions, and specific services used. You can contact Sekure Payment Experts directly for a detailed fee structure.

Sekure Payment Experts may charge a monthly fee, which can depend on the specific plan and services you choose. Be sure to review the pricing details when setting up your account.

Yes, Sekure Payment Experts supports international transactions and can process payments in multiple currencies.

Sekure Payment Experts offers customer support through various channels including phone, email, and live chat. Availability of support may change depending on your plan.

Setting up an account typically involves filling out an application, providing necessary documentation, and configuring your payment preferences. There are comprehensive instructions given during the setup procedure.

Yes, Sekure Payment Experts provides support for managing chargebacks and disputes, including tools and guidance to help resolve issues.

For in-person payments, Sekure Payment Experts may provide or recommend hardware such as card readers, terminals, and POS systems.

Sekure Payment Experts provides an online dashboard where you can view detailed transaction reports, analytics, and other financial data.

System requirements can vary based on the services you use. Typically, you’ll need a modern web browser and internet connection. Specific requirements are detailed in the setup documentation.

Yes, you can cancel your account, but it’s important to review the cancellation policy and any potential fees associated with ending your service. Make contact with customer service if you need help with the cancelling procedure.