Payment Depot Review

Payment Depot stands out as one of the top payment processing companies due to its ability to offer startups and small businesses access to wholesale interchange rates with no additional markups and minimal extra fees.

Interchange rates are the wholesale processing fees charged by card networks like Visa and Mastercard to process credit card transactions. Many payment processors increase these costs by adding surcharges, using interchange-plus or tiered-rate plans, or applying flat-rate fees, which results in higher fees per transaction for merchants.

Payment Depot takes a different approach. It doesn’t add a markup to the wholesale interchange rates. Instead, it provides the lowest possible rates directly to its merchants and earns revenue through monthly membership and per-transaction fees.

Since interchange rates can vary significantly based on industry, sale type, and card type, predicting fees can be challenging. However, Payment Depot’s model ensures that you receive the lowest processing rate per sale, often resulting in substantial savings compared to flat-rate or tiered-rate processors.

4.8

Pricing Plan

Starter

Growth

Interchange+

Pricing per transaction

0% + 10¢ (in-person)

0% + 10¢ (online)

0% + 10¢ (in-person)

0% + 10¢ (online)

0.2%-1.95%

Monthly subscription

₹6558

₹8218

₹0

Ranked 5 from 29 Credit Card Processing

Performance: |4.9|

Payment Depot is praised for its transparent pricing, offering wholesale rates with no markup, making it cost-effective for businesses processing large volumes. It provides excellent customer service, secure transactions, and integration with various payment systems. However, it may not be ideal for small businesses due to higher monthly fees. Overall, it’s a strong choice for mid to large-sized enterprises.

Uptime: |4.9|

Payment Depot offers reliable uptime, ensuring that transactions are processed without interruptions. Their service boasts consistent performance with minimal downtime, which is critical for businesses that require seamless payment processing. While specific uptime percentages aren’t always disclosed, customer feedback suggests a high level of reliability, making Payment Depot a dependable choice for uninterrupted payment services.

Customer Service: |4.8|

Payment Depot is known for its excellent customer service, offering responsive and knowledgeable support through phone, email, and chat. Customers appreciate the personalized assistance and quick resolution of issues. The company’s dedication to service is reflected in positive reviews, making it a strong option for businesses seeking reliable support alongside their payment processing needs.

Pricing: |4.7|

Payment Depot offers a transparent pricing model with a membership-based structure, providing wholesale rates with no markup. Plans start at around $79 per month, making it cost-effective for businesses with high transaction volumes. However, the monthly fees may be steep for smaller businesses. There are no hidden fees or long-term contracts, which adds to its appeal for those prioritizing cost efficiency.

Overview

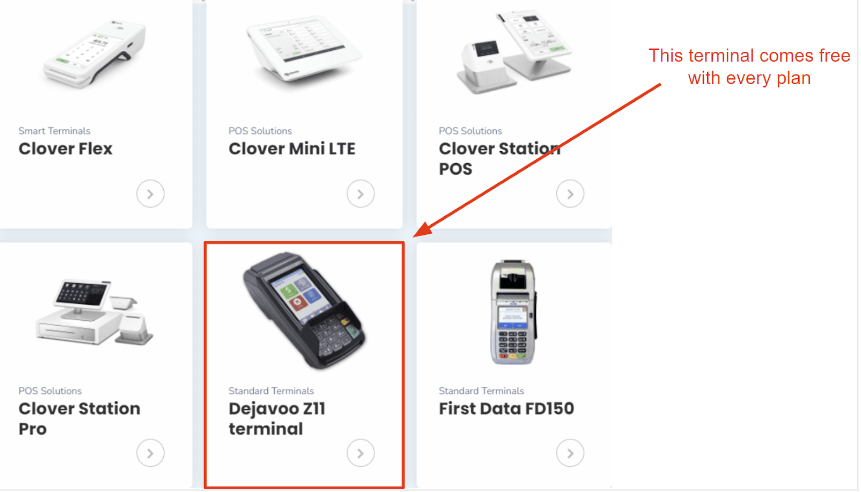

| POS equipment | Free Dejavoo terminal available, with options to purchase 2 Dejavoo terminals, 4 Clover devices, and 1 SwipeSimple mobile reader |

| Payments methods accepted | Credit and debit cards, digital wallets, ACH, and bank transfers. |

| Payout times | 24 hours |

| Contract length | Monthly with no cancellation fees. |

| Customer support | 24/7 technical support via phone and ticket system, with sales support available from 8:30 AM to 7:30 PM EST/PST. |

| Security | Level 1 PCI-compliant with tokenization, end-to-end encryption, payer authentication, and 24/7 fraud risk monitoring. |

Payment Depot Overview

Payment Depot is a payment processing company known for its transparent, membership-based pricing model, offering wholesale rates without markups. This approach makes it particularly cost-effective for businesses processing large volumes of transactions. The company provides a range of services, including credit and debit card processing, digital wallet acceptance, and ACH transfers, with fast payout times of 24 hours.

Payment Depot also offers a variety of POS equipment, including free Dejavoo terminals, and the option to purchase additional terminals, Clover devices, and mobile readers. Their security features are robust, including Level 1 PCI compliance, tokenization, end-to-end encryption, payer authentication, and 24/7 fraud risk monitoring.

Customer service is a strong point, with 24/7 technical support available via phone and ticket system, and sales support offered during extended business hours. The company operates on a monthly contract basis with no cancellation fees, providing flexibility to its users. Payment Depot is well-suited for mid to large-sized businesses seeking reliable, cost-efficient payment processing solutions.

Payment Depot Rates

Payment Depot has recently updated its rate structure, reducing the number of available plans. Currently, it charges a monthly membership fee starting at $79 for businesses that process up to $250,000 in transactions per year. For companies processing more than $250,000 annually, a custom quote for the monthly fee is required. The subscription fee is based on processing volume and does not include additional cents per transaction.

Cost-effective and dependable payment processing with a few support problems

Payment Depot appears very appealing at first glance, offering a straightforward and reasonably priced monthly subscription that could potentially reduce your credit card processing costs by up to 40%. With a model that features no markups on transactions and interchange-plus pricing with no monthly fees, Payment Depot positions itself as one of the most cost-effective options in the industry. But is it as good as it seems? I decided to investigate further.

Payment Depot is a subsidiary of Stax, which typically serves high-volume businesses. Unlike its parent company, Payment Depot focuses on small to medium-sized businesses, regardless of transaction volume. It’s available only in the US and offers various options for both e-commerce and traditional brick-and-mortar stores.

User reviews also reflect positively on Payment Depot, with many merchants praising its service and noting substantial savings. The number of negative reviews is relatively low, and long-term users often speak highly of their experiences.

After reviewing thousands of user comments and comparing Payment Depot with other leading payment processors, it generally lives up to its reputation. However, it isn’t without its flaws. Continue reading to determine if Payment Depot is the right fit for your business.

Reasons Payment Depot Was Our First Choice for the Best Credit Card Processor for Large Volume Transactions

We selected Payment Depot as the top credit card processor for businesses with high transaction volumes due to its subscription-based pricing model. This model involves paying a monthly fee, along with interchange rates plus a flat per-transaction fee. The key advantage is that Payment Depot doesn’t mark up the interchange rate with an additional percentage, allowing businesses to retain more of their revenue. This approach can lead to significant savings for high-volume businesses. Additionally, Payment Depot offers a variety of plans tailored to businesses of different sizes and growth stages that want to process credit card payments. These factors make it an ideal choice for high-volume transaction processing.

FEATURES |4.9|

Robust Solutions for Both In-Person and Online Transactions

Despite being more affordable than many competitors, Payment Depot does not skimp on features. It provides comprehensive solutions for in-person transactions, versatile e-commerce options, including an extensive API, and more. In fact, its feature set surpasses that of many higher-priced alternatives.

Here’s what I found most notable:

Free POS Terminals

No matter which plan you select, Payment Depot includes a free Dejavoo terminal. This EMV-enabled device supports contactless payments via credit/debit cards and digital wallets like Apple Pay, Samsung Pay, and Google Wallet. It also allows for easy signature capture via its touch screen.

If your business needs additional terminals, you might be able to negotiate for multiple free Dejavoo terminals. Considering the cost of these terminals, this could result in substantial savings.

Create Your Own E-Commerce Shopping Cart or Use a Pre-Built One

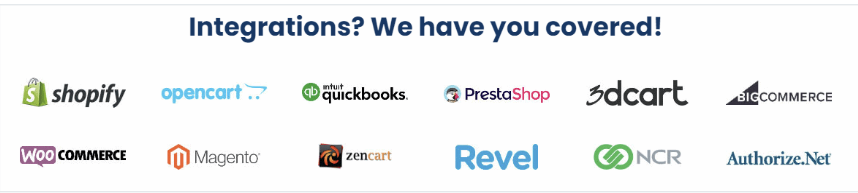

Payment Depot provides a wide array of e-commerce tools to suit your business needs. It integrates smoothly with popular payment gateways like Authorize.net, Stripe, PayPal, and others, and offers its own virtual terminal. You have the flexibility to either design a custom shopping cart for your website or mobile app or use a pre-built template to start selling immediately.

Additionally, you can streamline your e-commerce operations with integrations for QuickBooks, Sage, and other accounting software. Every sale, whether made online or in-person, is automatically recorded in your accounting system, saving you significant time on administrative tasks and allowing you to focus more on business growth.

Next-Day Deposits

Payment Depot processes all major debit/credit cards and ACH payments, with a goal of depositing funds into your account within 24 hours of each transaction. This is a significant advantage, as some processors may take over 48 hours.

However, Payment Depot does not offer same-day or instant deposits. While this option would be a valuable feature, even at a premium cost, its absence is a minor drawback.

Chargeback and Risk Monitoring

Payment Depot also facilitates chargeback disputes directly through your account portal, consolidating all necessary information and evidence in one place to save you time.

In addition, Payment Depot employs a 24/7 risk monitoring team to help minimize chargeback and fraud risks. They monitor changes in bank policies and emerging fraud techniques, proactively alerting you to potential issues before they become problems.

Popular Credit Card Processing

PROS AND CONS OF PAYMENT DEPOT

Pros of Payment Depot

Save up to 40% with subscription-based pricing that eliminates interchange markups.

Cost-effective interchange-plus pricing with no monthly fees.

Quick setup, possible in as little as 24 hours.

Free modern terminal provided.

Cons of Payment Depot

No option for same-day processing.

Live chat and email support can be difficult to reach.

EASY OF USE |4.9|

Fast and Easy Onboarding with a User-Friendly Platform

Getting started with Payment Depot is relatively quick and straightforward. While there is a vetting process, as long as you promptly provide the necessary information and documentation, you can begin processing in-person and online payments within 24 hours.

User reviews support this, with no complaints found about a lengthy onboarding process. On the contrary, many users praise the sales support for their assistance in getting started.

Getting Started with Payment Depot

To begin with Payment Depot, you have two options: call sales support or fill out a contact form. Calling typically results in a faster response and may give you an opportunity to negotiate a better deal with your sales agent.

You’ll need to describe your business to the sales agent to determine if you’re a good fit. Be prepared to discuss your industry and average monthly income. Payment Depot doesn’t generally work with high-risk businesses, but most other businesses should have no issues during this process.

Next, you’ll be required to provide identity and other documents through a secure online form to verify your business’s legitimacy. One should hear back from you in a day or two. If approved, you can start setting up your account and begin selling. Payment Depot will also send you a free POS terminal.

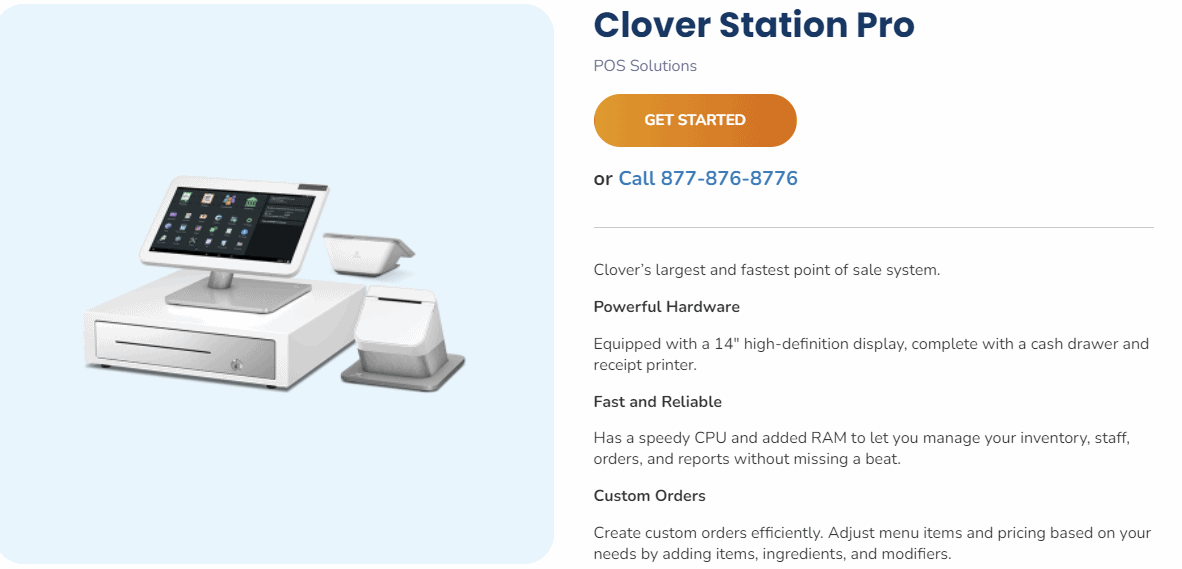

User-Friendly POS Terminals with Advanced Features

The fundamental needs are met by the free Dejavoo terminal, but Payment Depot is an authorized reseller of Clover technology for more demanding requirements. Clover devices feature a user-friendly interface that allows you to manage various aspects of your business directly from the terminal, including sorting inventory, managing staff schedules, creating custom orders, and more.

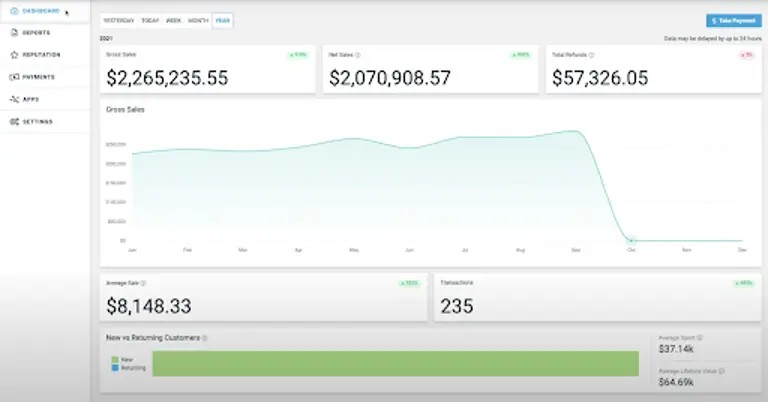

Comprehensive Payment Dashboard

Payment Depot provides an excellent dashboard for managing all your payments in one place. The responsive and intuitive interface offers a range of useful features.

For instance, you can easily create and send branded invoices or generate simple payment links for customers to pay for products or services. The dashboard also makes it easy to run promotions, monitor sales performance, and manually input payments.

PRICING |4.9|

Flexible Plans for Significant Savings

Payment Depot’s standout feature is its flexible pricing structure. Although it claims no percentage markup on transactions with its subscription plan, it actually charges a flat fee of 10¢ per transaction for both in-person and online payments. Despite this, these per-transaction fees are among the lowest available.

Payment Depot offers two subscription plans: the Starter plan (₹6558/month) which covers up to $120,000 in transactions per year, and the Growth plan (₹8218/month) which covers up to $150,000 per year. For businesses exceeding these limits, a custom quote can be requested, or you may be directed to Stax. In addition to subscription plans, Payment Depot now provides affordable interchange-plus pricing with rates ranging from 0.2% to 1.95%.

Regardless of the chosen plan, you will pay the wholesale interchange fees set by each credit card network on top of Payment Depot’s low transaction fees. These fees vary depending on factors such as the type of card, whether the transaction was in-person or online, and your business type. Additional minor fees may apply, such as for chargebacks or Clover terminal software, though these are often outside Payment Depot’s control.

While the interchange-plus plan can be less predictable, it has no monthly fee and offers competitive rates, making it ideal for businesses with lower transaction volumes or those just starting out. For businesses processing at least $8,000 per month, the subscription plans might be more cost-effective. Overall, Payment Depot’s pricing structure can lead to significant savings, potentially up to 40%, especially if your business benefits from a subscription model.

COMPLIANCE & SECURITY |4.5|

A PCI-Compliant Platform with Extra Protections

Payment Depot, along with its parent company Stax, boasts an excellent security track record, having never experienced a data breach. Achieving PCI compliance is straightforward since Payment Depot provides essential encryption and data protection with all its plans.

PCI Compliance & More

Payment Depot adheres to the highest PCI standards, making it suitable for businesses with a history of data breaches or those handling millions of credit card transactions annually.

Additionally, Payment Depot voluntarily aligns with the EU’s General Data Protection Regulation (GDPR) privacy law, despite being based in the U.S. This commitment to transparency and data protection is notable and goes beyond what is legally required.

While Payment Depot doesn’t provide a specific guide for achieving PCI compliance, their 24/7 technical support team is available to offer assistance. However, it would be beneficial to have accessible resources for PCI compliance without needing to contact support.

Additional Security Features

To ensure PCI compliance, Payment Depot employs end-to-end encryption across all payment devices, ensuring that card information is not stored after a transaction is completed.

Their e-commerce platform also features instant and automatic verification of customer information, which helps minimize the risk of chargebacks.

Payment Depot further enhances security through payment tokenization, which replaces sensitive card data with an alpha-numeric code during transactions, so no usable information is transmitted.

Overall, Payment Depot’s security measures are impressive, offering a high level of data protection that few other payment processors can match.

CUSTOMER SUPPORT |4.8|

Excellent Phone Support, Unresponsive Email

Payment Depot provides technical and sales support through an online form, live chat, and phone. With support teams based on both coasts, they cover the entire US. Technical support is available 24/7, while sales support operates from 8:30 AM to 7:30 PM EST/PST, depending on the team.

In my test of their support, I encountered some issues but was ultimately satisfied with the results.

I found the contact form to be ineffective; my inquiries about Payment Depot’s free POS terminals went unanswered during business hours. Conversely, the live chat support did provide the needed information, though it took several attempts to reach a live agent. I found the chat reps more focused on setting up calls with specialists than answering questions directly.

Phone support proved to be the most effective. Initially, I called outside of business hours and was asked to leave a message for a callback, which never came. On a follow-up call during business hours, I was promptly connected with a knowledgeable and helpful agent. This agent answered all my questions, including detailed technical ones about Payment Depot’s security standards, without hesitation or transfers. The agent’s expertise and responsiveness were impressive.

Exceptional Phone Support, Limited Initial Accessibility

I posed as an employee asking questions on behalf of my boss, claiming I was transcribing the answers. The agent requested that I send the transcript once the call ended. When I did, he reviewed it, making corrections and providing additional details for each answer. This level of thoroughness was impressive.

Despite initial difficulties in reaching customer service, I was very satisfied with the phone support I eventually received. However, having a knowledge base on Payment Depot’s website would have been helpful, potentially reducing the number of questions I had to ask through support.

Alternative Payment Depot

Frequently Asked Question.

Payment Depot uses a subscription-based pricing model. You pay a monthly fee plus a flat transaction fee of 10¢ per transaction (both in-person and online). They also offer interchange-plus pricing, where you pay the wholesale interchange fees plus a small markup.

Payment Depot is ideal for businesses with high transaction volumes due to its low per-transaction fees. They cater to a range of businesses but do not generally work with high-risk industries.

Payment Depot offers a free Dejavoo terminal and provides options to purchase additional terminals, Clover devices, and SwipeSimple mobile readers.

You can start processing payments within as little as 24 hours, provided you promptly submit all required information and documentation.

Payment Depot offers end-to-end encryption, payment tokenization, and complies with PCI standards. They also align with the EU’s GDPR for added data protection.

Payment Depot offers technical support 24/7 via phone and ticket system. Sales support is available from 8:30 AM to 7:30 PM EST/PST. Live chat support can be challenging to reach, and email support has been reported as unresponsive.

In addition to the subscription or interchange-plus fees, you may incur minor extra charges, such as for chargebacks or Clover terminal software.

Currently, Payment Depot does not offer a comprehensive knowledge base on their site, which can lead to a higher volume of support inquiries.

Payment Depot ensures PCI compliance by providing necessary encryption and data protection with all its plans. They also offer support to help businesses achieve and maintain PCI compliance.