Leaders Merchant Services Review

Leaders Merchant Services (LMS) has had a mixed reputation among merchants in the past, but the company has recently made efforts to improve its standing.

Leaders Merchant Services (LMS) has had a mixed reputation among merchants in the past, but the company has recently made efforts to improve its standing. These efforts have largely been successful.

With a 98% approval rate, essential yet dependable features, and excellent customer service, LMS has become one of the leading credit card processors, although some lingering issues from the past have yet to be fully addressed.

4.8

Pricing Plan

Swiped card transactions

Virtual Terminal Transactions

Pricing per transaction

~0.15% + $0

~2.9% + 30¢

Pricing per transaction

~0.15% + $0

~2.9% + 30¢

Ranked 1 from 29 Credit Card Processing

Performance: |4.9|

Leaders Merchant Services has improved its reputation in 2024 with a 98% approval rate, reliable payment processing tools, and excellent customer support. While it offers budget-friendly pricing and fast onboarding, some drawbacks include hidden fees and limited hardware options. Despite these issues, LMS remains a strong choice for businesses seeking straightforward, efficient credit card processing solutions.

Uptime: |4.9|

Leaders Merchant Services provides reliable uptime, ensuring businesses can process payments consistently without major interruptions. Its robust infrastructure, backed by partnerships with industry leaders like First Data and Clover, contributes to dependable service. While past issues with transparency and fees persist, LMS’s focus on stability and performance makes it a solid option for businesses seeking consistent payment processing.

Customer Service: |4.8|

Leaders Merchant Services offers excellent customer service, particularly through its 24/7 phone support. Response times are quick, and representatives are knowledgeable and attentive, providing thorough assistance. However, support channels are limited, with the primary option being the phone line. Despite these limitations, LMS’s commitment to quality support makes it a reliable choice for businesses needing prompt assistance.

Pricing: |4.7|

Leaders Merchant Services offers competitive pricing with low processing fees, including a flat monthly rate around $10 and transaction markups starting at 0.15%. However, actual fees often range between 1% and 5%, and there are additional costs like a $25 monthly fee for the Authorize.Net terminal and an annual $129 PCI-compliance fee, which can add up over time.

Overview

| POS equipment | Free equipment with a long-term contract. 3 Clover devices, 1 terminal, and 1 check reader available to purchase |

| Payments methods accepted | Credit and debit cards, digital wallets, ACH, bank transfers |

| Payout times | 72 hours |

| Contract length | Variable, with an average length of 3 years (no cancellation fee) |

| Customer support | 24/7 phone support |

| Security | PCI-compliant, advanced fraud detection and prevention, end-to-end encryption, tokenization |

What is Leaders Merchant Services?

Leaders Merchant Services provides various payment processing solutions tailored for both large and small businesses, including merchant account services, point-of-sale systems, online credit card processing, and merchant cash advances. Based in California, the company operates as a reseller, meaning that the equipment, software, and hardware you purchase come from another company. In this case, the equipment is sourced from Clover and its parent company, First Data, which is now owned by Fiserv—one of the leading global providers of payment and financial technology.

Services Offered

Beyond merchant accounts, Leaders Merchant Services also provides both physical and virtual payment terminals, as well as online ordering platforms. Their services include:

Point-of-Sale Payments: Leaders Merchant Services offers a range of POS products, from stand-alone terminals to contactless card readers that work with popular digital wallets, as well as fully virtual terminals for e-commerce businesses. As a First Data reseller, LMS primarily offers Clover and First Data POS equipment.

E-commerce Solutions: Leaders Merchant Services provides payment gateways and shopping cart software for small businesses with virtual retail stores or those that accept online payments. The gateway services are powered by Authorize.net, owned by Visa, while the shopping cart services are provided by CartManager, which handles sales tax calculations, shipping, multiple language displays, and offers a login feature for returning customers.

Reliable Credit Card Processing With a Mixed History

Leaders Merchant Services (LMS) has been in the credit card processing industry for a long time, though its history hasn’t always been positive. In the past, merchants and reviewers alike have raised concerns about the company’s pricing and lack of transparency. Recently, however, LMS has made efforts to improve. But have these efforts paid off?

After thoroughly researching various reviews and opinions—both positive and negative—I’ve found that today’s LMS stands out as one of the better credit card processors in the market. It provides reliable tools for both brick-and-mortar and e-commerce stores, and it supports business growth with low interchange-plus pricing and business funding options.

The quick and convenient onboarding process is especially beneficial for new businesses or those looking to expand. LMS boasts an impressive 98% approval rate (for authorized business types) and offers same-day onboarding, making it easy and straightforward to set up credit card processing.

That said, LMS isn’t without its flaws. Finding detailed and current information about its services remains a challenge, and there’s still room for improvement in their pricing structure. Nevertheless, growing U.S. businesses will find LMS to be a solid and user-friendly payment processor. Is it the right fit for your business? Read on to find out.

FEATURES |5.0|

High-Quality Essentials to Support Your Business Growth

Leaders Merchant Services doesn’t overwhelm you with an abundance of “nice to have” features like some competitors. Instead, LMS focuses on delivering a strong set of core features that ensure efficient, straightforward payment processing. With LMS, you’ll have dependable tools to support every stage of your business journey.

A Wide Range of POS Equipment Options

LMS offers a broad selection of devices for handling card-present transactions. Unlike many other credit card processors that only lease equipment, LMS allows you to purchase it outright. While this requires a higher upfront cost, owning your equipment can save you money in the long run. Plus, if you sign a long-term contract, you may even receive your equipment for free.

For a classic and reliable customer-facing terminal, the First Data FD150 device is an excellent option. If you also need to accept check payments, LMS provides the Magtek Mini-MICR—a compact device that makes processing checks easy.

As an authorized Clover reseller, LMS also offers Clover’s modern and intuitive POS systems for purchase. Clover devices come with specialized features tailored to various business types, including restaurants and retail stores.

Basic but Powerful E-commerce Tools

LMS provides two primary tools for processing card-not-present transactions: the widely-used Authorize.Net payment gateway and its own shopping cart integration for online stores.

With the Authorize.Net payment gateway, you can accept online payments, and the virtual terminal feature allows you to process payments made over the phone. As a third-party service, Authorize.Net offers integrated customer support and robust security measures.

LMS’s shopping cart integration streamlines e-commerce by allowing you to easily add “add to cart” buttons to your website or online store. It also automatically calculates tax and shipping costs and provides access to customer statistics, helping you identify the strengths and weaknesses of your business.

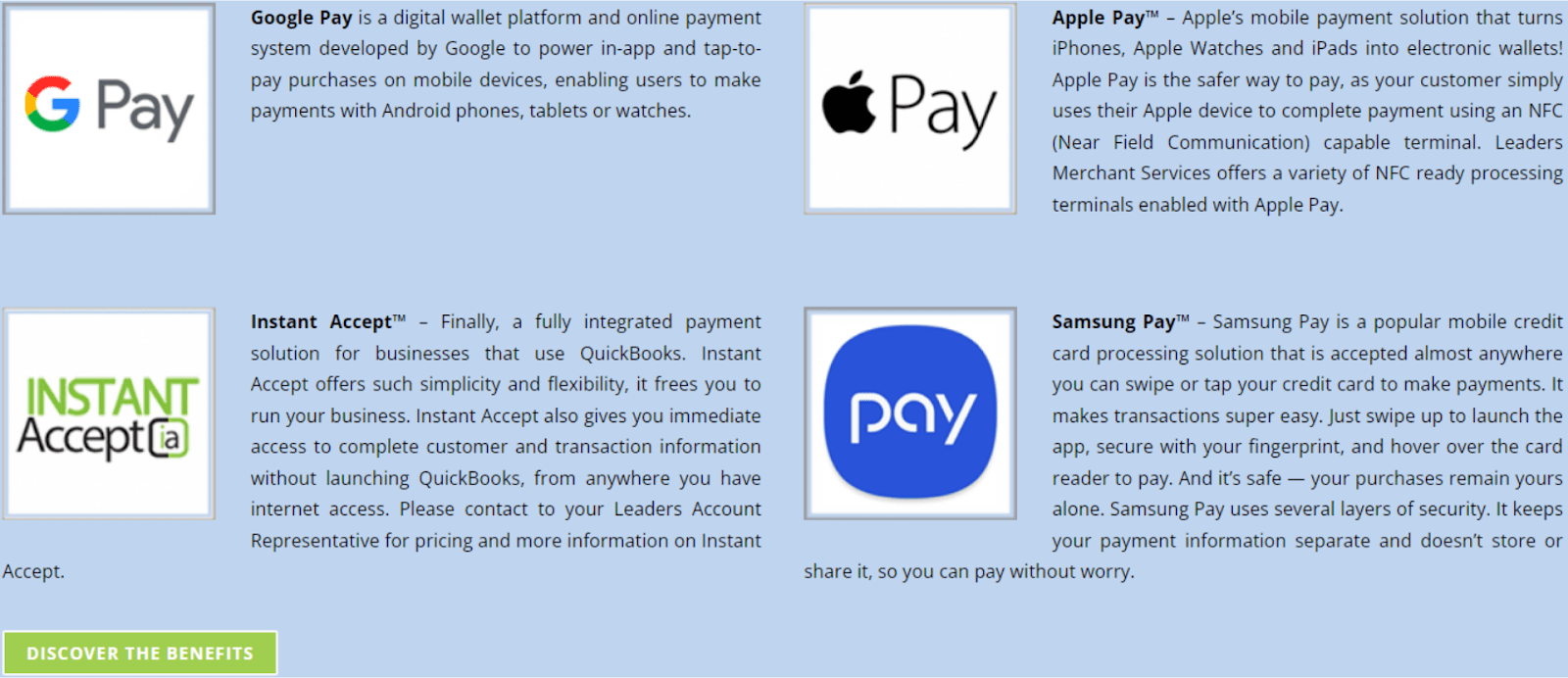

Offer Your Customers Flexible Payment Options

LMS provides excellent flexibility for both you and your customers by accepting a wide range of payment methods. In addition to processing all major credit and debit cards, LMS supports payments through Google Pay, Apple Pay, and Samsung Pay. If you purchase a Clover device, you can also accept payments via PayPal and Venmo..

One notable feature LMS offers is Instant Accept, which allows you to access a virtual terminal directly from your QuickBooks application, making it easier for customers to pay any outstanding invoices.

Whichever payment method you choose, you can expect payouts within 1 to 3 business days.

Expand Your Business With LMS Funding

If you’re starting out or looking to expand, extra capital might be necessary. LMS offers merchant cash advances, a type of loan repaid through a small commission on your future sales. This flexible approach allows you to avoid the usual stress of payback deadlines or the need for collateral.

Popular Credit Card Processing

PROS AND CONS OF LEADERS MERCHANT SERVICE

Pros of Leaders Merchant Services

Cost-effective interchange-plus pricing

Cash advances and business loans available to support business growth

98% approval rate

Same-day onboarding

Cons of Leaders Merchant Services

Extra fees for PCI compliance and software

Limited selection of hardware options

EASY OF USE |5.0|

Simple Account Setup, But Finding Information Can Be Challenging

Simple Account Setup, But Finding Information Can Be Challenging

Setting up and managing an account with LMS is very straightforward. The onboarding process is quick, and the POS and e-commerce tools provided are user-friendly and easy to navigate. However, the outdated and sometimes confusing website can make it more difficult than necessary to find even basic information.

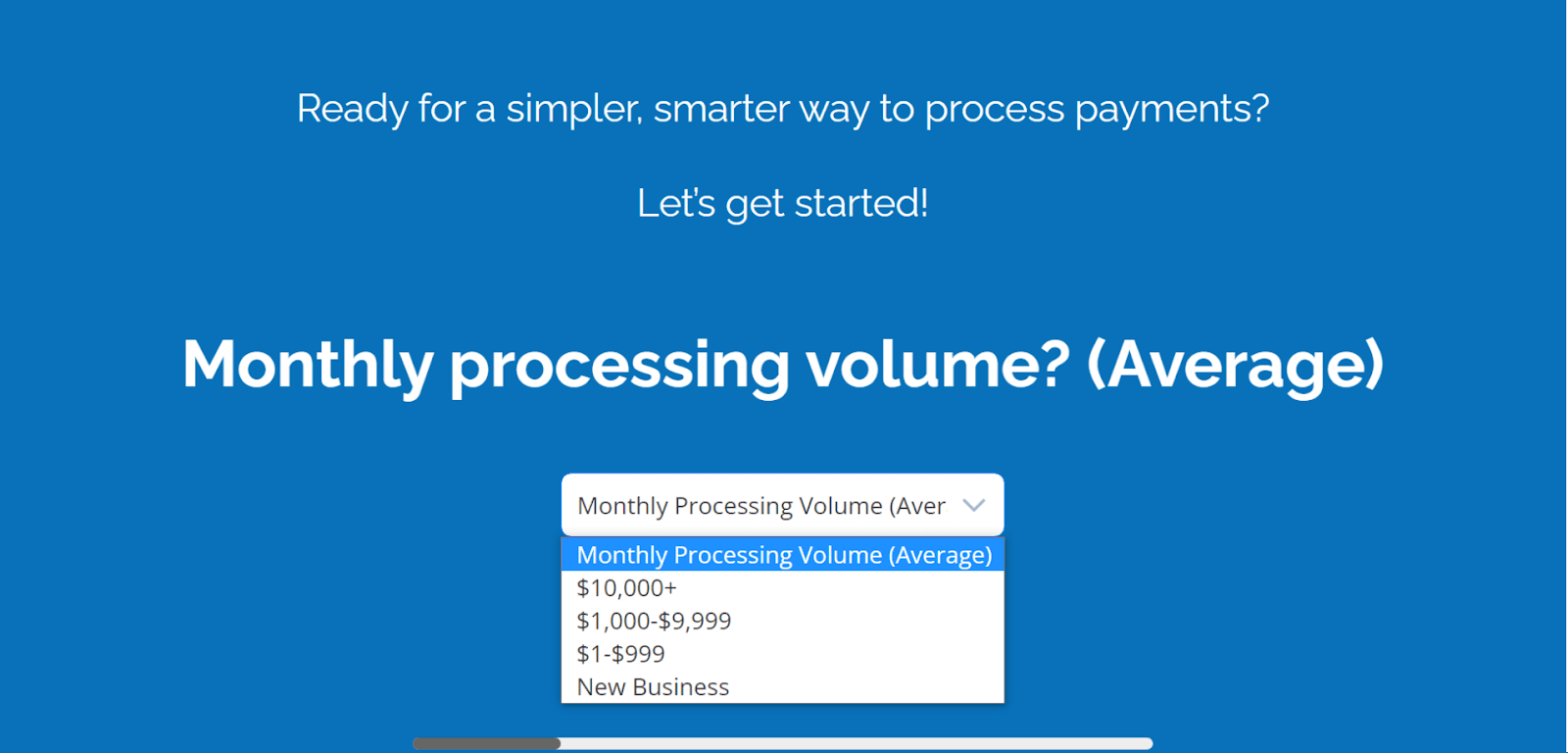

Getting Started with LMS

To begin with LMS, simply visit their website and click the prominent red “Apply Now” button. This will take you to an application page where you’ll need to provide your name, your business name, average monthly income, email, and phone number.

Alternatively, you can apply by calling the phone number at the top of the page and speaking with a sales representative. They’ll ask for details such as your business address, social security number, date of birth, and checking account number. Once you provide the required information, the representative will guide you through the rest of the onboarding process while you stay on the line.

High Approval Rate and Same-Day Setup

LMS boasts a 98% approval rate for merchant applications. If your financial history or industry makes it difficult to secure credit card processing elsewhere, LMS is worth considering. Once approved, the onboarding process can be completed in as little as 24 hours, allowing you to start accepting payments almost immediately.

Customized Accounts Tailored to Your Business Needs

Different businesses have varying requirements based on factors like size, industry, and more. For instance, a local gym won’t necessarily need the same features as a coffee shop.

LMS recognizes this and offers a range of services tailored to your business’s specific needs. Additional features available include subscription tools, gift cards and loyalty programs, and online menus for restaurants. You can negotiate these extras when you first sign up or contact a sales representative later as your business evolves.

PRICING |4.3|

Low Processing Rates, But Watch Out for Hidden Fees

One of the main sources of negative reviews in the past was LMS’s lack of transparency regarding its pricing model. While the company has made some efforts to address this, unclear pricing remains a significant drawback.

Merchants signing up with LMS typically expect a flat monthly fee of around $10. Although the advertised markup on credit card transactions is as low as 0.15%, customer reviews indicate that the actual rate usually falls between 1% and 5%.

These fees are generally reasonable, and LMS’s monthly and markup fees are among the lowest in the industry. However, there are additional costs that aren’t prominently disclosed. For example, using the Authorize.Net virtual terminal incurs a $25 monthly fee. There’s also an annual $129 PCI-compliance fee, or a monthly charge of around $40 if you’re not PCI-certified.

It’s also important to note that the average LMS contract has a minimum term of three years, which is longer than what most other processors require. However, you do have the option to negotiate a month-to-month agreement instead.

COMPLIANCE & SECURITY |4.9|

Comprehensive PCI Compliance With Additional Security Measures

All the equipment and services provided by LMS are fully PCI compliant, with some devices offering enhanced security features. LMS also assists you in obtaining PCI certification, although an annual PCI compliance fee is required.

PCI Compliance and Beyond

LMS provides a variety of equipment for card-present transactions, all of which adhere to PCI regulations. Each device is EMV level 1 and 2 approved and PCI-certified, ensuring that your customers’ credit card data is securely protected.

The Clover POS equipment, in particular, offers excellent security features, including Clover Security Plus. This service provides PCI compliance support, a security score benchmark, and access to data security specialists. For e-commerce businesses, LMS’s chosen payment gateway, Authorize.Net, is widely recognized as one of the most trusted and popular options available.

LMS offers services to help merchants achieve PCI compliance, for which a mandatory PCI compliance fee is charged. It’s advisable to achieve PCI compliance as quickly as possible if you choose LMS for your credit card processing, as failing to do so will result in a monthly PCI non-compliance fee, in addition to any other fees that may arise.

Additional Security Features

While LMS itself doesn’t offer additional security features, all the peripheral devices it supplies come equipped with built-in security tools. For instance, all hardware sold by LMS includes end-to-end encryption, and the Clover systems they provide feature tokenization and fraud prevention technology.

The Authorize.Net payment gateway and shopping cart integrations also ensure end-to-end encryption and comply with the Secure Socket Layer (SSL) protocol, which is currently the industry standard for advanced network security. Additionally, you can password-protect any of the physical or digital tools provided by LMS for added security.

CUSTOMER SUPPORT |5.0|

Limited Channels, but Excellent Phone Support

Previous merchant feedback often highlighted dissatisfaction with LMS’s customer support. Although these reviews likely reflect past experiences, LMS has significantly improved its service quality recently.

However, LMS’s customer support is limited in terms of contact channels. Apart from the toll-free number available on their homepage, the only other option is to fill out a contact form on their website, which only schedules a future call.

This means the 24/7 phone line is essentially your primary method of reaching LMS. Fortunately, their phone support is top-notch. When I called several times to inquire about LMS’s operational regions, multi-currency processing, and the onboarding process, each call was answered in under 2 minutes. The support representatives were thorough, attentive, and provided detailed and helpful responses. They also asked additional questions to better understand my business and demonstrated a genuine interest in assisting me.

For basic questions, you can refer to the FAQ section on LMS’s website. It’s a well-organized and informative resource that covers a range of topics about LMS, merchant accounts, and credit card processing.

Leaders Merchant Services REVIEW: BOTTOM LINE

Despite its past challenges, Leaders Merchant Services has made significant strides in improving its service quality. As of 2024, LMS stands out as one of the top credit card processors for growing businesses, offering easy onboarding and excellent support, making it particularly well-suited for startups looking to start accepting payments quickly and efficiently.

However, LMS still has areas to improve, such as enhancing transparency and updating its pricing structure. If you’re looking for a straightforward yet reliable credit card processor, LMS might be a good fit for you.

Alternative LMS

Frequently Asked Question.

Leaders Merchant Services is a payment processing company that offers merchant accounts, point-of-sale systems, online credit card processing, and merchant cash advances for businesses of all sizes. LMS acts as a reseller for equipment and software from companies like Clover and First Data, now owned by Fiserv.

You can apply for an account by visiting LMS’s website and clicking on the “Apply Now” button. You’ll need to provide your name, business name, average monthly income, email, and phone number. Alternatively, you can apply by calling LMS’s sales number and providing additional details such as your business address, social security number, date of birth, and checking account number.

LMS generally has a flat monthly fee of around $10 and an advertised credit card transaction markup starting at 0.15%. However, customer reviews suggest that the actual markup usually ranges between 1% and 5%. Additional costs may include a $25 monthly fee for the Authorize.Net virtual terminal and an annual PCI-compliance fee of $129, or a monthly fee of around $40 if you’re not PCI-certified.

LMS provides customer support primarily through a 24/7 phone line. There is also an option to fill out a contact form on their website, which schedules a future call. The phone support is highly rated, with quick response times and knowledgeable representatives. There is also a detailed FAQ section on their website for basic questions.

All equipment and services from LMS are PCI compliant. Devices include end-to-end encryption, and Clover POS systems feature additional security measures like tokenization and fraud prevention. The Authorize.Net payment gateway also ensures end-to-end encryption and adheres to the Secure Socket Layer (SSL) protocol.

Once approved, the onboarding process with LMS can be completed in as little as 24 hours, allowing you to start accepting payments almost immediately.

Yes, LMS offers various customizable services to fit different business needs, such as subscription tools, gift cards, loyalty programs, and online menus for restaurants. You can discuss these options during sign-up or contact a sales representative later as your business needs change.

The standard contract with LMS typically has a minimum duration of three years, which is longer than many other processors. However, it is possible to negotiate a month-to-month term if preferred.

Yes, LMS provides merchant cash advances, a type of loan repaid through a small commission on future sales, offering a flexible repayment approach without the usual pressures of deadlines or collateral.

PCI compliance refers to meeting the standards set by the Payment Card Industry Data Security Standard (PCI DSS) to ensure the security of customers’ credit card data during transactions. To process credit card payments without risking penalties or data breaches, both the business and its credit card processor must adhere to PCI compliance requirements.

A credit card processor is a service provider that enables merchants to accept and process payments made with credit and debit cards. In addition to processing payments, a credit card processor may also supply hardware for in-person transactions, offer software integrations for online payments, and provide additional services such as fraud prevention.

The best credit card processor depends on your business needs. Different processors offer varying features, so the ideal choice will be the one that aligns with your specific requirements. For instance, LMS is well-suited for brick-and-mortar stores and emerging businesses, while online businesses might benefit from a processor that provides more advanced e-commerce capabilities.