Helcim Review

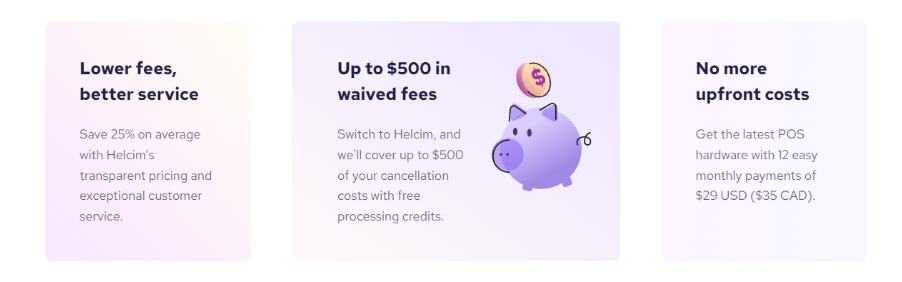

Helcim’s Contract Buyout Program is designed to help businesses transition from their current payment processor to Helcim by covering up to $500 in cancellation fees.

The program makes switching easier by offering processing credits that can offset early termination fees, allowing businesses to move to Helcim’s transparent and competitive pricing model without incurring additional costs. Helcim also provides guidance throughout the process, helping businesses navigate the cancellation and setup procedures smoothly.

This initiative is part of Helcim’s commitment to providing cost-effective payment solutions that simplify and enhance the payment processing experience for businesses. The buyout program is particularly attractive to businesses locked into unfavorable contracts, offering them a way out without financial penalties.

4.7

Pricing Plan

Up to $25,000 transactions/mo.

Over $25,000 transactions/mo.

Pricing per transaction

0.30% + 8¢ (in-person)

0.50% +25¢ (online)

0.50% +25¢ (virtual)

Discounted markup and transaction fees

Monthly subscription

₹0

₹0

Ranked 8 from 29 Credit Card Processing

Performance: |4.9|

Helcim delivers excellent performance with transparent pricing, no hidden fees, and competitive rates, especially for small to mid-sized businesses. Its user-friendly platform offers robust payment processing tools, including invoicing, recurring billing, and a customer management system. However, its phone support could be more responsive, and businesses with high transaction volumes might find better rates elsewhere.

Uptime: |4.9|

Helcim boasts impressive uptime with a reliable and resilient platform, ensuring minimal disruptions to payment processing. The company maintains a strong track record of high availability, backed by robust infrastructure and security measures. However, while downtime is rare, Helcim doesn’t provide specific uptime guarantees or detailed statistics publicly, which might be a consideration for mission-critical applications.

Customer Service: |4.8|

Helcim offers several ways for customers to get in touch with their customer service team:

1. Phone Support: You can call them directly. Their phone number is typically listed on their website’s contact page.

2. Email Support: Reach out via email. Their contact email address should be available on their website or in the support section.

3. Live Chat: Helcim often provides a live chat feature on their website for immediate assistance.

4. Help Center: Their website includes a help center or support section with articles and FAQs that might address common questions.

5. Social Media: They may also offer support through their social media channels.

Pricing: |4.7|

Helcim’s pricing is designed to be transparent and straightforward, with a flat-rate processing fee that varies based on transaction types and volumes. Typically, this includes a percentage of each transaction plus a nominal per-transaction fee. The company offers different pricing tiers to accommodate various business sizes and needs, allowing for adjustments based on transaction volume and processing requirements.

Overview

| POS equipment | Helcim offers card readers and thermal printers as add-ons for purchase. |

| Payments methods accepted | Accepts credit and debit cards, selected digital wallets, ACH, and bank transfers. |

| Payout times | Funds are typically available within 48 hours. |

| Contract length | Monthly with no cancellation fees. |

| Customer support | Available 7 days a week via phone, email, and ticket support. |

| Security | Level 1 PCI-compliant, voluntarily adheres to NIST standards, with advanced fraud detection and prevention measures. |

About

Helcim is a comprehensive payment processing solution designed to cater to a variety of business needs. The company offers a range of services including credit card processing, point-of-sale (POS) systems, online payments, and invoicing solutions. Helcim emphasizes transparency with a clear pricing model and no hidden fees, making it easier for businesses to understand and manage their payment processing costs. Here’s an overview of Helcim in table form:

Services Offered: Credit card processing, POS systems, online payments, invoicing

Pricing Model: Transparent, flat-rate transaction fees with no hidden costs

Pricing Tiers: Various plans based on business size and transaction volume

Key Features: Advanced reporting tools, fraud prevention, multi-channel support

User Experience: User-friendly interface designed for simplicity and efficiency

Customer Support: Support via phone, email, live chat, and a detailed help center

Scalability: Solutions designed for companies of all sizes, from small startups to major corporations

There’s Much to Appreciate with Transparent Pricing and Growth Incentives

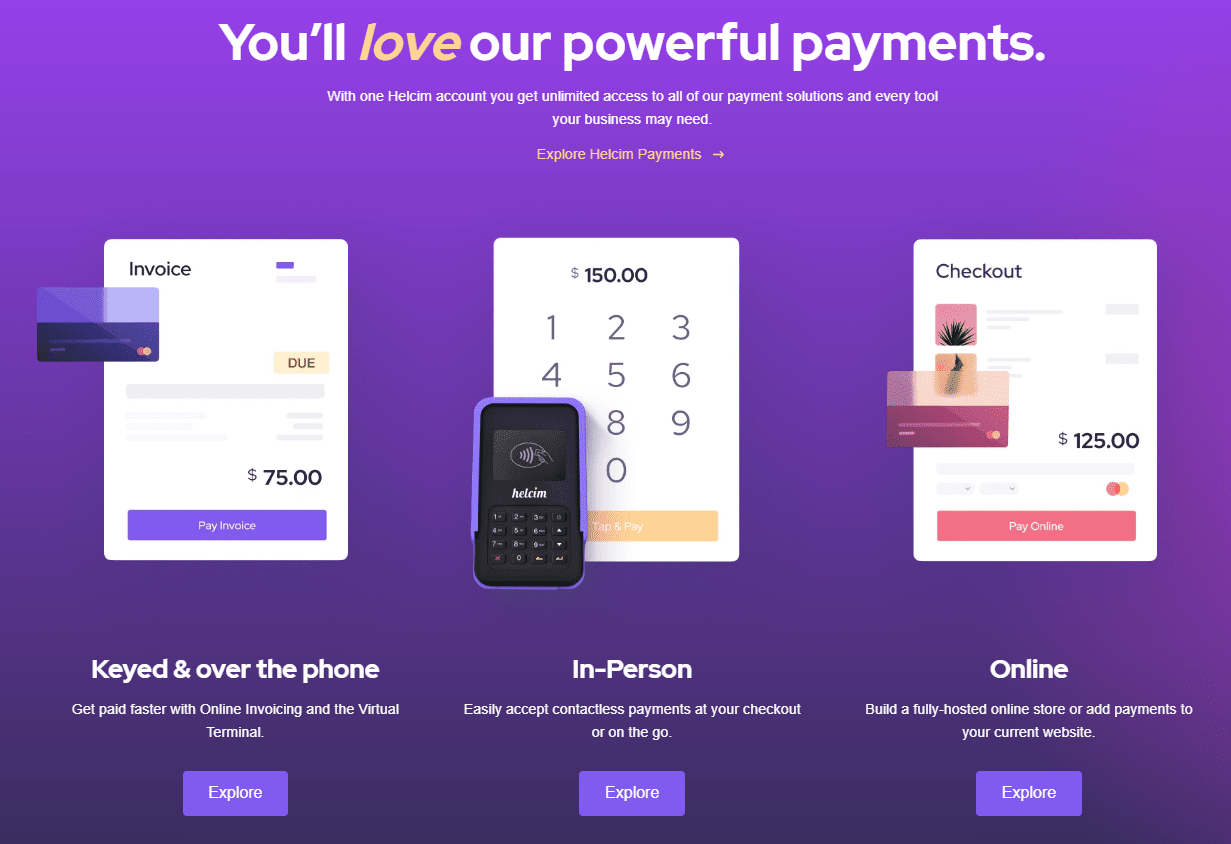

Helcim offers extensive benefits for both in-person and online payment processing. With a fully hosted e-commerce platform, affordable card readers, and support for recurring payments, Helcim is well-suited for small businesses. It also supports international payments, a feature not commonly provided by many credit card processors.

Customers value Helcim’s pricing transparency, as most processors only reveal fee details during the merchant account application process.

Interchange-plus pricing, which Helcim employs, often offers tiny, low-volume enterprises good value.. However, this model can result in less favorable rates as your business grows.

To address this, Helcim offers competitive interchange-plus rates on a sliding scale, lowering per-transaction rates as your monthly transaction volume increases.

That said, for businesses processing higher volumes, Stax might offer better value. Stax charges wholesale interchange rates plus a minimal transaction fee, along with a fixed monthly fee, potentially resulting in lower overall costs.

I’ve done the research on credit card companies for you. Continue reading to determine if Helcim is the right fit for your business.

FEATURES |3.7|

Helcim offers a comprehensive suite of features designed to streamline payment processing for businesses of all sizes. Their platform supports a wide range of payment methods, including credit cards, debit cards, and ACH transfers, catering to both in-person and online transactions. Here are some key features of Helcim:

Payment Processing: Takes credit cards, debit cards, and ACH transfers as well as other forms of payment.

Point-of-Sale (POS) Systems: Offers integrated POS solutions for in-person transactions, with options for both hardware and software.

Online Payments: Facilitates online payment processing through customizable payment forms and secure checkout experiences.

Invoicing: Provides tools for creating and sending professional invoices, with options for recurring billing and automated reminders.

Advanced Reporting: Includes detailed reporting and analytics tools for tracking sales, transactions, and customer data.

Fraud Prevention: Features built-in fraud detection and prevention tools to help protect against fraudulent transactions.

Multi-Channel Support: Facilitates payments over a range of channels, such as mobile, online, and in-store.

Integration Capabilities: Integrates with various third-party applications and platforms for streamlined business operations.

Customer Portal: Offers a portal for managing transactions, refunds, and customer interactions.

API Access: Provides APIs for custom integration and automation within business systems.

Services offered:

Helcim offers a range of services designed to support various aspects of payment processing and business management:

Payment Processing: Enables businesses to accept payments through credit cards, debit cards, and ACH transfers, both in-person and online.

Point-of-Sale (POS) Systems: Provides integrated POS solutions for handling in-store transactions, including both hardware (e.g., terminals and card readers) and software (e.g., register apps).

Online Payments: Facilitates secure online transactions with customizable payment forms and checkout processes for e-commerce websites.

Invoicing: Allows businesses to create, send, and manage invoices, with features for recurring billing and automated payment reminders.

Recurring Billing: Supports subscription-based businesses by automating recurring payments and managing billing cycles.

Advanced Reporting: Offers detailed analytics and reporting tools to track sales, transactions, customer data, and business performance.

Fraud Prevention: Includes tools and features to detect and prevent fraudulent transactions, enhancing payment security.

Mobile Payments: Supports mobile payment processing, allowing businesses to accept payments via smartphones and tablets.

Customer Portal: Provides a portal for businesses to manage transactions, refunds, and customer interactions.

API Access: Offers APIs for integrating Helcim’s payment solutions with custom business applications and automating processes.

Integration Capabilities: Enables integration with various third-party software and platforms to streamline business operations and enhance functionality.

Good E-Commerce Support, But Otherwise Limited

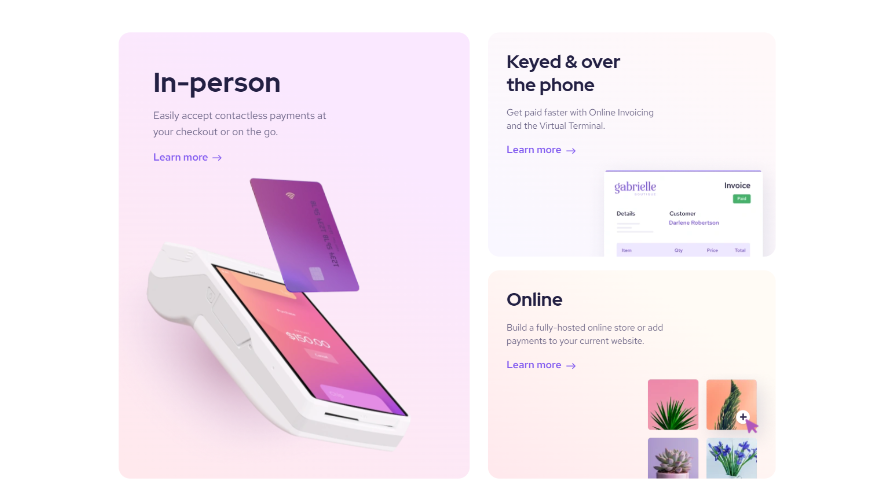

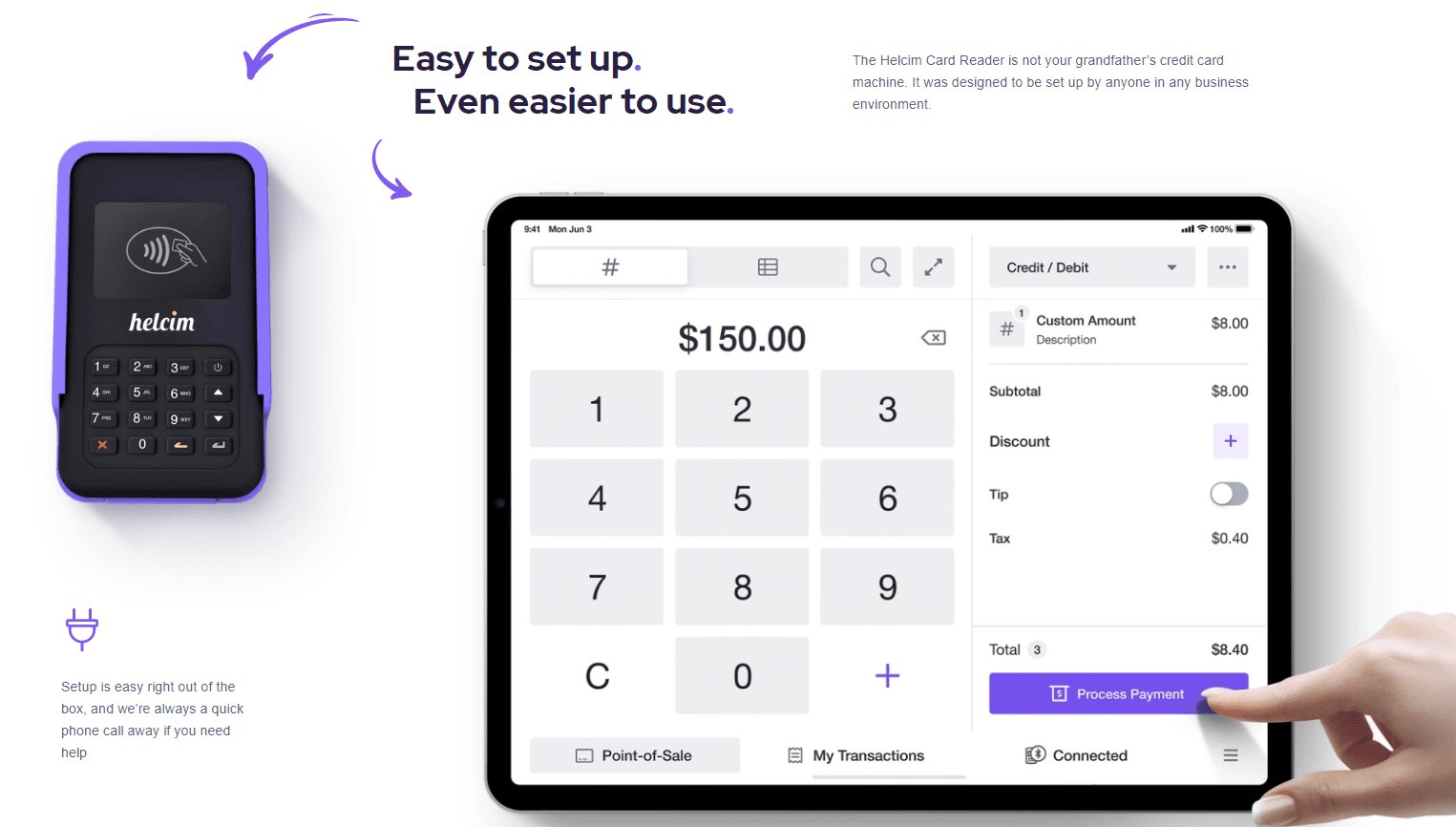

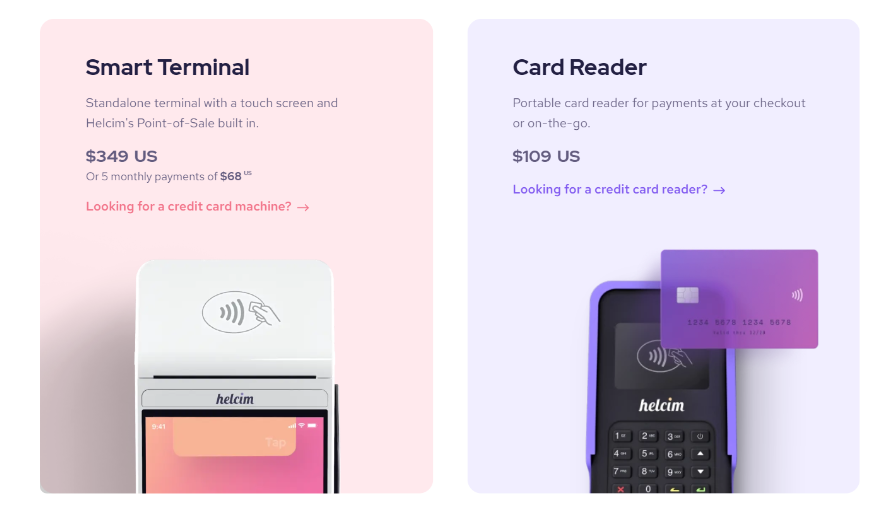

Helcim provides a basic card reader, which is quite minimal compared to many third-party devices. This simplicity is intentional, as the reader is designed to complement Helcim’s robust POS software.

One of Helcim’s standout features is its fully-hosted e-commerce platform, making it an excellent choice for launching your first online store.

A Simple Card Reader with Powerful Software

Helcim’s wireless card reader handles contactless and chip-and-PIN transactions, but it lacks support for swiped transactions. This limitation might be a fraud prevention measure, but it can be restrictive compared to many third-party hardware solutions that offer this feature.

At $109 plus tax, Helcim’s card reader is relatively affordable compared to competitors. However, you’ll need to purchase it separately, as it is not included with your merchant account. This upfront cost may be a hurdle if you’re just starting your business.

Helcim’s POS functionality is largely driven by its software, which allows for transaction entry, invoice creation, and payment requests via email or SMS. While you can accept in-person payments without the card reader, the software alone is less ideal for comprehensive payment processing.

Customers Can Manage Their Own Account

Helcim truly excels in e-commerce with its fully-hosted online store builder. Once you have a domain name, the platform seamlessly syncs with your main Helcim account, automatically copying products from your account to your web store.

A standout feature of Helcim’s Online Store builder is the customer portal. This allows your customers to handle their subscriptions, payment methods, addresses, and invoices independently, reducing the time you spend on overdue invoices and expired credit cards.

Helcim integrates with Magento and WooCommerce for existing web stores. For other e-commerce platforms or website builders, custom integrations via the API are required. While the API is useful, the limited number of pre-built integrations may be a challenge if you’re not technically inclined.

Access to Funds

Helcim supports payments via debit/credit cards, Google Pay, Apple Pay, ACH (or EFT in Canada), and international transactions, providing various payment options. However, it lacks support for PayPal and cryptocurrency payments, which could enhance its e-commerce features.

Payments are settled once daily, with funds typically available within two business days, except for ACH/EFT bank transfers, which take 3 business days for setup and 4 business days for payment receipt.

Built-in Customer Relationship Management (CRM)

Helcim includes a built-in CRM, which can help save on third-party software costs. You can manage customer information and store payment details securely in the Card Vault. The Card Vault allows you to process card-not-present transactions using Helcim’s virtual terminal without customers needing to re-enter payment details.

Extra Support for Restaurants

Helcim offers an online food ordering system, which can help small restaurants save on delivery app commissions. You can quickly create an online menu in Helcim’s store builder, manage tax calculations, create discount codes, and set tip recommendations. Contactless ordering is also available, enabling customers to order and pay from their tables.

To support restaurant operations, Helcim provides a wireless thermal printer that automatically prints incoming food orders for your kitchen.

Popular Credit Card Processing

PROS AND CONS OF HELCIM

Pros of Square Helcim

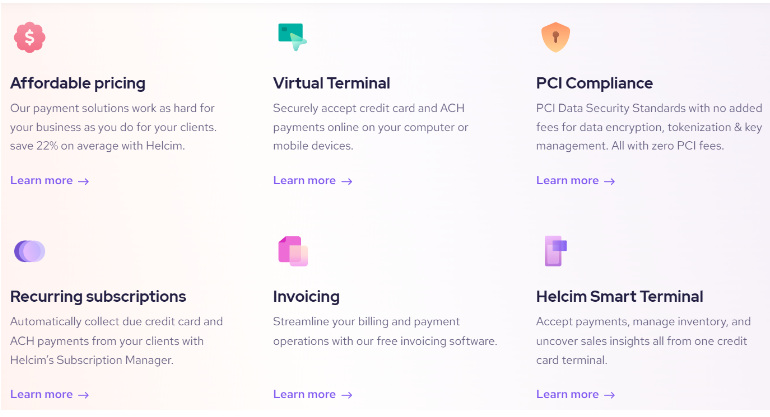

Transparent Pricing: Helcim offers clear, flat-rate pricing with no hidden fees, making it easier for businesses to understand their costs and manage their budget.

Comprehensive Features: The platform includes a wide range of tools such as integrated POS systems, online payment processing, invoicing, recurring billing, and advanced reporting, catering to diverse business needs.

Security and Fraud Prevention: Helcim includes robust security features and fraud prevention tools to protect against fraudulent transactions and data breaches, enhancing overall payment security.

User-Friendly Interface: The platform is designed to be intuitive and easy to use, which can improve operational efficiency and provide a better user experience for both businesses and their customers.

Scalability: Helcim’s solutions are scalable, making them suitable for businesses of all sizes, from small startups to large enterprises. This flexibility allows businesses to grow and adapt their payment processing as needed.

Customer Support: Helcim provides multiple support channels including phone, email, and live chat, along with a comprehensive help center, ensuring that businesses receive timely assistance when needed.

Merchant Statement Comparison Tool: The tool helps businesses compare their current processing costs with Helcim’s pricing, potentially highlighting savings and benefits.

Cons of Square Helcim

Limited International Availability: Helcim primarily serves businesses in North America, which may limit options for international businesses or those with global operations.

Hardware Costs: While Helcim offers POS systems, there may be additional costs for purchasing or leasing hardware, which could be a consideration for businesses on a tight budget.

Complexity for Small Businesses: Some of Helcim’s advanced features might be more than what small businesses need, and the platform’s full range of capabilities could be overwhelming for very small operations.

Custom Pricing for High Volumes: For businesses with very high transaction volumes or specific needs, custom pricing may be required, which could involve more negotiation and complexity.

Feature Overlap: For businesses that already use other specialized tools or platforms, there might be some overlap in features, which could require adjustments or integrations.

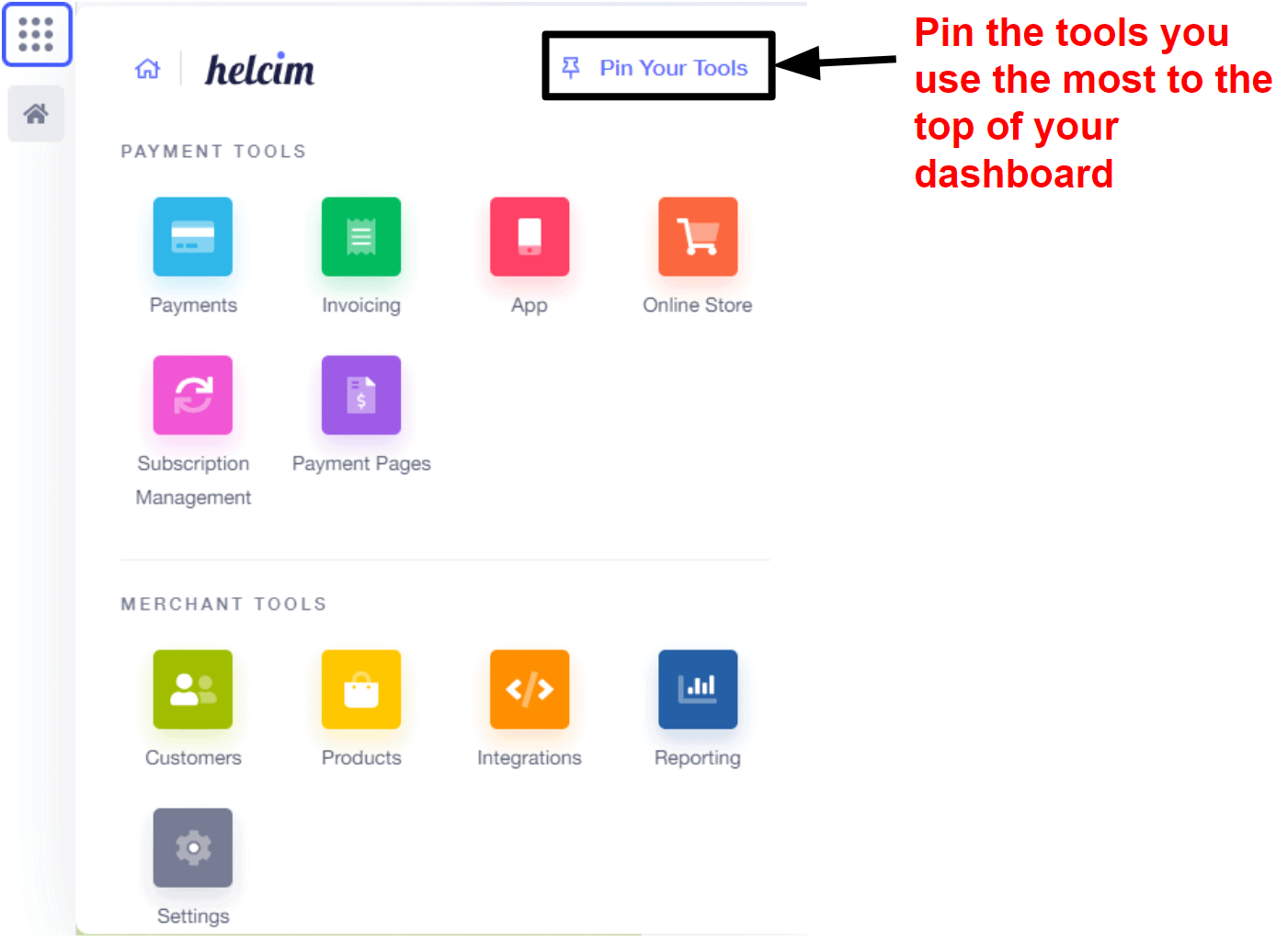

EASY OF USE |4.9|

Helcim is designed with ease of use in mind, aiming to provide a user-friendly experience for businesses of all sizes. Its ease of use is influenced by the following factors:

Intuitive Interface: Helcim features a clean, intuitive interface that simplifies the process of managing payments, transactions, and reports. The design is aimed at making navigation straightforward for users with varying levels of technical expertise.

Comprehensive Dashboard: The platform offers a central dashboard where businesses can view and manage all aspects of their payment processing, including sales, refunds, and customer data. This centralized view helps streamline operations and reduce the need for multiple systems.

Easy Setup and Integration: Setting up Helcim is generally straightforward, with guided processes for integrating payment solutions into both online and in-store environments. The platform supports integration with various third-party applications, which can simplify workflows.

Customer Support and Resources: Helcim provides extensive customer support through phone, email, and live chat. Additionally, their help center includes detailed guides, tutorials, and FAQs that assist users in navigating the platform and troubleshooting issues.

Customizable Payment Forms: For online transactions, Helcim allows businesses to create and customize payment forms that match their branding and requirements, making it easy to integrate payments into their website.

Mobile Compatibility: The platform is compatible with mobile devices, enabling businesses to manage payments and access their account information on-the-go. This flexibility is particularly useful for businesses with mobile or remote operations.

Advanced Reporting Made Simple: Helcim’s reporting tools are designed to be user-friendly, providing businesses with detailed insights into their sales and transaction data without requiring advanced technical knowledge.

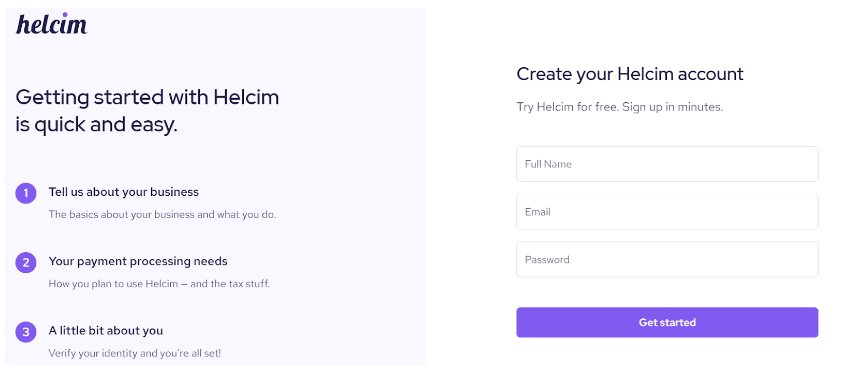

Helcim Is Ideal for New Businesses

Helcim offers a straightforward sign-up process where you provide basic details about yourself, your business, and your transaction history. While Helcim promises quick approvals, the exact timeframe isn’t specified.

Helcim does not cater to high-risk merchant accounts but does accept new businesses without a transaction history.

Getting Started With Helcim

To begin, click “Get Started” on Helcim’s website. You won’t need to upload documents initially but should have your tax number/SSN and any business transaction history ready.

After approval, you can download Helcim’s payment software to set up online payments and integrate approved third-party hardware. If you order hardware from Helcim for card-present transactions, expect a delivery time of 2-3 business days.

Creating an account on Helcim is a straightforward process. The steps to begin going are as follows:

1. Visit the Helcim Website: Go to Helcim’s website. On the homepage, look for the option to sign up or get started, typically found in the top right corner of the page.

2. Fill Out the Registration Form: Click on the sign-up or get started button. You will be prompted to enter your business details, including your company name, contact information, and business type. You may also need to provide information about your payment processing needs and any specific requirements you have.

3. Submit Documentation: After entering your business information, you may need to submit additional documentation for verification purposes. This could include business identification documents, bank account details, and any relevant licenses or permits. Helcim uses this information to ensure compliance and verify your business.

4. Set Up Your Account: Once your application is reviewed and approved, you will receive an email with instructions to complete your account setup. Follow the instructions to configure your account settings, integrate payment solutions, and set up any necessary hardware or software. You can then access your dashboard and start using Helcim’s services.

Easy-to-Use Payment Software

Helcim’s software is highly user-friendly, featuring a clean, modern interface and extensive tutorials in its knowledge base. Even without prior experience in credit card processing, you’ll find the dashboard easy to navigate.

In the settings, you can configure new tax regions, add currencies for international payments, and adjust account security to protect your sensitive data.

However, Helcim’s software lacks tooltips or direct links to the knowledge base for in-software help. While most settings are intuitive, some features, like the Helcim Defender for fraud protection, may be less clear.

Limited Third-Party POS Hardware Integration

Helcim supports a limited range of third-party POS hardware integrations. You can add Bluetooth barcode readers, Star Micronics/Syson cash drawers, and Star Micronics thermal printers to your setup. However, third-party terminals are not compatible with Helcim.

This limitation may not be an issue for new businesses without existing POS hardware but could be frustrating for established businesses looking to switch processors.

PRICING |4.9|

Helcim’s pricing structure is designed to be transparent and straightforward, focusing on providing clear and competitive rates. Here is a tabular overview of Helcim’s pricing structure based on general information:

Transaction Fees: Flat-rate percentage per transaction plus a per-transaction fee.

Credit Card Processing: Usually consists of a tiny set charge plus a percentage of the transaction value.

Debit Card Processing: Similar to credit card processing, with specific rates for debit transactions.

ACH Transfers: Fees for processing ACH transfers may vary based on transaction volume and specifics.

Monthly Fees: Generally, there are no monthly fees; pricing is based on transactions.

Setup Fees: Typically, no setup fees; however, there may be costs for hardware or advanced features.

Hardware Costs: Costs for POS hardware and card readers, if applicable.

Service Fees: Fees for additional services like advanced reporting or fraud prevention tools.

Custom Pricing: Available for large businesses with high transaction volumes or specific needs.

Payment Method:

Helcim supports a variety of payment methods to cater to different business needs. Their platform enables businesses to accept payments via major credit cards and debit cards, including Visa, Mastercard, American Express, and Discover. This flexibility ensures that businesses can handle a wide range of customer preferences, whether they are processing transactions in-person, online, or through mobile devices. Helcim’s point-of-sale (POS) systems are equipped to handle these card payments efficiently, providing a seamless checkout experience for customers.

In addition to card payments, Helcim also supports ACH (Automated Clearing House) transfers, allowing businesses to process bank-to-bank transfers for payments. This method is particularly useful for handling larger transactions or recurring payments, such as subscriptions or invoices. By offering these diverse payment options, Helcim helps businesses streamline their payment processes and meet the varied needs of their customers.

Business tool:

Helcim offers a variety of business tools designed to enhance payment processing and streamline business operations. Here are some of the key tools available:

Point-of-Sale (POS) Systems: Helcim provides integrated POS solutions for managing in-store transactions. This includes both hardware and software, allowing businesses to process sales, manage inventory, and track customer data.

Online Payments: Tools for integrating payment processing into e-commerce websites, including customizable payment forms and secure checkout options. This facilitates smooth online transactions for businesses of all sizes.

Invoicing: Features for creating and managing invoices, setting up recurring billing, and sending automated payment reminders. This tool is useful for businesses that need to handle billing for products or services on a regular basis.

Recurring Billing: Supports subscription-based business models by automating recurring payments and managing billing cycles. This feature is ideal for businesses with ongoing services or memberships.

Advanced Reporting and Analytics: Provides detailed insights into sales, transaction data, and customer behavior. Businesses can generate reports to track performance, identify trends, and make data-driven decisions.

Fraud Prevention Tools: Includes built-in features to detect and prevent fraudulent transactions, enhancing payment security and reducing the risk of chargebacks.

Customer Portal: A portal that allows businesses to manage transactions, refunds, and customer interactions efficiently. It provides a centralized location for handling various aspects of payment processing.

Mobile Payments: Tools for accepting payments through mobile devices, making it easier for businesses to process transactions on-the-go.

API Access: Offers APIs for integrating Helcim’s payment solutions with custom applications and automating processes within business systems.

These tools are designed to provide businesses with a comprehensive suite of solutions to manage payments, streamline operations, and improve overall efficiency.

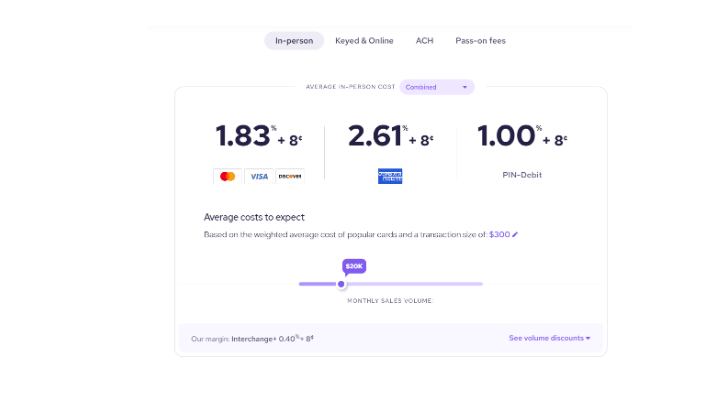

Helcim’s Transparent Pricing Is a Refreshing Change

Helcim offers competitive transaction rates, starting at 0.30% + 8¢ for in-person transactions and 0.50% + 25¢ for online transactions for merchants processing up to $25,000 per month. Rates decrease as your monthly processing volume increases; for example, processing $50,000-$100,000 per month brings rates down to 0.20% + 7¢ for card-present and 0.40% + 20¢ for card-not-present transactions.

For ACH/EFT bank transfers, Helcim charges 0.5% + 25¢ per transaction, with an additional $5 fee for returned or rejected transactions. This is in addition to the wholesale interchange rates set by card providers and banks.

Helcim’s pricing page also details other fees. The $15 chargeback fee is notably low and refundable if you win the dispute. There are no monthly, cancellation, compliance, or setup fees.

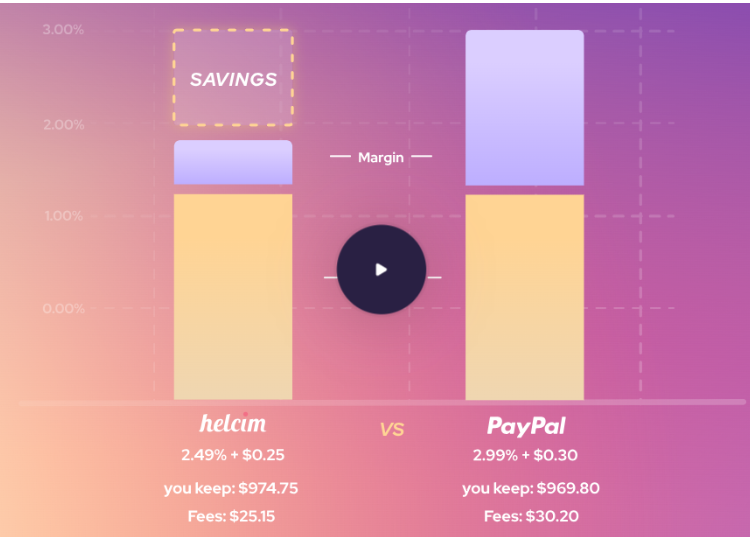

Helcim’s commitment to pricing transparency is a major advantage. The company even provides a rate comparison tool on its website, allowing you to quickly estimate potential savings without needing to contact them directly.

Up to $25,000 transactions/mo.

0.30% + 8¢ (in-person) 0.50% + 25¢ (Online) 0.50% + 25¢ (Virtual)

/Transaction /Transaction /Transaction

Why switch to Helcim?

Switching to Helcim can offer several advantages for businesses looking to optimize their payment processing. Here’s why businesses might consider making the switch:

Transparent Pricing: Helcim provides a clear and straightforward pricing model with no hidden fees. Their flat-rate transaction fees and detailed cost breakdowns help businesses understand exactly what they are paying for and potentially save money compared to complex fee structures of other providers.

Advanced Features: Helcim offers a comprehensive suite of tools and features, including integrated POS systems, customizable online payment solutions, invoicing, recurring billing, and advanced reporting. These features are designed to streamline payment processing, improve operational efficiency, and provide valuable insights into business performance.

Fraud Prevention and Security: Helcim includes robust fraud prevention tools and security features to protect against fraudulent transactions and data breaches. This helps businesses maintain a secure payment environment and reduce the risk of chargebacks.

User-Friendly Platform: Helcim’s platform is known for its ease of use, with a user-friendly interface that simplifies payment management for both in-store and online transactions. This can enhance the overall customer experience and operational efficiency.

Scalability and Flexibility: Helcim provides scalable solutions that cater to businesses of all sizes, from startups to large enterprises. Their flexible pricing plans and integration capabilities ensure that businesses can tailor their payment processing to meet specific needs and grow with their business.

Comprehensive Customer Support: Helcim offers multiple support channels, including phone, email, and live chat, along with a detailed help center. This ensures that businesses receive timely assistance and support when needed.

Merchant Statement Comparison Tool: The Merchant Statement Comparison Tool helps businesses evaluate their current payment processing costs and compare them with Helcim’s pricing. This tool can highlight potential savings and benefits, making it easier for businesses to make an informed decision about switching.

Overall, switching to Helcim can provide businesses with cost savings, advanced features, enhanced security, and excellent support, making it a compelling choice for many looking to improve their payment processing operations.

Helcim vs Paypal

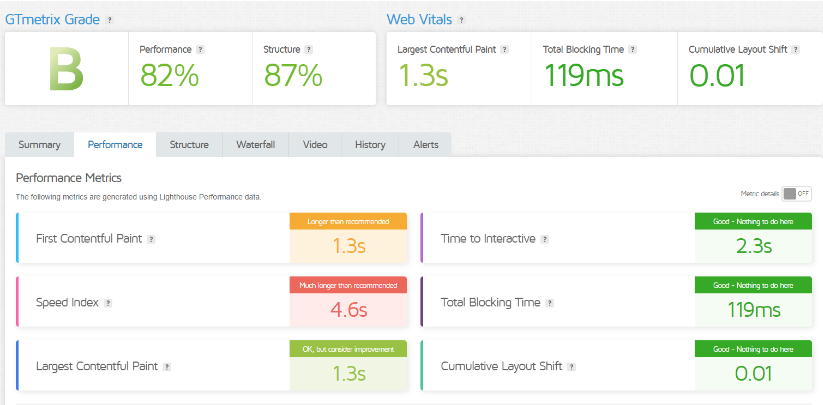

GTMetrix:

The GTMetrix report for the Helcim website indicates a generally good performance with a grade of B and an overall performance score of 82%. The website has a solid structure, scoring 87%, which suggests that the site is well-built with efficient coding practices. The web vitals show a Largest Contentful Paint (LCP) of 1.3s, which is within acceptable limits, indicating that the main content of the page loads quickly. The Total Blocking Time is minimal at 119ms, and the Cumulative Layout Shift (CLS) is extremely low at 0.01, meaning the page content remains stable during loading, ensuring a smooth user experience.

However, there are areas that could be improved. The Speed Index is at 4.6s, which is significantly longer than recommended, indicating that the overall load time could be optimized further. The First Contentful Paint (FCP) also takes 1.3s, which is slightly longer than the ideal threshold, suggesting that the initial visual content takes some time to appear. Improving these metrics could enhance the user experience, especially for visitors on slower connections or mobile devices.

COMPLIANCE & SECURITY |4.9|

Compliance:

PCI-DSS Compliance: Helcim is PCI-DSS (Payment Card Industry Data Security Standard) compliant, which means they adhere to strict security standards for handling and processing credit card information. This compliance ensures that cardholder data is managed and transmitted securely.

Regulatory Adherence: Helcim follows regulatory requirements relevant to payment processing, including data protection laws and financial regulations. This adherence helps ensure that their services are in line with industry standards and legal requirements.

Fraud Prevention: Helcim employs advanced fraud prevention tools and techniques to protect against fraudulent transactions. This includes real-time monitoring, risk assessment, and fraud detection algorithms.

Security:

Data Encryption: Helcim uses encryption technology to protect sensitive data during transmission and storage. This encryption ensures that payment information and personal data are secure from unauthorized access.

Secure Payment Processing: Their payment processing systems are designed to safeguard transactions, using tokenization and secure methods to handle payment details without exposing sensitive information.

Regular Security Audits: Helcim conducts regular security audits and assessments to identify and address potential vulnerabilities. These audits help maintain the robustness of their security measures and compliance with industry standards.

Two-Factor Authentication (2FA): For added security, Helcim may offer two-factor authentication for accessing accounts and sensitive information. This additional layer of security helps protect against unauthorized access.

Data Privacy: Helcim is committed to maintaining the privacy of user data. They implement strict data protection policies and practices to ensure that personal and financial information is handled with care and confidentiality.

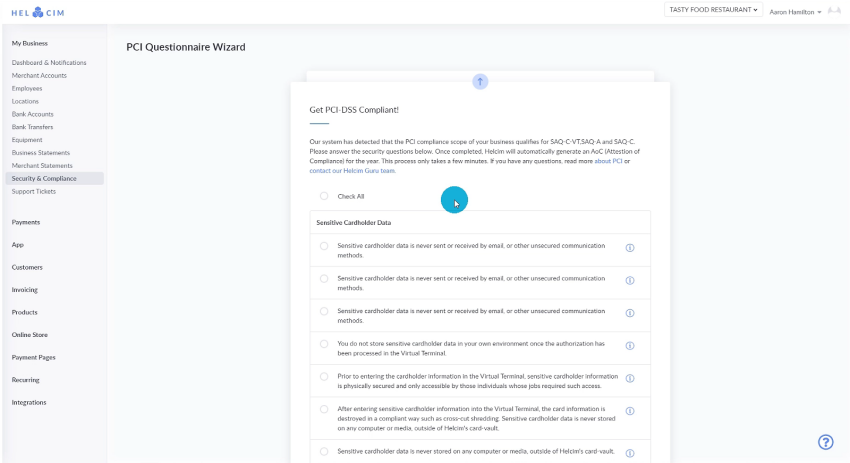

Strong Fraud Protection and PCI Compliance Support

Helcim ensures that all merchants achieve PCI compliance by offering tutorials and a built-in PCI compliance questionnaire. Your data and funds are safeguarded through military-grade encryption, stringent password policies, and advanced Intrusion Detection/Prevention firewall systems.

PCI Compliance & Beyond

As a Level 1 PCI-compliant service provider, Helcim undergoes regular audits to guarantee secure payment processing. PCI compliance support is included for all merchant accounts at no extra cost.

If you need help with the PCI compliance questionnaire, Helcim offers a video tutorial and a written guide. Additionally, hovering over the information icon next to each question provides further details.

Additional Security Features

Helcim follows the voluntary security guidelines set by the National Institute of Standards and Technology (NIST) to ensure the safety of your information and finances. Your data is secured with end-to-end AES-256 encryption, the most robust Advanced Encryption Standard available.

Helcim also offers enhanced protection through its Fraud Defender feature. Fraud Defender scans incoming transactions for inconsistencies, such as mismatched shipping locations, issuing banks, billing addresses, and more. It compares each transaction to your business’s average order to generate a risk score.

You can configure Fraud Defender to automatically decline high-risk transactions or those sent to non-verified addresses. However, you must set this up manually, and real-time alerts for suspicious transactions are not provided.

CUSTOMER SUPPORT |5.0|

Helcim offers robust customer support to assist businesses with their payment processing needs. An outline of their customer service offerings is provided below:

Support Channels:

Phone Support: Helcim provides phone support for direct and immediate assistance. Businesses can call their support team to get help with any issues or questions related to their account or payment processing.

Email Support: For less urgent inquiries or detailed issues, businesses can reach out to Helcim via email. This allows for written communication and the opportunity to provide detailed information about any problems.

Live Chat: Helcim offers live chat support on their website, providing real-time assistance for quick questions and immediate help during business hours.

Help Center: Helcim’s online help center is a valuable resource that includes a comprehensive knowledge base with articles, guides, and FAQs. This self-service option allows businesses to find answers to common questions and troubleshoot issues independently.

Support Features:

Onboarding Assistance: Helcim offers support during the onboarding process to help businesses set up their accounts, integrate payment solutions, and configure necessary features.

Technical Support: Their support team is available to assist with technical issues, including troubleshooting payment processing problems, hardware setup, and software integration.

Account Management: Helcim provides account management support to help businesses with account-related questions, billing issues, and any changes needed to their services.

Training and Resources: Helcim offers training resources and documentation to help businesses understand how to use their platform effectively. This includes tutorials, webinars, and guides on various features and tools.

Review:

Alternative Helcim

Frequently Asked Question.

Helcim offers transparent pricing, robust features, and no hidden fees, making it an ideal choice for businesses seeking a reliable, user-friendly payment processing solution.

Helcim operates on a no-contract, no-hidden-fees basis, providing businesses with clear, predictable costs without long-term commitments.

Helcim is designed for small to medium-sized businesses seeking scalable, secure, and affordable payment processing solutions with a focus on transparency and ease of use.

Funds are typically deposited into your bank account within one to two business days, ensuring quick access to your earnings.

Helcim does not charge a monthly fee, allowing businesses to only pay for the transactions they process.

Payment hardware is usually shipped quickly, and most businesses receive their equipment within a few business days.

Helcim offers transparent, interchange-plus pricing with competitive rates, ensuring you only pay the true cost of each transaction.

No, you do not need to change banks. Helcim can deposit funds into your existing bank account.

Yes, Helcim offers volume discounts, with lower rates available for businesses processing higher transaction volumes.

Signing up for Helcim is straightforward, requiring basic business information and a few steps to get started.

A merchant statement analysis compares your current processing fees with Helcim’s rates to identify potential savings.

Running a statement comparison helps you understand how much you could save by switching to Helcim, making informed decisions easier.

Yes, Helcim’s statement comparison tool is completely free, with no obligation to switch after running your analysis.

After uploading your statement, Helcim’s team reviews it and provides a detailed comparison of your current rates versus theirs.

Once you run your statement’s numbers, Helcim provides a detailed breakdown showing potential savings, helping you decide whether to switch.

Helcim’s rates are often more competitive than other providers, thanks to their transparent pricing and lack of hidden fees.

Switching to Helcim is simple, with dedicated support to guide you through the process and ensure a seamless transition.

Yes, Helcim’s statement comparison tool is secure and confidential, ensuring your financial information is protected during the analysis.