Paysafe Review 2024

At Paysafe, we provide ambitious businesses with a secure platform for online payments, empowering them to succeed, while helping consumers transform transactions into meaningful experiences.

One of the top suppliers of end-to-end payment systems worldwide is Paysafe. With over 20 years of experience, Paysafe offers a range of payment services designed to meet the needs of businesses of all sizes. From payment processing and e-commerce solutions to fraud prevention and security features, Paysafe delivers a secure and flexible payment ecosystem for merchants and consumers alike.

4.8

Pricing Plan

Online

Cash Discount Plan

Interchange Plus

Pricing per transaction

0.99% + 25¢ (debit cards)

1.99% + 25¢ (credit cards)

2.99% + 25¢ (specialty/rewards credit cards)

3.99% + 25¢ (foreign credit cards)

$0 (1%-4% surcharge to customers)

0.50% + $0.10

Monthly subscription

₹1328

₹1328

₹660

Ranked 2 from 29 Credit Card Processing

Performance: |4.9|

Paysafe’s platform is designed for high performance, handling millions of transactions daily with minimal latency. The system architecture is built to scale, ensuring that transaction processing remains efficient even during peak periods. This reliability has made Paysafe a trusted choice for businesses that require fast, seamless payment processing.

Uptime: |4.9|

Paysafe guarantees an impressive uptime, with the platform consistently achieving over 99.9% availability. This ensures that merchants can accept payments without interruptions, providing a reliable service that supports business continuity. Paysafe’s robust infrastructure includes multiple redundancies and failover mechanisms to prevent downtime.

Customer Service: |4.8|

Paysafe is known for its dedicated customer service, offering support around the clock through multiple channels, including phone, email, and live chat. The support team is highly trained to handle a wide range of issues, ensuring that merchants and customers receive prompt and effective assistance. Additionally, Paysafe provides a comprehensive online help center with resources and guides.

Pricing: |4.7|

Paysafe offers a flexible pricing model tailored to the needs of individual businesses. The company typically charges a combination of a percentage fee per transaction and a flat fee, with additional costs for specific services such as chargeback management or currency conversion. While pricing details may vary based on business type and transaction volume, Paysafe aims to provide competitive and transparent pricing to its clients.

Overview

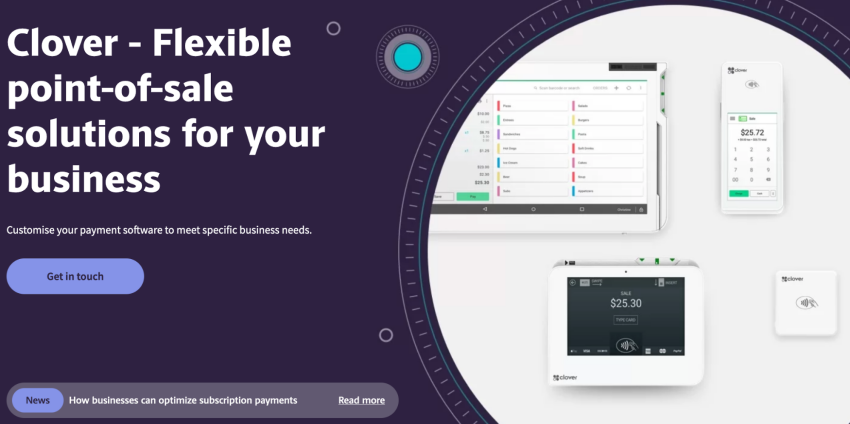

| POS equipment | Clover terminals, Pax A920, Pax A80, and FD150 available for purchase or lease. |

| Payments methods accepted | Credit and debit cards, ACH, EFT, digital wallets, bank transfers, Skrill, and Venmo. |

| Payout times | 1-2 business days. |

| Contract length | Monthly, with no cancellation fees. |

| Customer support | 24/7 technical support line available for customers; additional support offered Monday to Friday via phone and email. |

| Security | Level 1 PCI compliance, tokenization, end-to-end encryption, GDPR compliance, and more. |

Customized Fees and International Support, but Lacks Transparency

Paysafe focuses on providing a simple, secure, and flexible payment solution, positioning itself as a reliable and user-friendly option. While it promotes itself as suitable for businesses of all sizes, our findings suggest that Paysafe is particularly well-suited for businesses that sell high-ticket items in low volumes.

Paysafe’s offerings include point-of-sale (POS) devices, e-commerce payment gateways, and omnichannel payment solutions, making it versatile for both brick-and-mortar and online businesses. This flexibility enables businesses to accept payments through various channels, broadening their customer reach.

Unlike many other processors, Paysafe operates in multiple regions, including the US, UK, Canada, and Europe, with partners in Latin America. This makes it a great choice if your business operates in multiple countries or is planning to expand and prefers to stick with one system.

However, despite these notable features, Paysafe has received mixed reviews. Upon further investigation, it became clear that most of the negative feedback is related to a different consumer product: the paysafecard.

Fortunately, the credit card processing aspect of Paysafe receives much more favorable reviews. Many users have praised it for its quick response times, excellent account managers, competitive rates, and quality equipment.

That said, Paysafe may not be the best fit for every business. Continue reading to determine if Paysafe is the right choice for yours.

FEATURES |4.8|

Global Payment Solutions: Paysafe provides comprehensive payment solutions that cater to businesses operating globally. This includes support for multiple currencies and cross-border transactions.

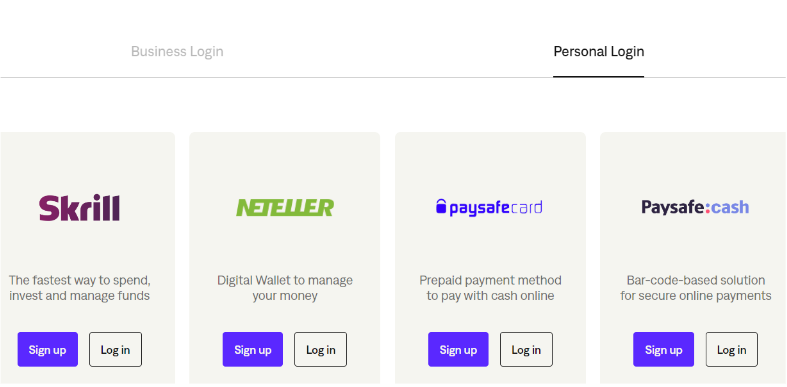

Digital Wallets: The website highlights Paysafe’s popular digital wallet services, such as Skrill and Neteller, which enable users to store funds, make payments, and transfer money securely online.

Prepaid Cards: Paysafe offers prepaid cards, allowing users to manage their spending while providing an alternative to traditional banking.

Fraud Prevention: Paysafe emphasizes its advanced security features, including fraud detection and prevention tools designed to protect businesses and consumers from fraudulent activities.

Customizable Solutions: The site showcases how Paysafe tailors its payment solutions to meet the unique needs of different industries, from e-commerce to gaming.

Customer Support: The website provides access to customer support resources, including 24/7 assistance via phone, email, and live chat, as well as an extensive online help center.

User-Friendly Interface: The website is designed with a user-friendly interface that makes it easy to navigate, find information, and access services.

Integration Capabilities: Paysafe offers seamless integration with various e-commerce platforms, allowing businesses to easily incorporate Paysafe’s payment solutions into their websites.

Resource Center: The website features a resource center with articles, guides, and case studies to help businesses stay informed about the latest trends and best practices in payment processing.

News and Updates: Paysafe regularly updates its website with news, press releases, and insights into the payment industry, keeping users informed about the company’s developments and market trends.

Services Offered

1. Payment Processing: Paysafe provides secure and efficient payment processing solutions for businesses, allowing them to accept payments from various sources, including credit and debit cards, bank transfers, and alternative payment methods.

2. Digital Wallets: Paysafe offers digital wallet services through brands like Skrill and Neteller, enabling users to store funds, make online payments, and transfer money easily and securely.

3. Prepaid Cards: Paysafe issues prepaid cards that can be used for online and offline purchases. These cards are linked to the Skrill and Neteller wallets, providing a convenient way to manage spending.

4. eCash Solutions: Paysafe provides eCash services through Paysafecard, a prepaid online payment method that allows users to make purchases without the need for a bank account or credit card.

5. Fraud and Risk Management: Paysafe offers advanced fraud prevention and risk management tools, helping businesses protect against fraudulent transactions and minimize chargebacks.

Not Packed with Extras, but Covers All the Essentials

Paysafe focuses on providing simple, reliable features that merchants need. While it may seem less feature-rich compared to some other processors, the offerings from Paysafe are more than adequate for most small businesses.

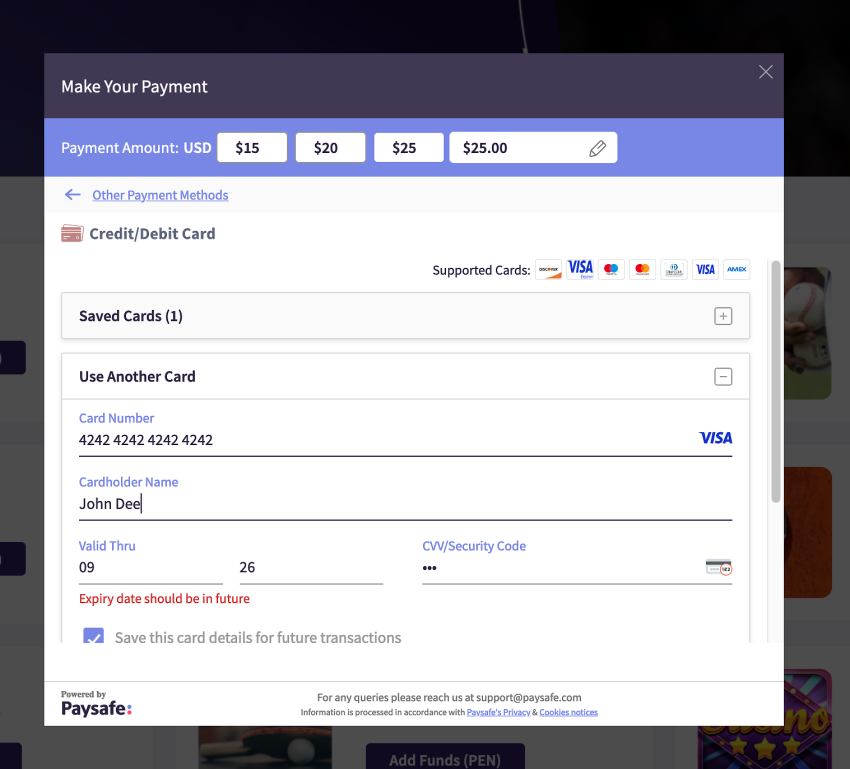

Online Checkout Powered by Authorize.net

Paysafe offers a secure and user-friendly online payment gateway, allowing you to accept credit card payments globally in multiple currencies. This gateway, powered by Authorize.net—a Visa subsidiary—ensures the safety and reliability of transactions. Furthermore, Paysafe offers sophisticated APIs that let you incorporate a checkout page straight into your website while yet upholding strict security standards.

However, Paysafe doesn’t offer as many integrations as some other processors. It supports shopping cart integrations with popular eCommerce platforms like WooCommerce and Magento, but more options for accounting or payroll software integrations would be beneficial.

Accept a Wide Variety of Payment Methods Globally

I was thoroughly impressed with the range of payment methods Paysafe offers—over 250 options. Whether it’s credit and debit cards, digital wallets, virtual wallets, bank transfers, or local payment solutions, Paysafe ensures you can meet the diverse needs and preferences of your customers.

Additionally, funds are typically available within 1-2 business days, with an option for guaranteed next-day funding at an additional cost. This is one of the fastest payout schedules in the industry, though it’s important to note that next-day funding is only available after you’ve been a Paysafe merchant for several months.

Paysafe Works With Leading POS Systems Like Clover and Pax

Paysafe offers a secure and user-friendly online payment gateway, allowing you to accept credit card payments globally in multiple currencies. This gateway, powered by Authorize.net—a Visa subsidiary—ensures the safety and reliability of transactions. Furthermore, Paysafe offers sophisticated APIs that let you incorporate a checkout page straight into your website while yet upholding strict security standards.

Popular Credit Card Processing

PROS AND CONS OF PAYSAFE

Pros of Paysafe

Wide Acceptance: Paysafe is accepted by a large number of merchants worldwide, making it convenient for users to make transactions across different platforms.

Security: Paysafe prioritizes security with features like encryption, two-factor authentication, and fraud detection systems, ensuring that transactions are safe and secure.

Ease of Use: The platform is user-friendly, with straightforward processes for making payments, managing accounts, and handling transactions.

Multiple Payment Options: Paysafe supports a variety of payment methods, including prepaid cards, digital wallets, and direct bank transfers, providing flexibility for users.

Global Reach: Paysafe operates in numerous countries, allowing users to make cross-border transactions easily.

Support for Cryptocurrencies: Paysafe has integrated support for cryptocurrencies, which appeals to users who prefer using digital currencies.

Cons of Paysafe

Fees: Paysafe may charge fees for certain transactions, such as withdrawals or currency conversions, which can add up over time for frequent users.

Limited Access in Some Regions: Although Paysafe is available in many countries, there are still regions where the service is not accessible or where certain features are restricted.

Customer Support: Some users have reported issues with customer support, such as long response times or difficulties in resolving disputes.

Prepaid Card Limitations: While Paysafe offers prepaid cards, they may have limitations, such as spending caps or restricted usage in certain regions or for specific types of purchases.

Compliance and Verification: Users might find the compliance and verification processes to be stringent, which could lead to delays in account activation or transaction approval.

Dependence on Third-Party Merchants: Users are limited to making purchases only with merchants who accept Paysafe, which may not include all desired vendors or platforms.

EASY OF USE |4.8|

The Paysafe website is designed with ease of use in mind, providing a user-friendly interface that makes it simple for both businesses and consumers to navigate. Key features include intuitive navigation menus, clear calls to action, and accessible resources that allow users to quickly find the information or services they need. The site also offers detailed guides, FAQs, and support tools, ensuring that users can easily integrate Paysafe’s payment solutions, manage transactions, and access customer support without any hassle. Additionally, the developer resources and API documentation are well-organized, making it straightforward for technical teams to implement and customize payment solutions.

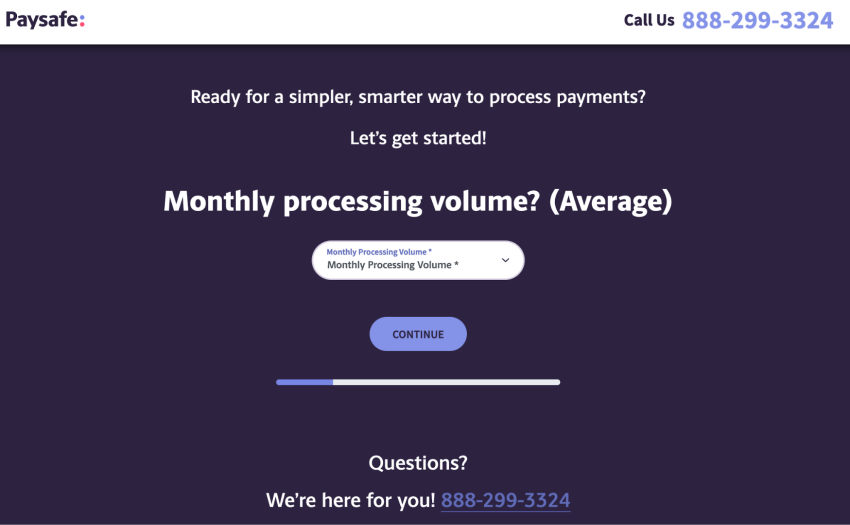

Straightforward Onboarding, but No Online Application

Setting up and managing a Paysafe account is very straightforward. The onboarding process is quick, and the payment processing tools are easy to use. However, you’ll need to speak with a customer service representative to get started, which may take some time.

Getting Started with Paysafe

To begin the application, you fill out a basic questionnaire about your business on the website. After that, a business consultant will call you to guide you through the rest of the process.

This usually involves submitting required documents like identification, banking details, and company information. The sign-up process is simple, though it can be a bit inconvenient that you can’t complete it entirely online, as with some other processors.

Paysafe may additionally request more details relevant to your company model in order to assess your risk profile and regulatory compliance. While there are certain industries Paysafe doesn’t support (such as weapons and direct marketing), it does consider high-risk businesses like crypto companies and travel agencies on a case-by-case basis.

Personalized Onboarding with Dedicated Account Manager

During onboarding, your dedicated account manager will guide you through setting up your payment processing system. This includes configuring your preferred payment channels, whether online terminals or physical POS systems. Your account manager provides personalized support throughout the entire setup process.

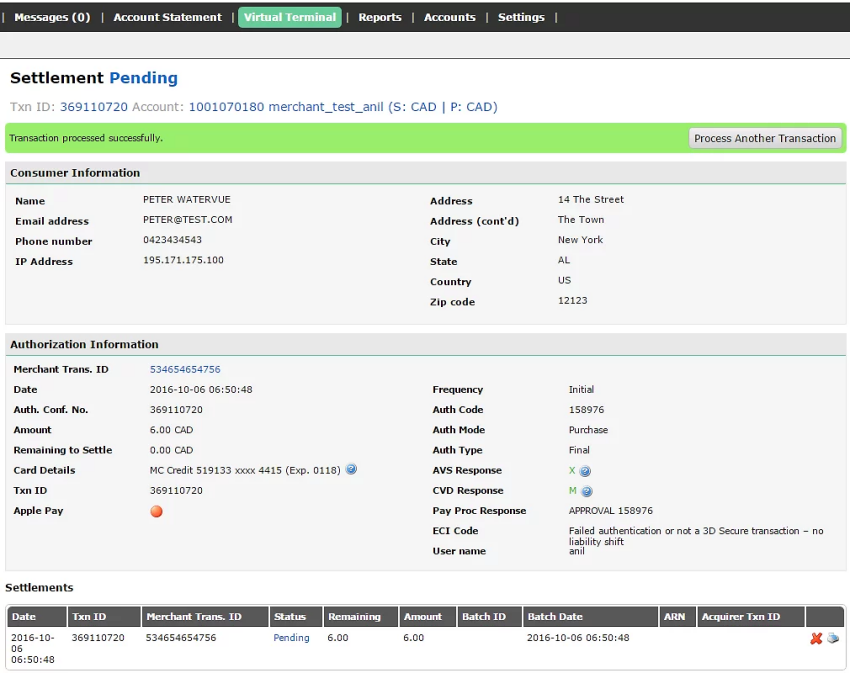

Online Dashboard for Tracking and Reporting

Paysafe provides a detailed online dashboard called the Merchant Back Office for tracking and monitoring your payments. This dashboard lets you view all transactions, take orders via a virtual terminal, generate reports, and process refunds.

While the user interface of the merchant dashboard is somewhat dated compared to other processors, it remains functional and fairly user-friendly. Managing your account from this centralized platform allows you to keep a close eye on payment data, helping you make informed business decisions.

Create a Account

To create an account on the Paysafe website, follow these steps:

1. Visit the Website: Go to the Paysafe website at https://www.paysafe.com/en/.

2. Navigate to Sign Up: Look for the “Sign Up” or “Register” button on the homepage. Usually, this can be found in the page’s upper right corner.

3. Choose Your Service: Depending on whether you’re a business or an individual, select the appropriate option (e.g., Skrill, Neteller, or Paysafecard) and click on the corresponding sign-up link.

4. Fill Out the Registration Form: Enter the required information, including your name, email address, and other personal or business details. You may also need to choose a username and password.

5. Agree to Terms: Review and agree to the terms and conditions, as well as any privacy policies provided by Paysafe.

6. Verify Your Email: Paysafe will send a verification email to the address you provided. Open the email and click the link to confirm your account.

7. Complete Profile Setup: Depending on the service, you may need to provide additional information, such as payment details or business verification documents.

8. Start Using Paysafe: Once your account is set up and verified, you can start using Paysafe’s services for payments, transfers, or other financial transactions.

PRICING |4.9|

Transaction Fees: Percentage fee per transaction, varying by payment method (e.g., credit card, digital wallet).

Flat Fees: Fixed fee per transaction or specific services like international payments or currency conversion.

Monthly Fees: Subscription fees for services such as payment gateways or merchant accounts.

Setup Fees: Initial setup fees may apply based on the complexity of the integration.

Chargeback Fees: Fixed fee for handling chargebacks when customers dispute transactions.

Additional Service Fees: Extra fees for services like fraud prevention, multi-currency processing, or advanced reporting.

Paysafecard & Paysafecash

Paysafecard:

Paysafecard is a prepaid online payment method that allows users to make secure and anonymous payments on the internet without the need for a bank account or credit card. Users can purchase a Paysafecard voucher from a wide network of retail locations and use the 16-digit PIN to pay for goods and services at thousands of online merchants.

It is particularly popular for online gaming, streaming services, and e-commerce, offering a straightforward way to control spending and protect personal financial information.

Paysafecash:

Paysafecash is an innovative payment solution that enables users to pay for online purchases with cash. Customers choose the Paysafecash option at checkout, receive a barcode, and then pay the corresponding amount in cash at a nearby partner location. This service is ideal for those who prefer to use cash for online transactions or do not have access to traditional banking services.

Paysafecash ensures that users can participate in the digital economy while maintaining their preference for cash payments, bridging the gap between online and offline transactions.

Pricing Tailored Pricing Options, but Limited Online Transparency

One of the main challenges with Paysafe is the lack of easily accessible pricing information online, making it difficult to quickly compare options if you’re in a hurry to get started.

I managed to obtain some details from customer support, but keep in mind that Paysafe customizes its pricing, so these figures are only estimates. However, I did learn that there are no long-term contracts, and no application or cancellation fees, which is a significant advantage over other processors.

In my experience, Paysafe’s pricing is most favorable for businesses selling high-ticket items at lower volumes, such as handcrafted goods, luxury items, or specialty tech products. While it could work for other types of businesses, it’s important to do the math to determine the best pricing for your needs.

Paysafe structures its fees based on the type of card used, so your per-transaction rate will vary. For online transactions, fees range from 0.99% + 25¢ (for debit cards) to 3.99% + 25¢ (for foreign credit cards), depending on the payment method. Additionally, the monthly fees are around $16, which is one of the lowest I’ve encountered.

If you prefer a more transparent pricing model, the Interchange Plus plan might be a good option. This plan is even cheaper, at ₹660 and 0.50% + $0.10 per transaction, but it does include additional fees like a batch fee, a PCI monthly fee, and a monthly minimum fee of $25.

For in-person sales, Paysafe offers an excellent cash discount plan. If bundled with the online plan, the service is around $20 per month. The cash discount is particularly beneficial as it promotes cash payments and shifts the transaction fee to the customer.

Beyond monthly and transaction fees, there are other potential costs, such as POS leasing fees, chargeback fees, retrieval fees, fees for enhanced security packages, and PCI non-compliance fees. It was challenging to get clear information on these costs, and this lack of transparency is definitely a drawback.

Overall, Paysafe’s pricing can be cheaper in some scenarios, but it generally falls within the average range. If you’re looking for more flexible pricing options, Leaders Merchant Services (LMS) might be a better choice.

Tools in Paysafe

Payment Gateway Integration: Tools and APIs that allow businesses to integrate Paysafe’s payment solutions into their websites and apps, supporting various payment methods.

Fraud and Risk Management Tools: Advanced tools for monitoring transactions, risk scoring, and fraud prevention to protect businesses and customers.

Developer Resources: A dedicated section with APIs, SDKs, and documentation to assist developers in integrating and customizing payment solutions.

Merchant Dashboard: An online dashboard for businesses to manage transactions, access reports, and monitor account activity in real-time.

Currency Conversion Tools: Tools that support multi-currency transactions, allowing businesses to process payments in different currencies and manage exchange rates.

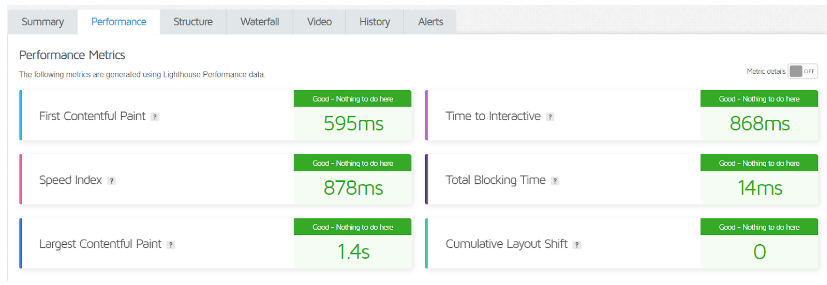

GTMetrix

COMPLIANCE & SECURITY |4.8|

Paysafe ensures robust compliance and security through a comprehensive framework designed to protect sensitive information and adhere to regulatory standards. Firstly, it employs advanced encryption and fraud prevention technologies to safeguard data across all transactions. Secondly, Paysafe’s compliance practices are aligned with international standards, including GDPR and PCI-DSS, ensuring rigorous data protection and privacy.

Paysafe employs advanced encryption and fraud prevention technologies to protect transaction data and ensure secure processing.

The company adheres to international standards, including GDPR and PCI-DSS, for comprehensive data protection and privacy.

Regular audits and assessments are conducted to maintain high security standards and address emerging threats.

Finally, the company conducts regular audits and assessments to maintain the highest security measures and address emerging threats, reinforcing its commitment to safeguarding customer information and maintaining trust.

Compliance & Security Advanced Security Measures to Safeguard Your Customers' Data

As its name suggests, Paysafe prioritizes payment security, adhering to industry standards and implementing additional protective measures to ensure the safety of your customers’ data throughout the payment process. Being a European-based company, Paysafe also complies with the General Data Protection Regulation (GDPR) laws.

PCI Compliance & Beyond

Paysafe provides a variety of equipment for card-present transactions, all of which meet PCI regulations. Each device is EMV level 1 and 2 approved and PCI-certified, ensuring the secure handling of sensitive information. For e-commerce, Paysafe uses the Authorize.net payment gateway, which also upholds the highest level of PCI compliance.

However, it’s your responsibility to complete the annual PCI compliance questionnaire to avoid non-compliance fees. While Paysafe doesn’t offer direct assistance with this process, it partners with several accredited firms. These partners, Qualified Security Assessors, and Approved Scanning Vendors, can help you identify and address vulnerabilities in your security practices.

Additional Security Features

Paysafe has a dedicated risk management team that monitors transactions 24/7 to prevent and detect fraud. The team actively flags and blocks suspicious payments, especially those originating from certain IP addresses or regions.

To further safeguard against fraud, particularly in card-not-present transactions, Paysafe employs advanced security measures. These include address verification, end-to-end encryption, and tokenization during the checkout process.

For an additional cost, Paysafe offers an Enhanced Security Package. While the specifics weren’t provided, a sales representative explained that this package functions as an insurance policy, offering protection in case your customers’ information is compromised.

CUSTOMER SUPPORT |4.8|

Paysafe offers 24/7 customer support through various channels, including phone, email, and live chat, to assist with inquiries and issues.

The company provides dedicated account managers and support teams for tailored assistance and resolution of complex problems.

Paysafe’s website features an extensive knowledge base with FAQs, guides, and troubleshooting resources to help customers find solutions independently.

Decent Phone Support, but Limited Options for Non-Customers

Phone support for non-customers is available during regular business hours, though the exact times aren’t clearly stated. An after-hours message indicated that representatives are available from 9:00 a.m. to 7:30 p.m. (EST), but I found conflicting times listed on the website.

Once you’re a customer, you can also reach your account manager via email and phone support outside of business hours.

When I called during business hours with questions about starting a merchant account, I was quickly connected to a customer service representative, who then transferred me to sales. Both times, the sales reps were extremely patient and thorough, answering all my questions in detail, even when I needed clarification. They weren’t pushy about closing a deal, and one even encouraged me to explore other options before making a decision.

One sales representative, Nico, provided me with his direct line at the end of our conversation, making it easier to reach out with further questions or to get started. I appreciated his personalized approach, which wasn’t overly sales-focused.

While the phone support was excellent, it was disappointing that Paysafe doesn’t offer other ways to contact support, especially for non-customers. Unlike other processors that provide live chat or comprehensive online knowledge bases, Paysafe only has a basic FAQ PDF with brief answers that aren’t very helpful.

Alternative Paysafe

Frequently Asked Question.

Paysafe provides payment processing solutions, digital wallets, fraud prevention, and other financial services for businesses and consumers.

You can sign up for a Paysafe account through their website by providing your business and contact information.

Fees vary depending on the services and volume of transactions. Details are available in the pricing section or by contacting customer support.

Paysafe uses advanced encryption, fraud detection, and compliance measures to secure transactions and protect data.

Yes, Paysafe offers integration options for various e-commerce platforms and provides technical support for the setup process.

Contact Paysafe customer support for assistance with technical issues. They offer help via phone, email, and live chat, among other platforms.

Follow the procedures outlined in the customer support section for handling refunds and disputes, or reach out directly to customer service.

Paysafe supports a wide range of businesses, but certain industries may have specific requirements or restrictions. Check their guidelines for more information.

Paysafe supports multiple currencies and operates in various countries. Check their website for a list of supported currencies and countries.

Log in to your account on the Paysafe website and navigate to the account settings section to update your information.

Paysafe adheres to strict data privacy policies and complies with relevant regulations to protect user information. Review their privacy policy for details.

Customer support can be reached through their website’s contact page, via phone, email, or live chat. Check the support section for contact details.