Chase Payment Solutions Review

Chase Payment Solutions is a comprehensive payment processing service offered by JPMorgan Chase, one of the largest financial institutions in the United States.

This service is designed to cater to businesses of all sizes, providing them with the tools needed to accept and process payments efficiently. Chase Payment Solutions offers a variety of payment options, including credit and debit card processing, mobile payments, and e-commerce solutions, making it a versatile choice for merchants looking to streamline their payment processes.

4.7

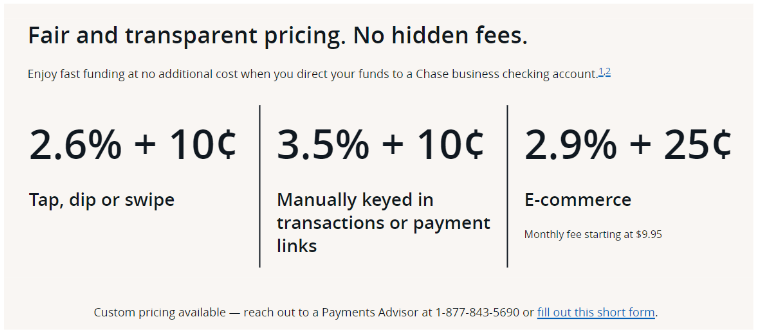

Pricing Plan

Card-present Transactions

Keyed-in Transactions

E-Commerce Transactions

Pricing per transaction

2.6% + 10¢

3.5% + 10¢

2.9% + 25¢

Monthly subscription

₹0

₹0

₹0

Ranked 6 from 29 Credit Card Processing

Performance: |4.9|

Chase Payment Solutions delivers strong performance with quick transaction processing times, ensuring businesses can efficiently manage cash flow with near-instantaneous payment access. The platform is highly reliable, benefiting from Chase’s robust banking infrastructure, which minimizes downtime and ensures consistent service availability. Advanced security measures, including encryption and fraud protection, further enhance its dependability. While generally easy to use, particularly when integrated with Chase banking services, some users have noted occasional challenges with customer support, though these are typically resolved swiftly, making it a solid choice for payment processing.

Uptime: |4.9|

Chase Payment Solutions is known for its excellent uptime, providing businesses with a highly reliable payment processing platform. Leveraging the robust infrastructure of JPMorgan Chase, the service ensures that merchants experience minimal disruptions, which is crucial for maintaining continuous business operations. The high uptime performance means that businesses can process transactions consistently without worrying about potential outages or downtime that could impact sales and customer satisfaction. This reliability is particularly important for businesses that operate in fast-paced environments where every transaction counts. Chase’s commitment to maintaining a stable and secure network further reinforces its reputation as a dependable payment processing solution.

Customer Service: |4.8|

24/7 Support: Provides round-the-clock customer service via phone, email, and online chat for quick issue resolution.

Dedicated Account Managers: Offers personalized assistance through dedicated account managers for businesses with specific needs.

Educational Resources: Access to comprehensive guides, tutorials, and webinars to help businesses maximize the platform’s features.

Multi-Channel Assistance: Support is available through various channels, ensuring businesses can reach out in their preferred way.

Continuous Improvement: Focuses on refining customer service processes based on user feedback to enhance overall support quality.

Pricing: |4.7|

Chase Payment Solutions offers flexible and competitive pricing, typically comprising transaction fees, monthly service charges, and potential additional costs based on the services used. Transaction fees vary depending on the payment method and type of transaction, while monthly fees are tied to the selected service level. For businesses with high transaction volumes, custom pricing arrangements are available, often featuring lower fees. Chase does not require long-term contracts, offering businesses flexibility, though some services or equipment may incur additional costs. This pricing structure is designed to accommodate businesses of all sizes.

Overview

| POS equipment | 5 available POS devices for purchase |

| Payments methods accepted | ACH, digital wallets, and credit and debit cards. |

| Payout times | Same day when depositing into a Chase business account; next day for deposits into a third-party account |

| Contract length | Monthly (with no cancellation fees) or variable (cancellation fees may apply) |

| Customer support | 24/7 phone support |

| Security | PCI compliance, tokenization, end-to-end encryption, advanced fraud detection and prevention, and payer verification |

About Chase Payment Solutions

One of the standout features of Chase Payment Solutions is its integration with other Chase business banking services, allowing for seamless financial management. Merchants can easily monitor transactions, manage cash flow, and access funds quickly, often within the same business day, through their Chase business accounts. Additionally, Chase provides robust security measures, including fraud protection and PCI compliance, ensuring that both businesses and their customers are safeguarded against potential threats.

Chase Payment Solutions also offers extensive customer support and resources to help businesses optimize their payment processes. Whether it’s setting up the service, troubleshooting issues, or learning how to make the most of the available features, Chase provides dedicated support teams and educational resources. This combination of advanced technology, security, and customer support makes Chase Payment Solutions a strong contender in the payment processing industry, especially for businesses already banking with Chase.

Quick Payouts… but Mixed Reviews

Chase Payment Solutions℠ (commonly referred to as Chase) is among the largest payment processors globally, serving over 5 million customers in the US and Canada. It offers next-day funding, with the option for same-day funding available to select customers. With a solid selection of POS hardware, up-to-date e-commerce payment software, and extensive support to help your business expand, Chase is a suitable option for small- to medium-sized businesses that require dependable access to their funds.

However, there are a few factors to consider. Same-day funding requires a Chase Business Banking account, which may incur additional fees. These fees can be waived, but only if you maintain a minimum daily balance of $2,000.

Additionally, reviews of Chase and its parent company, JP Morgan, are mixed. Some customers have reported sudden account closures or funds being held without prior notice. The specific details behind these complaints are often unclear. It’s also important to remember that dissatisfied customers are generally more inclined to voice their grievances than those who are satisfied.

So, is Chase Payment Solutions℠ as good as it claims to be? Read on to find out if this credit card processor could be a fit for your business.

Services Offered:

Chase Payment Solutions offers a comprehensive suite of services for businesses, including credit and debit card processing, mobile and online payment acceptance, and point-of-sale (POS) systems. It provides a secure payment gateway for e-commerce transactions, supports recurring billing, and features advanced fraud detection and security measures. Additionally, Chase Payment Solutions integrates with Chase’s business banking services for streamlined financial management and offers next-day funding for quick access to processed funds. This broad range of services is designed to support efficient payment processing and enhance overall business operations. Key services include:

Credit and Debit Card Processing

Mobile Payment Processing

E-Commerce Solutions

Point-of-Sale (POS) Systems

Virtual Terminal

Recurring Payments

Payment Gateway

Fraud Detection and Security

Next-Day Funding

Reporting and Analytics

Integration with Chase Business Banking

Chase Payment Solutions: Credit/debit cards:

Chase Payment Solutions provides robust credit and debit card processing services designed to accommodate businesses of all sizes. Here are the key aspects:

Major Card Acceptance: Supports the acceptance of all major credit and debit cards, including Visa, MasterCard, American Express, and Discover, enabling businesses to offer flexible payment options to their customers.

In-Person and Online Payments: Facilitates both in-person transactions through point-of-sale (POS) systems and online payments via secure payment gateways, catering to a variety of business models.

Quick Processing Times: Transactions are processed quickly, allowing for efficient customer service and helping businesses manage their cash flow with fast access to funds, often available by the next business day.

Security: Includes advanced security features such as encryption and fraud detection, ensuring that all card transactions are secure and compliant with industry standards.

Customization and Flexibility: Offers customizable payment processing solutions, with options to tailor pricing and services based on the volume and type of transactions a business handle.

This service is central to Chase Payment Solutions, providing businesses with a reliable, secure, and efficient way to handle credit and debit card payments.

Chase Payment Solutions: Business card:

Chase Payment Solutions offers tailored solutions for businesses looking to manage and process payments made through business credit cards. Here are the key aspects:

Business Credit Card Acceptance: Supports the acceptance of business credit cards, allowing companies to process payments from other businesses efficiently. This is particularly useful for B2B (business-to-business) transactions.

Integration with Financial Management Tools: Transactions processed through business cards can be easily integrated with accounting software and other financial management tools, simplifying expense tracking and reconciliation for businesses.

Enhanced Reporting: Provides detailed reporting and analytics specific to business card transactions, enabling companies to monitor spending patterns, manage budgets, and optimize cash flow.

Security and Compliance: Ensures that all business card transactions are protected by advanced security measures, including encryption and fraud detection, while maintaining compliance with industry standards like PCI DSS (Payment Card Industry Data Security Standard).

Flexible Processing Options: Offers flexibility in processing options, whether it’s for recurring payments, large one-time transactions, or integration with corporate purchasing systems.

Chase Payment Solutions’ business card services are designed to meet the needs of companies that rely on business credit cards for day-to-day operations, offering security, convenience, and comprehensive management tools.

FEATURES |4.9|

Chase Payment Solutions offers a wide range of features designed to meet the payment processing needs of businesses of all sizes. Here is a table summarizing the key features:

Comprehensive Payment Processing: Accepts various payment methods, including credit/debit cards, mobile payments, and online transactions.

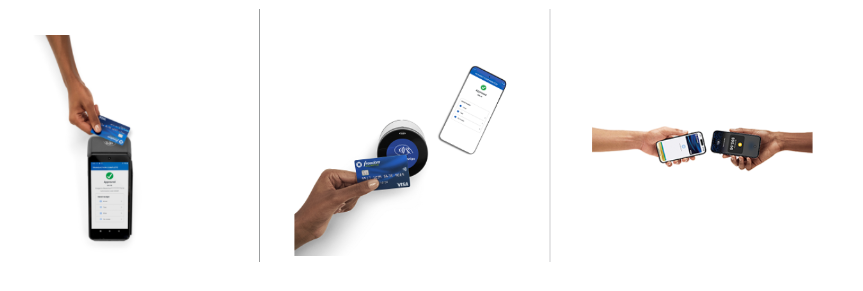

Point-of-Sale (POS) Systems: Provides POS systems for in-person transactions, including mobile POS options.

E-Commerce Solutions: Offers secure payment gateways and integration with e-commerce platforms for online sales.

Mobile Payment Support: Supports mobile payments like Apple Pay and Google Pay, with mobile card readers available.

Advanced Security Measures: Includes encryption, tokenization, and fraud detection to protect transactions and ensure PCI compliance.

Reporting and Analytics: Offers detailed reporting tools for transaction tracking, sales monitoring, and financial insights.

Integration with Chase Business Banking: Seamlessly integrates with Chase business accounts for easy financial management and reconciliation.

Customer Support: 24/7 customer service through phone, email, and chat, with dedicated account managers and educational resources.

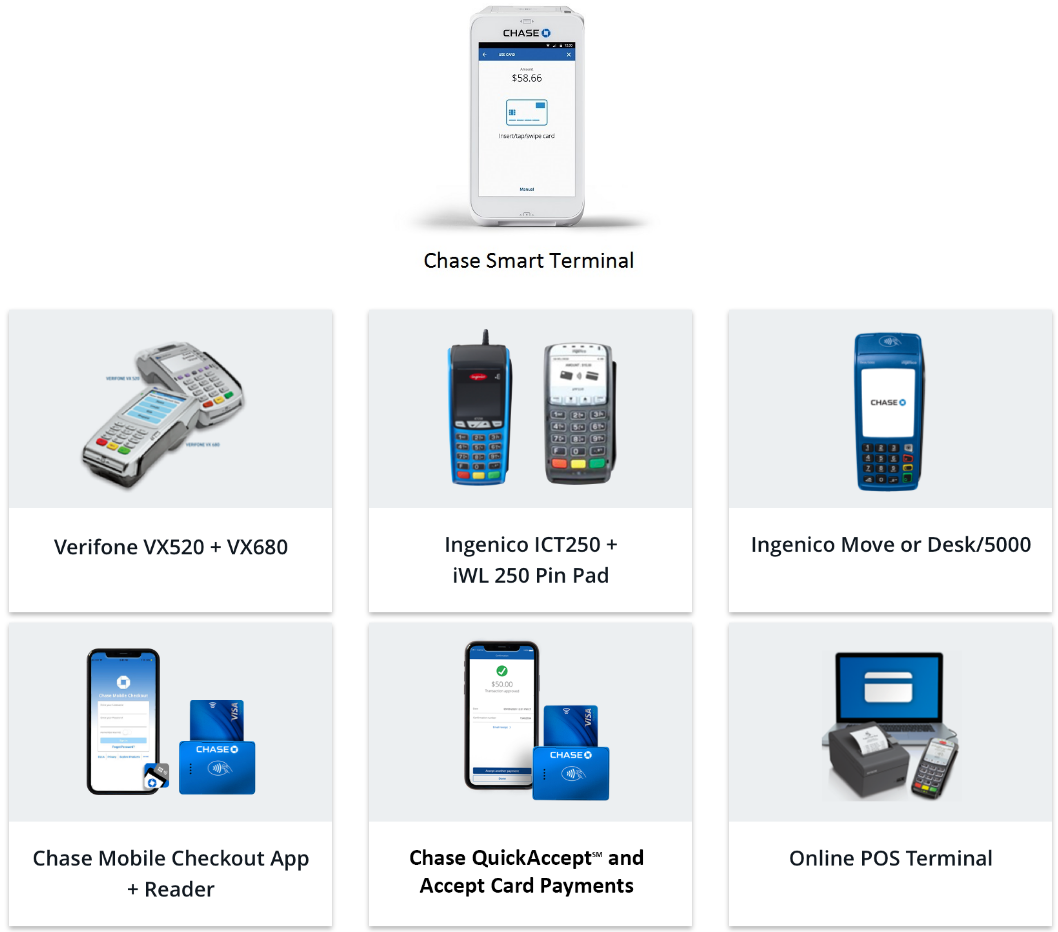

Strong Features Limited by Few POS Hardware Options

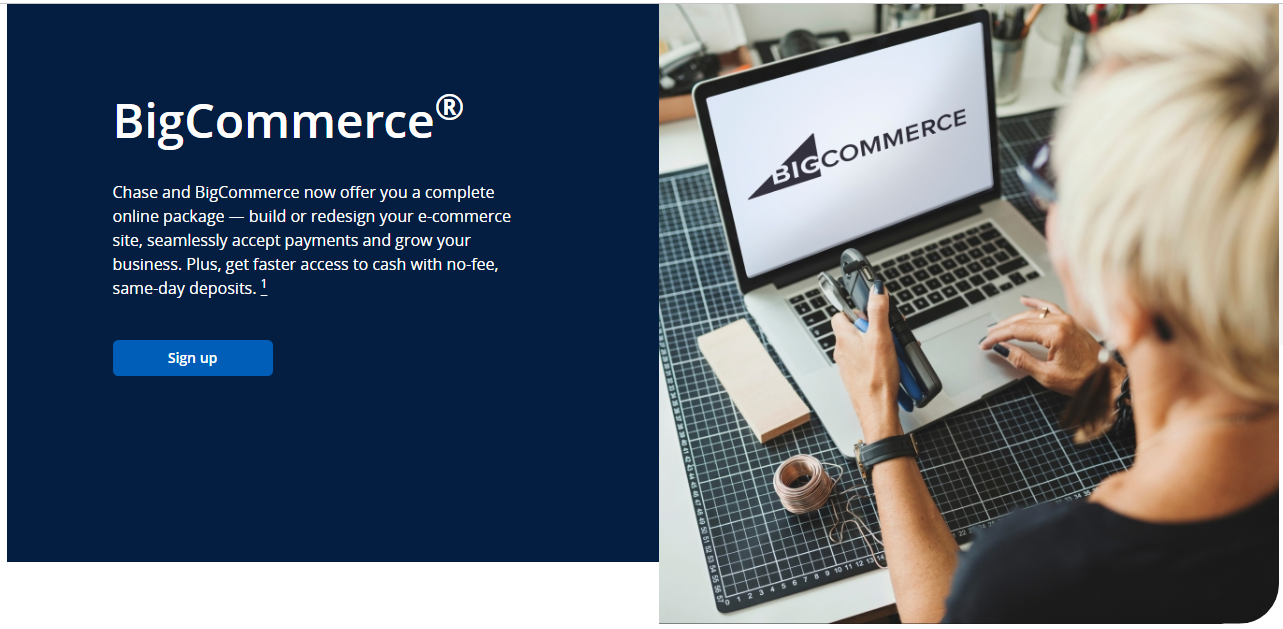

Chase offers an impressive array of features, especially considering it doesn’t charge any monthly fees. It includes the popular Authorize.net payment gateway for e-commerce and the Orbital virtual terminal for remote transactions. Additionally, its partnership with BigCommerce allows for same-day access to e-commerce sales funds, provided deposits are made into a Chase banking account. Moreover, Chase’s proprietary business analytics platform, Customer Insights, enables you to track sales, customer demographics, and even the times of day your customers prefer to shop.

However, Chase falls short in its POS hardware offerings (besides pricing, which I’ll address later). The selection is limited to just 5 POS devices, and one of these is only available if you have a Chase Business Banking account.

5 Devices with Limited Reprogramming Options

With only 5 POS devices available for purchase—3 terminals and 2 mobile card readers—your hardware choices are somewhat restricted. The most modern option is the proprietary Chase Smart Terminal, which must be purchased outright. However, as a proprietary device, it’s unlikely you’ll be able to reprogram it if you decide to switch payment processors.

Although Chase lists additional devices on its support page, these are not offered to new customers.

Notably, Chase is one of the few payment processors that doesn’t resell Clover’s cutting-edge devices. If you already own Clover hardware, you won’t be able to use it with Chase Payment Solutions℠.

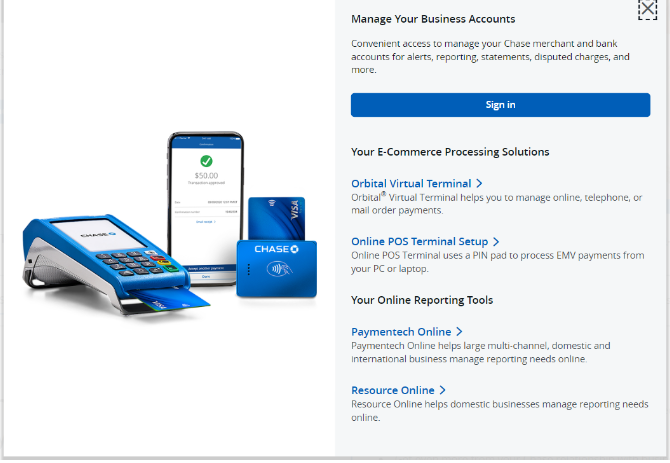

Industry-Leading E-Commerce Software

Chase Payment Solutions℠ offers a robust suite of e-commerce software to support your business. Alongside the well-regarded Authorize.net payment gateway, you’ll have access to the Orbital virtual terminal, providing two strong options for managing card-not-present transactions.

Additionally, Chase has partnered with BigCommerce to assist small e-commerce businesses. This seamless, pre-built integration requires no technical expertise, making it easy to start accepting payments through your BigCommerce store and get up and running with this powerful e-commerce platform.

Access Your Funds Quickly

You may accept bank transfers, ACH payments, digital wallets in more than 130 currencies, credit and debit cards, and more with a Chase Payment SolutionsTM merchant account. Chase provides next business day funding, and if you have a Chase Business Banking account, you can even receive same-day funding.

It’s important to note that same-day funding might come with additional costs. The Chase Business Complete Banking account costs $15 per month, but this fee can be waived if certain conditions are met. This means you could potentially access same-day funding at no extra cost, a benefit that many other payment processors don’t offer.

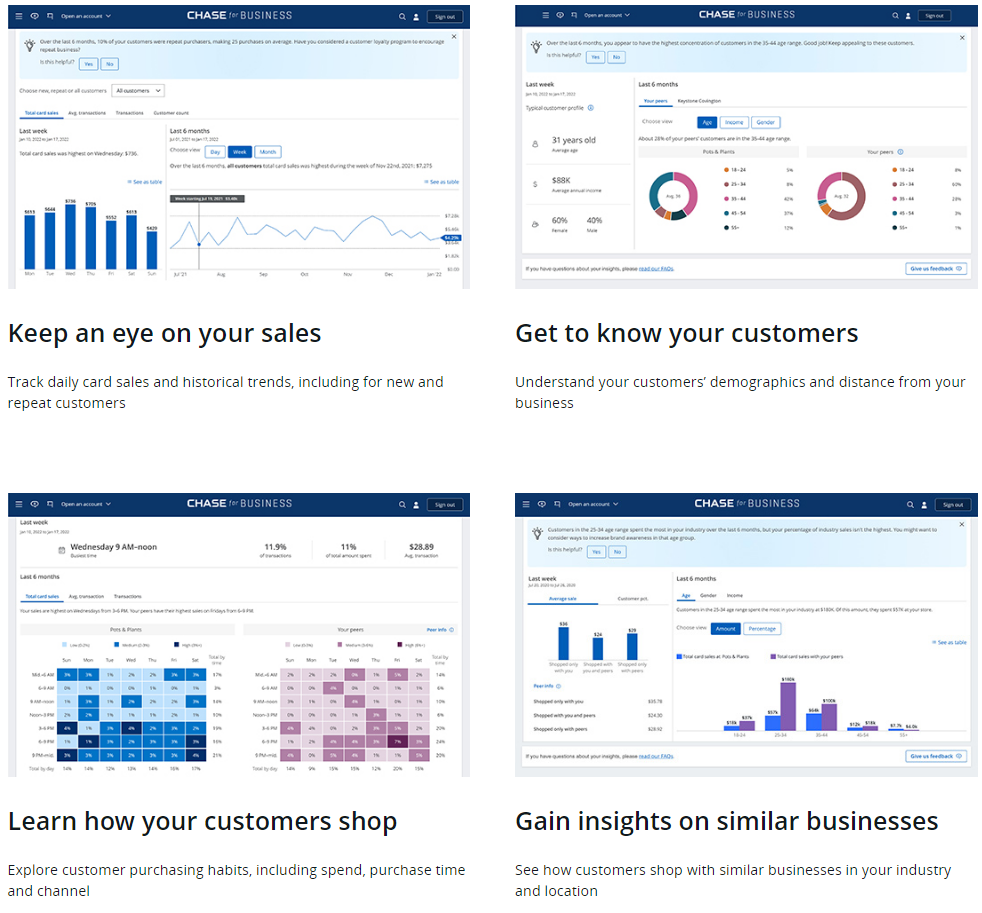

User-Friendly Business Analytics Software

Chase Customer Insights is a powerful business analytics and intelligence tool. It allows you to easily track your daily, weekly, and monthly sales, monitor trends over time, identify the times of day your customers are most likely to shop, and more.

Additionally, you can compare your sales trends against those of similar businesses in your industry and local area. This feature helps you enhance your competitive edge and optimize your sales strategy.

Industry-Specific Payment Software Powered by Chase

Chase offers 10 different software tools, both free and paid, tailored to specific industries. These include:

FuseBill (subscription management)

BuilderTrend (construction project management and invoicing)

PayRent (rent collection and property management)

EventZilla (event management and marketing)

If your business requires specialized payment software, Chase likely has a solution that fits your needs.

Popular Credit Card Processing

PROS AND CONS OF CHASE PAYMENT SOLUTIONS

Pros of Chase Payments Solutions

1. Comprehensive Service Offering: Provides a wide range of payment processing options, including credit/debit cards, mobile payments, and e-commerce solutions.

2. High Reliability and Uptime: Leveraging Chase’s robust infrastructure, the service ensures minimal downtime and consistent availability.

3. Quick Access to Funds: Offers next-day funding, allowing businesses to access their money faster and maintain healthy cash flow.

4. Advanced Security Measures: Includes strong security features like encryption, tokenization, and fraud detection, ensuring transactions are secure.

5. Seamless Integration with Chase Banking: Easily integrates with Chase business accounts, providing streamlined financial management and ease of reconciliation.

6. Customizable Solutions: Flexible pricing and service options are available, tailored to the specific needs of different business sizes and industries.

7. Strong Reporting and Analytics: Provides detailed transaction reports and financial analytics, helping businesses make informed decisions.

Cons of Chase Payments Solutions

1. Potential Hidden Fees: Some users report encountering unexpected fees for services like chargebacks or PCI compliance, adding to the overall cost.

2. Customer Support Issues: There are occasional reports of delays or challenges in resolving complex issues with customer support.

3. Complex Pricing Structure: The pricing can be difficult to navigate, with various fees depending on transaction types and volumes, making it hard to estimate total costs.

4. Long Setup Times: Integration with other systems or customizing services can take longer than expected, especially for more complex setups.

5. Limited Features for Non-Chase Users: Some features and benefits are optimized for businesses that also use Chase for their banking needs, which may limit appeal to non-Chase customers.

6. Less Competitive for Small Businesses: Smaller businesses might find more cost-effective options with providers that cater specifically to their needs.

7. Limited International Support: The service is primarily focused on U.S. businesses, with limited support for international transactions.

EASY OF USE |5.0|

Chase Payment Solutions is designed with user-friendliness in mind, making it accessible for businesses of all sizes. The platform features an intuitive interface with a customizable dashboard that simplifies navigation and highlights key metrics and tools. Setting up payment processing, whether for in-person or online transactions, is straightforward, with guided steps to ensure a smooth onboarding process. The integration with other software and systems, such as accounting or e-commerce platforms, is supported with resources and assistance to streamline the setup.

The mobile app enhances ease of use by allowing businesses to manage transactions, view reports, and process payments from anywhere. With 24/7 customer support available via phone, email, and chat, users can get help whenever needed. Additionally, Chase Payment Solutions provides educational resources like tutorials and webinars to help users fully understand and leverage the platform’s features, making payment management efficient and less time-consuming.

User-Friendly, but Slightly Complicated

Applying for Chase Payment Solutions℠ is relatively simple, but to access same-day funding, you’ll need to set up a business checking account with Chase first. Once that’s done, Chase will provide you with a list of documents required to set up your account. Next, you’ll need to apply for a merchant account, either through the website or by phone. If you choose to apply online, a sales representative will contact you within 24 hours to guide you through the process.

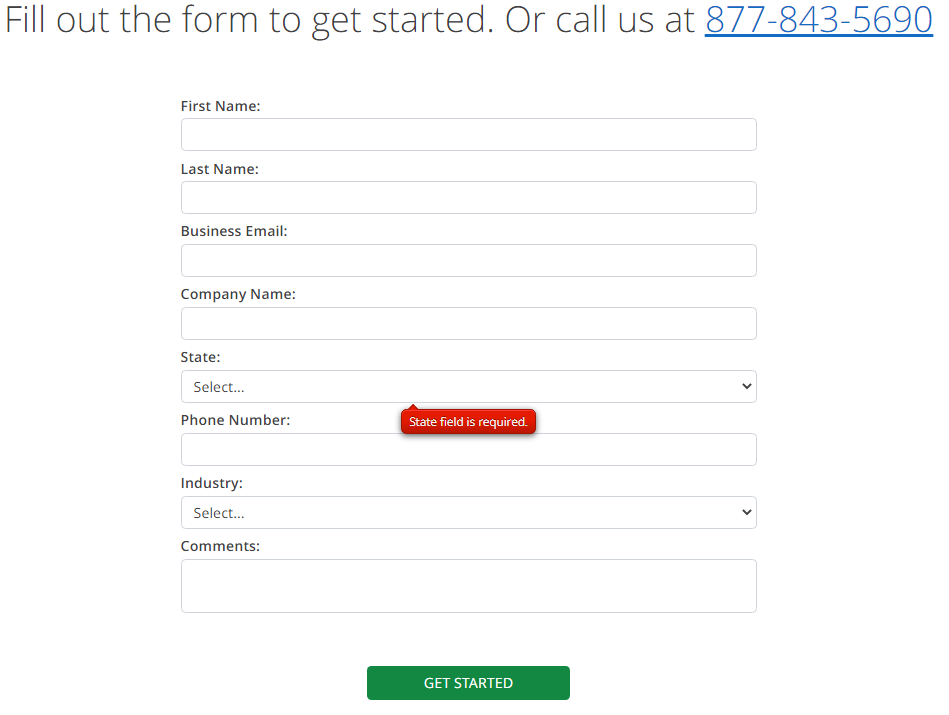

Getting Started With Chase Payment Solutions℠

To open a Chase Payment Solutions℠ account, visit the Chase website and navigate to Business > Accept Credit/Debit Cards > Connect with us. This will bring up the application form and a phone number if you prefer to apply over the phone.

You should be prepared to provide information about your average transaction size and monthly sales volume (or an estimated annual sales volume). While you don’t need to provide this immediately if applying online, the sales representative will request this information during the follow-up call. If you’re inquiring about custom rates, you’ll also need to provide 3 months of payment processing statements.

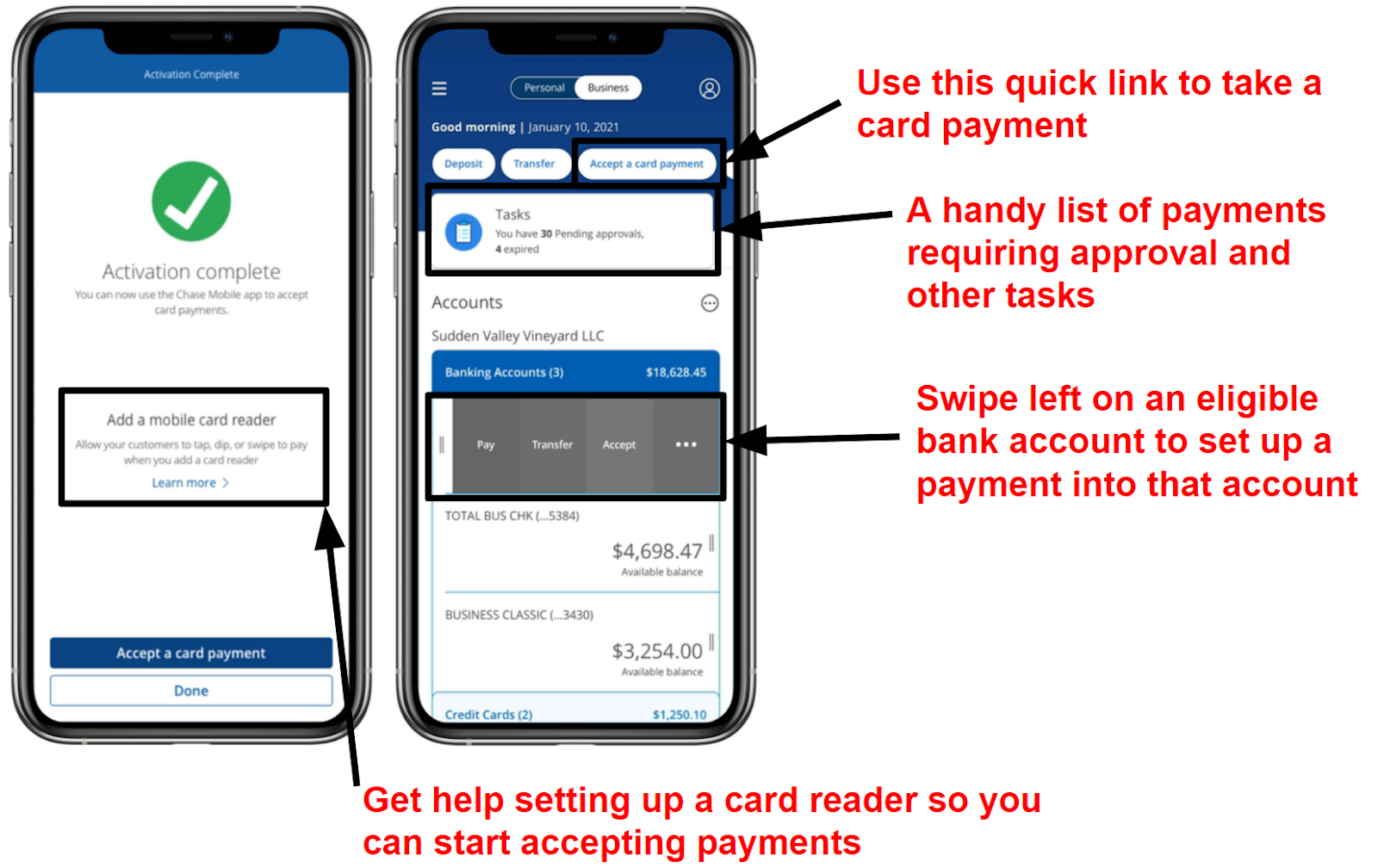

Manage Your Payments on Your Smartphone

Chase Payment Solutions℠ offers a user-friendly mobile app, Chase Mobile, available for both Android and iOS devices.

Through the app, you can accept payments, handle disputes, create and send payment links, and approve payments under review. Additionally, Chase Mobile serves as your banking app, allowing you to manage your business accounts directly from your smartphone.

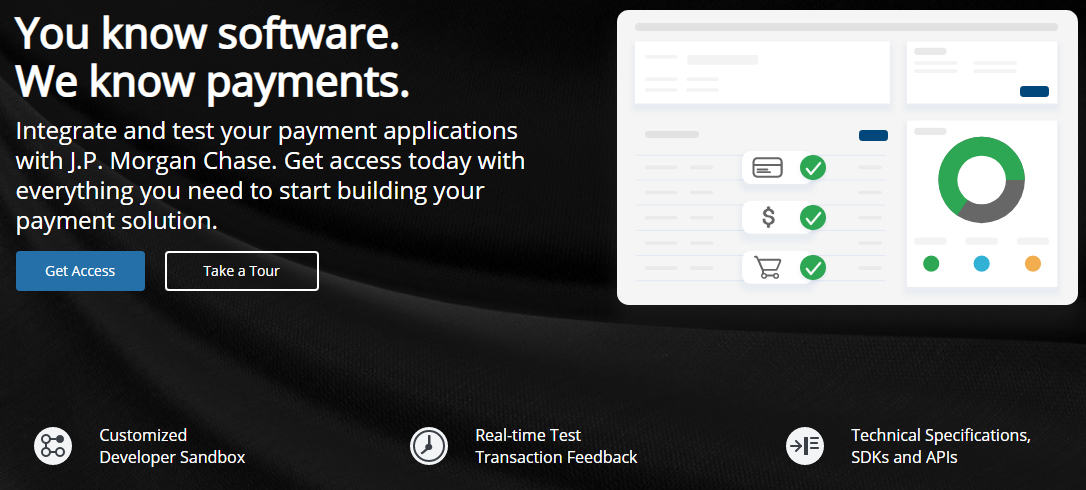

A Complete Developer Toolkit

If you require a custom software solution that Chase doesn’t offer, you’ll have everything you need to build it yourself.

You’ll have access to an extensive library of SDKs and APIs, along with documentation to help you integrate these tools into your development environment. Additionally, you’ll receive the tools necessary to test your software in real-time, plus a sandbox environment to ensure everything functions properly before going live.

How to create Account in Chase Payment Solutions?

To create an account with Chase Payment Solutions, follow these steps:

1. Visit the Chase Payment Solutions Website:

Go to the official Chase Payment Solutions website to start the application process. You may also contact Chase directly if you prefer a more personalized approach.

2. Contact Chase Sales or Support:

Online Inquiry: Fill out the online inquiry form on the Chase Payment Solutions website to request more information or get in touch with a representative.

Phone Call: Call Chase’s sales team or customer support for assistance with setting up an account. The contact number can be found on their website.

3. Provide Business Information

Business Details: Submit your business information, including your business name, type, address, and contact details.

Financial Information: Provide relevant financial details such as your bank account information and business financial statements.

4. Complete the Application Form:

Online Application: If applying online, complete the application form with your business and financial information. Make sure all the information is correct and current.

Paper Application: Alternatively, you may need to fill out a paper application if instructed by Chase.

5. Review and Submit Documentation:

Supporting Documents: Provide any required documentation, such as business licenses, tax identification numbers, and personal identification for business owners.

Verification: Chase will review your application and documentation to verify your business and ensure compliance with their requirements.

6. Set Up Payment Processing:

Choose Services: Select the payment processing services that best suit your business needs, such as POS systems, e-commerce solutions, or mobile payment options.

Integration: Work with Chase to integrate the payment processing tools into your existing systems or set up new ones.

7. Receive Account Details:

Account Setup: Once your application is approved, you will receive your account details and instructions for accessing the Chase Payment Solutions dashboard and tools.

Training and Support: Take advantage of any training resources or support offered by Chase to get familiar with the platform and its features.

8. Start Processing Payments:

Go Live: Begin using Chase Payment Solutions to process payments, manage transactions, and leverage the various tools and features provided.

PRICING |5.0|

Chase Payment Solutions offers a flexible pricing structure tailored to the needs of various businesses. Here’s an overview of their pricing:

1. Transaction Fees

Card Processing Fees: Typically include a percentage of each transaction plus a flat fee. The exact rates depend on the type of card (credit or debit) and transaction method (in-person, online, mobile).

Interchange Fees: These fees are set by the card networks (Visa, MasterCard, etc.) and are passed through to businesses, often along with Chase’s own processing fees.

2. Monthly Fees

Service Fees: There may be monthly service fees associated with account maintenance, POS systems, or other features. The cost varies based on the service level and volume of transactions.

Subscription Fees: For businesses using advanced features or higher tiers of service, there might be subscription fees that cover additional functionalities and support.

3. Equipment Costs

POS Hardware: Costs for POS terminals, card readers, and other hardware can vary. Chase may offer different pricing options or leasing arrangements.

Software Fees: Fees for any additional software or apps required for processing payments may be included or billed separately.

4. Additional Fees

Chargeback Fees: Fees may be incurred if a customer disputes a charge and a chargeback occurs.

PCI Compliance Fees: Businesses are required to comply with PCI DSS standards, and there may be fees associated with compliance and security services.

Refund Fees: Fees may apply for processing refunds or returns, depending on the terms of the service agreement.

5. Custom Pricing

High-Volume Accounts: Businesses with high transaction volumes or specific needs may qualify for custom pricing arrangements, which can offer lower rates or tailored services.

6. No Long-Term Contracts

Flexibility: Chase Payment Solutions typically does not require long-term contracts, allowing businesses to adjust their services as needed without being locked into a lengthy commitment.

The exact pricing structure for Chase Payment Solutions can vary based on factors such as transaction volume, business type, and the specific services used. It’s best to contact Chase directly to get a personalized quote and detailed information about the costs associated with your particular needs.

Simple Pricing at First Glance

Chase offers a straightforward flat-rate pricing model with no monthly or hidden fees. Like most flat-rate processors, you’ll pay a fixed percentage markup and a small flat fee per transaction, and Chase displays these rates transparently on its website. Regardless of the interchange rates charged by different card brands, you’ll pay 2.6% + 10¢ for card-present transactions (swiped, contactless, or chip-and-pin) and slightly higher rates for keyed-in (3.5% + 10¢) and e-commerce (2.9% + 25¢) transactions.

For small businesses, these are the only fees you’ll need to pay. When I contacted customer support, they confirmed there are no monthly fees for software or PCI compliance. You’ll be on a month-to-month contract, so there’s no need to worry about early termination fees.

However, if you want to use one of the 10 specialized software tools powered by Chase, you’ll likely incur a monthly fee. Additionally, if you wish to use Chase QuickAccept for same-day deposits from mobile payments, you’ll need to pay $15 per month for a Chase Business Complete Banking Account. These fees can be waived under certain conditions, and you can still accept mobile payments without QuickAccept, but it’s important to note if same-day payments are essential for your business.

That said, Chase Payment Solutions℠ doesn’t offer the lowest transaction fees on the market. For instance, Leaders Merchant Services offers lower rates, but these come on top of the interchange fees charged by the various card brands. It’s worth comparing the two options to determine which one works best for your business.

Businesses with higher transaction volumes may be able to negotiate lower fees, but this often involves signing a contract with early termination fees. Flat-rate pricing models can become expensive for high-volume and larger businesses. As your business grows, you might save money by switching to a processor like Stax, which charges a flat monthly fee in exchange for 0% markups on transactions.

Despite the absence of additional fees, you will need to purchase your hardware outright. Chase’s hardware is reasonably priced ($49.95 for the mobile reader and $399 for the smart terminal), but since it’s proprietary, you may not be able to reprogram it if you decide to stop using Chase.

Card-present Transactions

2.6% + 10¢

/Transaction

Keyed-in Transactions

3.5% + 10¢

/Transaction

E-Commerce Transactions

2.9% + 25¢

/Month

COMPLIANCE & SECURITY |4.8|

Chase Payment Solutions prioritizes compliance and security to protect both businesses and their customers. Here’s an overview of their compliance and security features:

1. PCI Compliance

PCI DSS Standards: Chase Payment Solutions adheres to Payment Card Industry Data Security Standard (PCI DSS) requirements, ensuring that all transactions are processed in a secure manner. This includes safeguarding cardholder data and maintaining a secure environment.

Compliance Assistance: Provides tools and resources to help businesses meet PCI DSS requirements, including guidelines for securing payment systems and data.

2. Data Encryption

Encryption Protocols: Uses advanced encryption techniques to protect sensitive payment information during transmission and storage. This ensures that cardholder data is secure from unauthorized access.

Tokenization: Employs tokenization to replace sensitive card information with unique identifiers (tokens), reducing the risk of data breaches.

3. Fraud Detection and Prevention

Real-Time Monitoring: Implements real-time fraud detection systems to monitor transactions for suspicious activity and prevent fraudulent transactions.

Alerts and Notifications: Provides alerts and notifications for unusual or potentially fraudulent transactions, allowing businesses to take immediate action.

4. Secure Payment Gateway

Secure Transactions: Ensures that all online transactions are processed through a secure payment gateway, protecting data from interception and tampering.

Authentication Tools: Includes features such as 3D Secure authentication (e.g., Verified by Visa) to add an extra layer of security for online payments.

5. Data Storage and Handling

Secure Storage: Ensures that sensitive payment information is securely stored using encryption and other protective measures.

Data Access Controls: Implements strict access controls to ensure that only authorized personnel can access sensitive information.

6. Compliance with Regulations

Regulatory Compliance: Complies with various industry regulations and standards, including GDPR (General Data Protection Regulation) for businesses operating in Europe.

Regular Audits: Conducts regular security audits and assessments to ensure ongoing compliance with industry standards and regulations.

7. Risk Management

Risk Assessment Tools: Provides tools and resources for businesses to assess and manage payment processing risks.

Dispute Resolution: Offers support and procedures for handling disputes, chargebacks, and other issues related to transaction security.

Chase Payment Solutions integrates these security and compliance measures to offer a secure and reliable payment processing environment, protecting both business and customer data from potential threats.

Handle Most of It Yourself

Chase Payment Solutions℠ is PCI-compliant and includes some built-in security features, but don’t expect extensive assistance with the compliance process. While you can receive support from Chase’s data security team for your PCI assessments, the bulk of the compliance responsibilities will fall on you.

PCI Compliance & Beyond

Chase Payment Solutions℠ provides guidance on PCI compliance, but you’ll need to manage your annual questionnaires, quarterly network scans, and any required on-site visits on your own. There is support available through the 24/7 customer service line, but it may not be ideal if you’re new to PCI compliance and unsure where to begin.

Additionally, Chase Payment Solutions℠ offers a HIPAA-compliant payment service. However, Chase itself is not HIPAA-compliant, so if you require HIPAA-compliant payments, you’ll need to use InstaMed alongside Chase, which involves an extra cost.

Additional Security Features

Chase offers robust fraud protection. In addition to real-time monitoring and alerts typically provided by merchant services, Chase provides zero liability protection. As long as you adhere to data security standards and report unauthorized transactions promptly, Chase will reimburse you for any losses.

You’ll also benefit from Authorize.net’s advanced fraud detection and prevention tools. These tools include 13 configurable filters that address various factors such as transaction size, transaction frequency, customer location, and payer verification. You can set up these filters to automatically decline suspicious transactions or hold them for manual review, helping to safeguard your business against fraud.

CUSTOMER SUPPORT |4.5|

Chase Payment Solutions provides comprehensive customer support to assist businesses with their payment processing needs. An outline of their assistance services is provided below:

1. 24/7 Customer Support

Availability: Customer support is available 24/7 via phone, email, and online chat. This ensures that businesses can get help at any time, regardless of when issues arise.

Access: Support can be accessed through the Chase Payment Solutions website or by calling their dedicated support line.

2. Dedicated Account Managers

Personal Assistance: For businesses with complex needs or high transaction volumes, Chase provides dedicated account managers. These professionals offer personalized support and strategic advice tailored to the business’s specific requirements.

Proactive Support: Account managers work closely with businesses to address issues, optimize payment solutions, and ensure smooth operation.

3. Online Resources

Help Center: The Chase Payment Solutions website includes a comprehensive help center with articles, FAQs, and guides on various topics related to payment processing.

Tutorials and Webinars: Access to educational resources such as video tutorials, webinars, and written guides to help businesses understand and effectively use the platform’s features.

4. Troubleshooting and Issue Resolution

Technical Support: Offers assistance with technical issues related to payment processing, including problems with POS systems, payment gateways, and integration with other software.

Dispute Resolution: Provides support for handling disputes, chargebacks, and other transaction-related issues, helping businesses resolve conflicts efficiently.

5. Onboarding Assistance

Setup Help: Provides support during the initial setup and onboarding process to ensure a smooth transition to using Chase Payment Solutions.

Training: Offers training resources to help businesses get up to speed with the platform’s features and capabilities.

6. Customer Feedback and Improvement

Feedback Channels: Encourages businesses to provide feedback on their experiences, which is used to improve service quality and address common concerns.

Continuous Improvement: Regularly updates support practices and resources based on customer feedback and industry best practices.

Overall, Chase Payment Solutions aims to provide responsive and effective customer support to ensure businesses can efficiently manage their payment processing needs and resolve any issues that arise.

Friendly but Sales-Oriented

Chase Payment Solutions℠ offers support through a request ticket channel and a 24/7 phone line. You can also reach out via a contact form, which functions more as a callback request than an email ticket.

I called the number listed on the application form at 3:00 p.m. UK time (11:00 a.m. EST), assuming the customer support team is based at company headquarters in New York City. As expected from a large company, this number was for the sales department. I waited about 5 minutes in the queue before being connected.

The representative I spoke with was focused on closing the sale but was also friendly and helpful. He confirmed that, as a small business owner, I would be charged the flat-rate transaction fees advertised on a month-to-month contract.

He addressed all my questions except for a key one: I asked about the possibility of negotiating the advertised rates, indicating that I might consider this as my business grows. He sidestepped this question, mentioning that such discussions would be feasible once I had more financial processing history.

Usually, you’d need to log in to submit a ticket, but I found a workaround. During my research, one of Chase’s knowledge bases allowed me to submit a ticket without logging in. I received an

Alternative Chase Payments

Frequently Asked Question.

We provide a range of services including payment processing, online transactions, invoicing, and point-of-sale solutions to help manage and streamline your business operations efficiently.

To create an account, visit our sign-up page, provide your contact details, and follow the prompts to set up your profile and preferences.

We accept various payment methods including credit/debit cards, bank transfers, and online payment systems like PayPal and digital wallets.

To reset your password, click the “Forgot Password” link on the login page, enter your email address, and follow the instructions sent to your inbox.

You can contact customer support via email, phone, or through our website’s live chat feature for assistance with your inquiries and issues.

Our refund policy allows returns within a specified period, typically 30 days, subject to conditions. Please refer to our detailed refund policy on our website for more information.

To update your account information, log in to your account, navigate to the settings or profile section, and make the necessary changes.

Yes, we use advanced encryption and security measures to protect your payment details and personal information during transactions.

To cancel or modify an order, log in to your account, go to the order history, select the order, and follow the prompts for cancellation or modification.

Our terms of service and privacy policy are available at the bottom of our website’s homepage or under the “Legal” section for easy access.