POS Pros Review

“POS Pros Review: Top Credit Card Processing Solutions & Free Equipment for Businesses”

POS Pros helps businesses discover the best point-of-sale (POS) system tailored to their industry and requirements. With 26 partner brands, including Clover, Revel, SwipeSimple, and TouchBistro, they offer consultations and demos to guide you toward the right choice and prevent expensive purchases missing vital features. However, the pricing could be more clearly communicated.

POS Pros positions itself as an all-in-one solution for point-of-sale payment processing, offering low-cost monthly plans with competitive transaction fees. Additionally, their cash discount program can help businesses lower processing expenses.

Though its industry-specific POS and e-commerce solutions appeal to businesses of all sizes, the quote-only pricing model could be a potential downside.

4.6

Pricing Plan

Cash Discount

Interchange Plus POS Plan

Tiered Pricing

Pricing per transaction

0% + 0.00¢

0.30% + 10¢ (in-person)

1.95% (online)

1.5% (in-person)

1.95% (online)

Monthly subscription

₹2490

₹415

₹415

Ranked 9 from 29 Credit Card Processing

Performance: |4.9|

POS Pros delivers solid performance with reliable, user-friendly POS solutions that integrate well with various business tools. The system ensures smooth, efficient transactions and quick response times, even during peak hours. While generally dependable, performance can vary based on hardware and internet quality. Overall, it’s a strong choice for businesses seeking consistent and effective POS functionality.

Uptime: |4.9|

POS Pros is known for its impressive uptime, ensuring that businesses experience minimal downtime and uninterrupted transaction processing. The system is highly reliable, which is critical for maintaining smooth operations. Consistent uptime enhances overall efficiency and customer satisfaction, making POS Pros a dependable choice for businesses that prioritize continuous availability in their point-of-sale systems.

Customer Service: |4.8|

POS Pros offers responsive and knowledgeable customer service, providing effective support for setup, troubleshooting, and system optimization. Users appreciate the assistance and expertise of the support team, although response times can occasionally be slower during high-demand periods. Overall, POS Pros delivers strong customer service, contributing to a positive user experience and efficient problem resolution.

Pricing: |4.7|

POS Pros offers competitive pricing with low-cost monthly plans and affordable transaction fees. However, the pricing structure relies on a quote-only model, which can make it difficult for businesses to obtain clear, upfront cost comparisons. Despite this, the overall cost is generally considered reasonable, but the lack of transparency may be a drawback for some users.

Overview

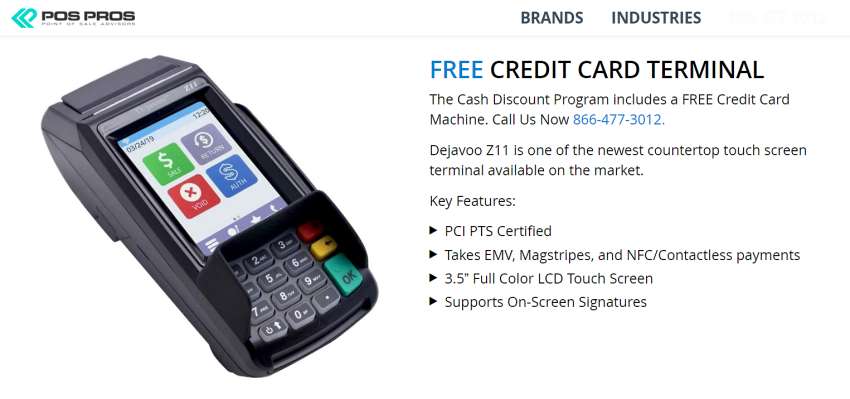

| POS equipment | Free Dejavoo Z11, Clover Mini, or Clover Flex terminals. Other POS terminals, systems, and accessories available for purchase |

| Payments methods accepted | Credit and debit cards, digital wallets, ACH, bank transfers |

| Payout times | Next day |

| Contract length | Monthly (no cancellation fees) |

| Customer support | 24/7 support and POS technical help desk with purchase of POS equipment and merchant account, sales support available Monday to Friday via phone and email from 6:00 AM – 9:00 PM (CT) |

| Security | Level 1 PCI compliant, tokenization, fraud prevention, and chargeback management |

Customized Payment Processing Solutions and Plans

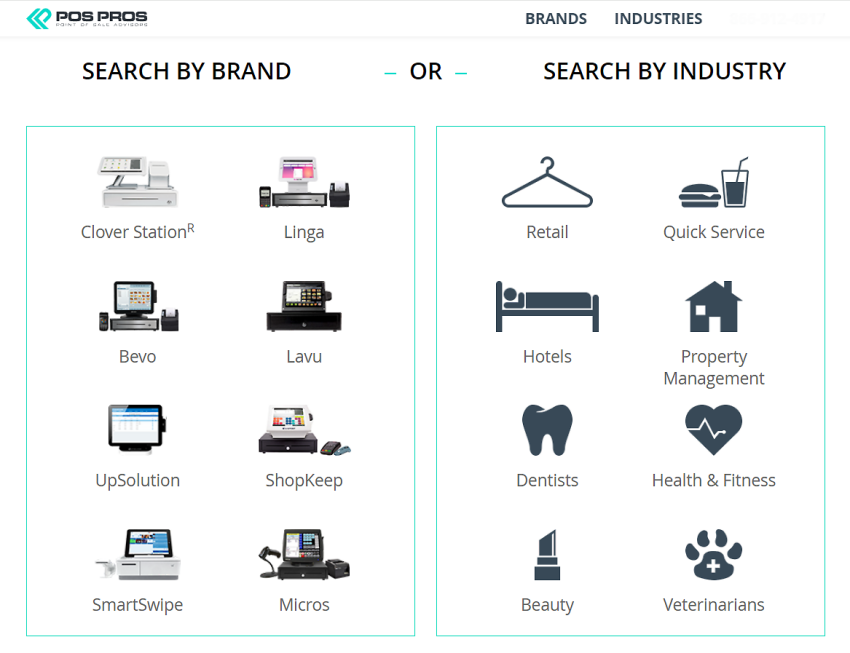

POS Pros offers a tailored approach to point-of-sale (POS) solutions, avoiding a one-size-fits-all model. Instead, they help you select the ideal POS system and plan based on your business type, size, and processing requirements.

Recognizing that each business has unique POS needs, POS Pros provides a free consultation with a specialist to recommend equipment suited to your industry. A key feature is their free virtual system demos, allowing you to evaluate the POS systems’ interface and features before making a purchase, which is especially useful for new businesses to avoid costly, unsuitable equipment.

In addition to POS systems, POS Pros offers card-not-present and e-commerce payment solutions through Authorize.net’s virtual terminal and payment gateway.

Their pricing options include interchange-plus, tiered pricing, and cash discount models. Monthly plan fees are budget-friendly, and transaction fees are competitive. All plans operate on a month-to-month basis with no cancellation fees.

POS Pros’ approach is beneficial for new businesses and those looking to switch providers, with a promise to either save you money on current processing rates or pay you $500. Established businesses with existing contracts will also benefit from POS Pros’ offer to cover cancellation fees.

Based on support interactions and merchant feedback, POS Pros merits further consideration. Continue reading to determine if it meets your business needs.

FEATURES |4.9|

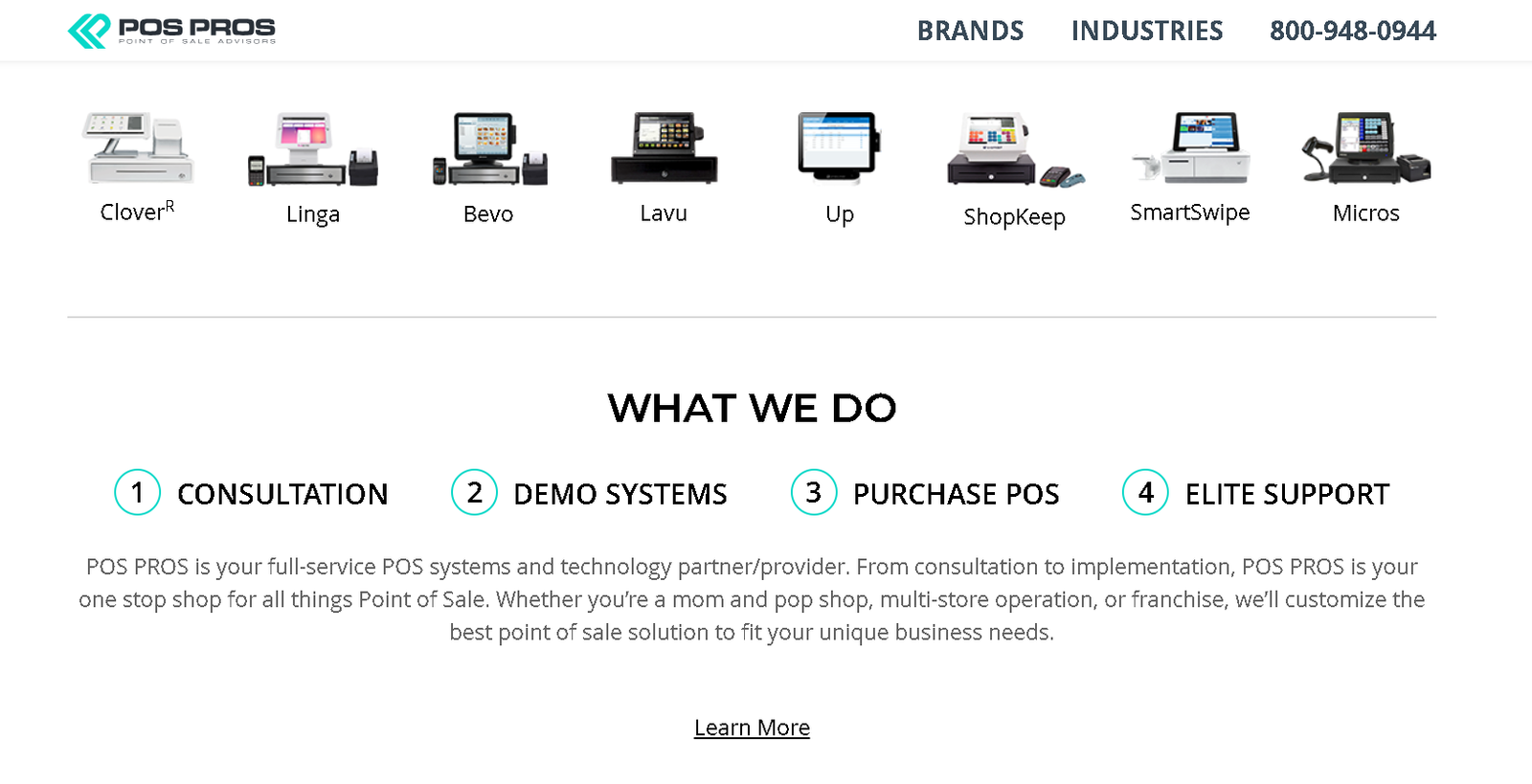

Versatile In-Person and Online Payment Solutions

Unlike many payment processors that offer single solutions for either in-person or online transactions, POS Pros provides a comprehensive range of hardware options from over 25 brands, including well-known names like Clover, SmartSwipe, Revel, and TouchBistro.

While their main focus is on point-of-sale (POS) hardware, POS Pros also offers strong e-commerce capabilities. These include integrations with popular shopping carts, accounting software, marketing tools, and other essential business applications.

Industry-Specific POS Hardware and Software

POS Pros goes beyond just selling equipment. After an initial consultation, you’ll have the opportunity to test recommended POS solutions tailored to your specific business needs. These user-friendly terminals come equipped with features designed to help manage various aspects of your operations.

For example, if you operate a restaurant, your sales representative might suggest Linga POS or TouchBistro software. Wineries and similar businesses with multiple locations might be advised to use Revel, Order Port, or Clover POS systems. Retailers may find SmartSwipe and Clover POS terminals and mobile readers to be suitable options.

POS Pros’ personalized approach helps minimize the risk of investing in unsuitable equipment.

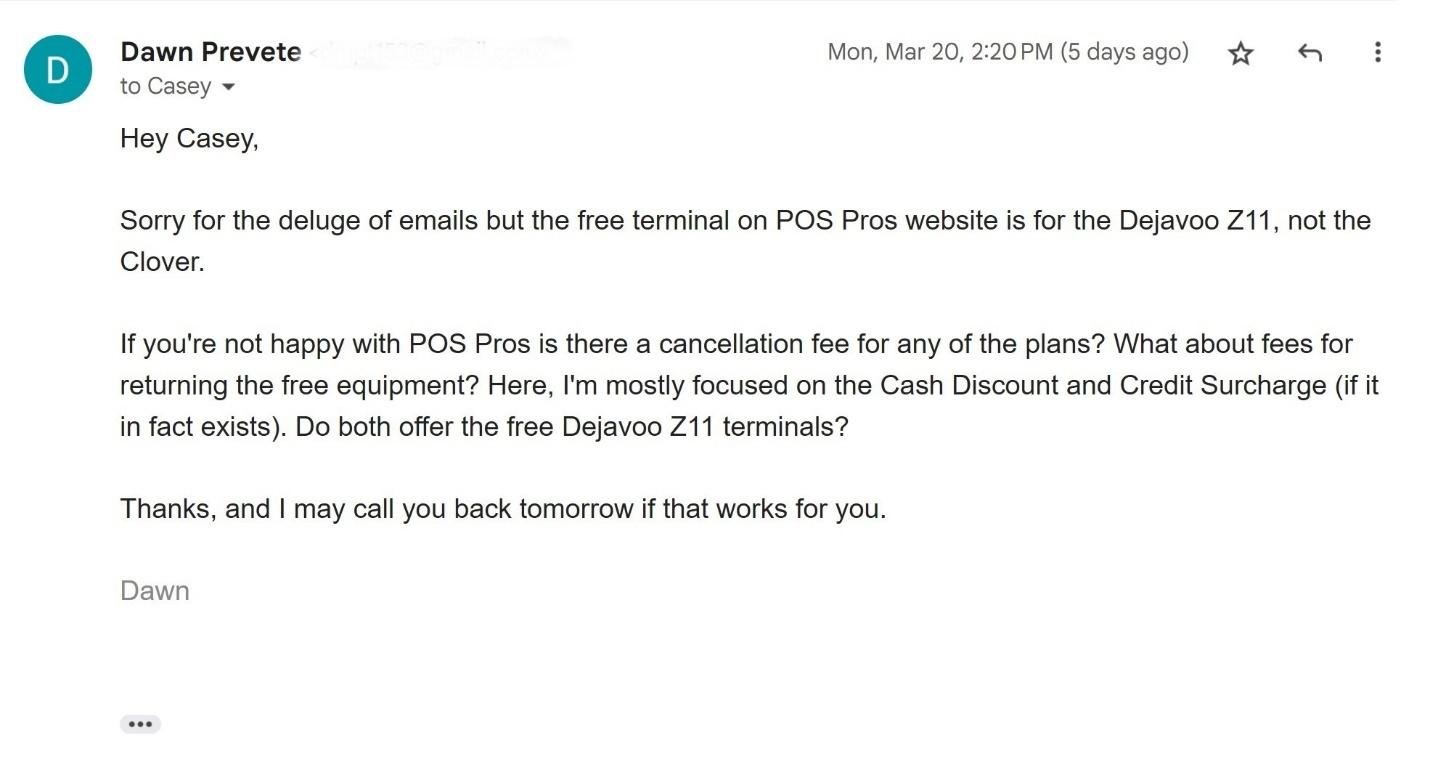

While POS Pros offers free terminals such as the Dejavoo Z11, Clover Mini LTE, or Clover Flex, not all POS equipment is free. Purchased equipment belongs to you, but free equipment must be returned upon cancellation to avoid additional charges.

E-Commerce Functionality

POS Pros uses Authorize.net as its virtual terminal and secure payment gateway for online or keyed-in payments. Customers can pay using credit cards, debit cards, e-checks, digital wallets, or PayPal. Depending on your plan, you might incur a monthly fee of $7.95 or $14.95 for the gateway and virtual terminal, though this fee may be waived if you process $250,000 or more.

Authorize.net is user-friendly and integrates with various e-commerce and accounting software, such as WooCommerce, Shopify, QuickBooks, and FreshBooks. It also allows you to create and send digital invoices and set up recurring or installment payments.

Convenient Next-Day Deposits

POS Pros supports payments from major credit and debit cards, checks, and digital wallets. While the payment types accepted are standard, the expedited payout is noteworthy. Funds are deposited into your linked bank account within 24 hours, regardless of the payment method or plan you choose.

Reduce Processing Fees With Cash Discounting

To lower credit card processing fees, consider the Cash Discount plan. This plan offers customers a discount for paying with cash. If a customer opts out of the discount and pays with a credit or debit card, a 4% service fee is added to cover processing costs. For instance, an item priced at $10.40 will cost $10.00 when paid in cash, and $10.40 when paid by card.

With the cash discounting plan, POS Pros provides a free Dejavoo Z11 terminal and signage to inform customers about the discount process.

Besides reducing processing fees, cash discounting can minimize the risk of fraudulent transactions and chargebacks. It is also legal in all states.

Popular Credit Card Processing

PROS AND CONS OF POS PROS

Pros of Pos Pros

POS equipment customized for industry and processing requirements

Quick payout times

No contracts or cancellation fees

Cash discount program available

Advanced fraud protection and security features

Cons of Pos Pros

Lack of transparency regarding plan pricing and details

Customer support challenges

Limited e-commerce functionalities

EASY OF USE |4.8|

User-Friendly Vetting and Onboarding

POS Pros makes account setup straightforward for both new startups and established businesses. For new ventures, submitting just a social security number with your application is sufficient.

For established businesses looking to switch processors, POS Pros offers to cover the cancellation fee from your previous provider.

Once assigned a POS Pros sales agent, you’ll receive guidance through the application and approval process. They’ll assist with onboarding and address any questions or concerns. Additionally, POS Pros has a help desk team available for troubleshooting POS-related issues.

Getting Started With POS Pros

To begin, simply complete an online form on the POS Pros homepage, providing details such as your monthly processing volume, name, company name (if applicable), email address, and phone number.

After submitting the form, you’ll receive a pop-up confirmation and be informed that a representative will reach out within a day. Alternatively, you can bypass the form by scheduling a call with a sales agent to start the application process directly.

Easy Application and Quick Loan Approval

A notable advantage of choosing POS Pros as your payment processor is the opportunity to access up to $500,000 in working capital. The application process is straightforward and can be completed online through their secure mobile app, with fast approval times.

To qualify for a cash advance, your business must be operational for at least one year and have a revenue of $50,000 annually, or $4,200 per month over the past three months.

Within just 10 minutes of submitting your information, POS Pros will assess your business and determine your eligibility for a loan and the amount you can borrow.

Niche Business Management and Sales Features

POS Pros offers tailored solutions for both in-person and e-commerce businesses, allowing you to review detailed sales, payment, and customer reports through integrated dashboards.

Their POS systems include specialized software for various business types, such as restaurants, retail stores, gyms/fitness centers, healthcare facilities, and more. Depending on your chosen hardware and software, you might access tools like menu editing, seating tracking, and tip management for restaurants.

Essential business management features, including booking, inventory, and employee management tools, are also included. Depending on the hardware, you may offer gift cards and loyalty programs to enhance customer engagement.

From the virtual terminal dashboard, you can easily manage sales data, create digital invoices, schedule recurring payments, and view customer information.

PRICING |5.0|

Pricing Appears Reasonable, but Lacks Transparency

POS Pros offers three pricing plans: interchange-plus, tiered pricing, and cash discount. These plans are designed for small to mid-sized businesses across various industries, including retail, property management, fitness, and healthcare.

However, the website does not disclose plan pricing, equipment costs, or related fees. This lack of transparency may stem from POS Pros’ customized approach, but it can be a drawback as your costs are likely influenced by your business type and sales volume.

From my experience, the quotes I received were fair and competitive. The overall processing costs were lower compared to other processors’ interchange-plus rates, though you might find better savings with subscription-style plans from providers like Stax or Payment Depot.

Here’s the pricing I was verbally quoted by my sales representative:

Monthly Plan Fees and Transaction Fees:

Interchange-Plus:

₹415 monthly fee

0.30% + 10¢ per in-person transaction

0.95% for debit card transactions and 1.95% for credit card transactions online

Tiered Pricing:

Lower transaction fees compared to interchange-plus, but potentially higher overall costs

0.35% for in-person debit card payments and 1.5% for credit card payments

Same rates for online and keyed-in payments as the interchange-plus plan

Cash Discount Plan:

₹2490 per month

Offers a 4% discount to customers paying with cash

Additional fees include a monthly charge for using the virtual terminal and payment gateway. There may also be a non-PCI compliance fee ranging from $49.95 to $85.95 per month, depending on your account specifics.

My main concern was the verbal nature of the pricing information provided by my sales rep, who did not follow up with written details despite my request. Complaints on the Better Business Bureau website often mention unclear sales information and issues with billing after contract cancellation or early termination fees. Be sure to thoroughly review your contract before signing.

Cash Discount

0% + 0.00¢

/Transaction

Interchange Plus POS Plan

0.30% + 10¢ (in-person) 1.95% (online)

/Transaction /Transaction

Tiered Pricing

1.5% (in-person) 1.95% (online)

/Transaction /Transaction

COMPLIANCE & SECURITY |4.5|

Robust Fraud Protection and Security Features

POS Pros, part of the Paysafe family, provides strong security and fraud prevention measures to protect your finances and customer data.

Their terminals, systems, and mobile card readers support advanced and secure payment methods, including EMV chip, tap-to-pay, and contactless mobile payments. Both in-person and online transactions are protected through end-to-end encryption and tokenization.

PCI Compliance & More

As a Level 1 PCI Compliant payment processor—the highest level of PCI compliance—POS Pros ensures top-tier security for handling credit and debit card data. They also adhere to CCPA, HIPAA, and GDPR regulations, ensuring that your customers’ financial information is kept secure.

When you sign up with POS Pros, you have three months to achieve PCI compliance. If you do not submit your PCI self-assessment questionnaire within this period, POS Pros will impose a monthly non-compliance fee.

Additional Security Features

POS Pros enhances security with a range of fraud protection tools available through its virtual terminal and payment gateway. These features include real-time fraud monitoring, address verification, device/browser detection, and card verification code (CVC) checks.

To avoid chargeback fees, POS Pros offers advanced fraud detection filters and tools that help identify, manage, and prevent suspicious transactions. For example, the Authorize.net dashboard allows you to block excessive transactions from the same IP address or from IP addresses known for fraudulent activity.

For healthcare practitioners, POS Pros recommends HIPAA-compliant POS terminals and systems, such as those from Clover and Revel, ensuring that sensitive patient data remains secure.

CUSTOMER SUPPORT |4.2|

Sales-Focused Phone Support and Unresponsive Email Support

Customer support at POS Pros has some limitations. There is no live chat option, and you can only reach support by phone or email during business hours (Monday to Friday, 6:00 AM – 9:00 PM CT). Based on my experience, email support is largely ineffective, as I did not receive any responses.

The primary support method is via phone. When you call, you will connect with a sales agent after a brief wait. While the POS specialist I spoke with was helpful, they were not entirely transparent, and I had to ask detailed questions to get a full understanding of the costs.

I was concerned that my sales agent did not provide an email confirmation with detailed information about the plan’s pricing, features, and fees.

Additionally, determining PCI non-compliance and other associated fees proved challenging, as these can vary significantly based on your sales rep and the specifics of your merchant account. This variability can impact your expenses and make it especially difficult for small or new businesses to accurately forecast their costs.

While most payment processors offer both sales representatives and dedicated customer support teams, POS Pros only provides 24/7 support and a technical help desk after you sign up for a merchant account or purchase one of their POS solutions.

Alternative LMS

Frequently Asked Question.

POS Pros offers three types of payment plans: interchange-plus, tiered pricing, and cash discount. These plans cater to small and mid-sized businesses across various industries.

No, POS Pros does not list pricing details for plans or equipment on their website. Pricing is typically customized based on your business type and sales volume, which you will need to discuss with a sales representative.

Fees include monthly plan fees, transaction fees, and possibly additional charges for using the virtual terminal and payment gateway. Non-PCI compliance fees can also apply if you do not submit your PCI self-assessment questionnaire within three months of signing up.

POS Pros uses Authorize.net for online and keyed-in payments. Authorize.net supports various payment methods, including credit cards, debit cards, e-checks, digital wallets, and PayPal. It integrates with many e-commerce and accounting platforms and offers features like digital invoicing and recurring payments.

POS Pros offers robust fraud protection and security features, including real-time fraud monitoring, address verification, device/browser detection, and card verification code (CVC) checks. They are also Level 1 PCI Compliant and adhere to CCPA, HIPAA, and GDPR regulations.

The cash discount plan allows businesses to offer a 4% discount to customers who pay with cash. This can help reduce processing fees and minimize the risk of fraudulent transactions. The plan costs ₹2490 per month.

Customer support is available by phone and email during business hours (Monday to Friday, 6:00 AM – 9:00 PM CT). However, there is no live chat support, and email responses can be unreliable. Sales-focused phone support is the primary method of contact, with a technical help desk available once you are a customer.

To start, you can fill out an online form with details about your processing needs. Alternatively, you can schedule a call with a sales agent to begin the application process directly.

You have three months from signing up to become PCI compliant. Failure to submit your PCI self-assessment questionnaire within this time frame may result in a monthly non-compliance fee.

Yes, POS Pros offers access to up to $500,000 in working capital. The application process is simple, and approval is quick, but your business must be operational for at least one year with a minimum annual revenue of $50,000 or $4,200 per month for the past three months.