How Xero Simplifies Financial Management for Agencies

How Xero Simplifies Financial Management for Agencies explores how Xero helps agencies streamline invoicing, track expenses, manage cash flow, and gain real-time financial visibility. The post explains how agencies can reduce accounting stress, improve profitability, and scale confidently using Xero’s cloud-based tools designed for modern, fast-growing teams.

Table of Contents

- 1 Introduction to Financial Challenges Faced by Agencies

- 2 Why agency finances are more complex than regular businesses

- 3 What Is Xero and Why Agencies Prefer It

- 4 Centralized Financial Control for Growing Agencies

- 5 Simplified Invoicing and Billing Workflows

- 6 Expense Tracking Made Effortless

- 7 Seamless Bank Reconciliation

- 8 Cash Flow Visibility in Real Time

- 9 Project-Based Accounting for Agencies

- 10 Collaboration Between Teams and Accountants

- 11 Integrations That Power Agency Operations

- 12 Automation That Saves Time and Reduces Stress

- 13 Security, Compliance, and Data Protection

- 14 Scalability for Agencies at Every Stage

- 15 Cost-Effectiveness and ROI for Agencies

- 16 Real-World Use Cases for Agencies

- 17 Conclusion

- 18 Frequently Asked Questions

Introduction to Financial Challenges Faced by Agencies

Running an agency isn’t just about delivering great work. Behind the scenes, finances can feel like juggling flaming torches while riding a unicycle. Multiple clients, different billing models, recurring retainers, project-based pricing—things get complicated fast.

Why agency finances are more complex than regular businesses

Unlike traditional businesses, agencies manage overlapping projects, variable income streams, and client-specific expenses. One missed invoice or delayed payment can throw off the entire cash flow.

The need for smarter financial tools

Spreadsheets and manual accounting simply don’t scale. Agencies need a system that works with them, not against them. That’s where Xero comes in.

What Is Xero and Why Agencies Prefer It

Xero is a cloud-based accounting platform designed to make financial management simple, transparent, and accessible from anywhere.

Overview of Xero

Xero allows agencies to manage invoicing, expenses, bank reconciliation, reporting, and cash flow—all from one clean dashboard.

Cloud-based accounting explained in simple terms

Think of Xero like Google Docs for your finances. Everything updates in real time, everyone sees the same numbers, and there’s no “latest version” confusion.

Centralized Financial Control for Growing Agencies

Managing multiple clients and projects

Agencies often struggle to keep track of who owes what. Xero centralizes all client data, invoices, and payments in one place.

One dashboard, complete visibility

At a glance, you can see outstanding invoices, upcoming bills, and your current financial position. No digging required.

Simplified Invoicing and Billing Workflows

Creating professional invoices in minutes

Xero lets you create branded invoices that look professional and get paid faster.

Automated recurring invoices for retainers

For agencies working on monthly retainers, automation is a lifesaver. Set it once, and Xero handles the rest.

Expense Tracking Made Effortless

Real-time expense capture

Snap receipts, upload bills, and track expenses as they happen.

Linking expenses directly to projects

This is huge for agencies. Every expense can be tied to a specific client or project, making profitability crystal clear.

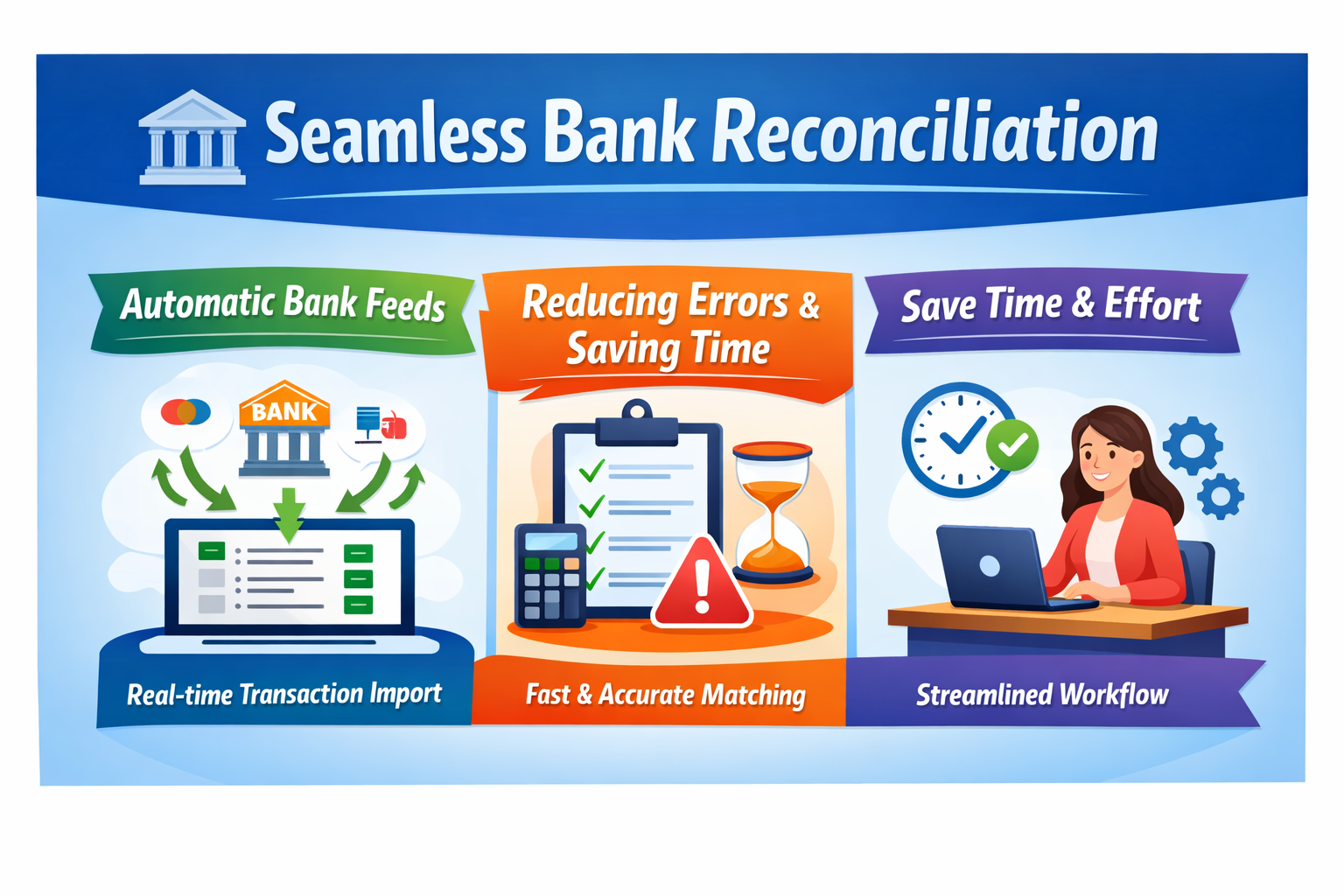

Seamless Bank Reconciliation

Automatic bank feeds

Xero connects directly to your bank, pulling transactions in automatically.

Reducing errors and saving time

No more manual entry. Transactions match themselves, cutting down errors and saving hours each month.

Cash Flow Visibility in Real Time

Understanding cash flow without spreadsheets

Xero’s visual cash flow reports make it easy to see what’s coming in and what’s going out.

Forecasting future income with confidence

Know whether you can hire, invest, or expand—before making risky decisions.

Project-Based Accounting for Agencies

Tracking profitability per client

Not all clients are equal. Xero helps you identify high-profit and low-margin projects.

Knowing which projects actually make money

This insight lets agencies refine pricing, adjust scope, or even drop unprofitable clients.

Lightinthebox Conversion Optimization Tips for Agencies

Anker au: Premium Charging Solutions for Modern Devices

Remote Review: Is It the Best Platform for International Employment?

LATAM Airlines: Digital Transformation in the Aviation Industry

How italki Connects Learners Worldwide Through Smart Marketing

Collaboration Between Teams and Accountants

Multi-user access without confusion

Your finance team, managers, and accountants can all access the same data—securely.

Working with accountants in real time

No more back-and-forth emails or file sharing. Everyone stays in sync.

Integrations That Power Agency Operations

CRM, project management, and payroll tools

Xero integrates with hundreds of tools agencies already use.

Building a connected financial ecosystem

When systems talk to each other, data flows smoothly and decisions become easier.

Automation That Saves Time and Reduces Stress

Automating repetitive accounting tasks

From invoice reminders to bank reconciliation, automation frees up valuable time.

Letting your team focus on creative work

Less admin. More strategy. More creativity.

Security, Compliance, and Data Protection

Keeping sensitive financial data safe

Xero uses strong encryption and security protocols to protect your data.

Compliance without complexity

Tax reports, audits, and compliance become far less stressful.

Scalability for Agencies at Every Stage

Supporting freelancers, small teams, and large agencies

Whether you’re a solo consultant or a 100-person agency, Xero scales with you.

Growing without changing systems

No painful migrations as your agency grows.

Cost-Effectiveness and ROI for Agencies

Lower operational costs

By saving time and reducing errors, Xero lowers overall accounting costs.

Long-term financial clarity

Clear numbers lead to smarter decisions and sustainable growth.

Real-World Use Cases for Agencies

Digital marketing agencies

Track campaign costs, manage retainers, and monitor ROI.

Creative and design studios

Manage project budgets and ensure creative work stays profitable.

Consulting and professional services firms

Bill accurately, track time-based projects, and maintain clean records.

Conclusion

Managing agency finances doesn’t have to feel overwhelming. Xero simplifies the entire process—from invoicing and expenses to cash flow and reporting. It gives agencies clarity, control, and confidence in their numbers. If you want to spend less time stressing over finances and more time growing your agency, Xero is a solution worth considering.

Frequently Asked Questions

Yes, Xero works perfectly for small agencies and freelancers, offering scalable features.

Absolutely. Xero is designed to manage multiple clients with ease.

Yes, it integrates with CRMs, project management tools, and payroll systems.

Not at all. Its interface is user-friendly, even for non-accountants.

Yes, real-time cash flow tracking is one of its strongest features.

Recent Post

Trustedhousesitters Review: Is It the Best House Sitting Platform in 2026?

Why diecastmodelswholesale Is a High-Intent Keyword for E-Commerce Growth

How to Build a High-Converting Digital Campaign for Boots Brands

Why Kiwi.com Is Popular Among Frequent Travelers

How Airalo Helps Businesses and Digital Nomads Stay Connected

Instapage: The Best Landing Page Builder for High Conversions

Todoist: The Ultimate Task Management Tool for Busy Teams

How Envato Market Helps Businesses Save Time and Design Costs

Similarweb: The Ultimate Website Traffic Analysis Tool for Marketers